PNC Bank 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proceedings and Note 22 Commitments and Guarantees in the

Notes To Consolidated Financial Statements in Item 8 of this

Report.

Key Factors Affecting Financial Performance

Our financial performance is substantially affected by a

number of external factors outside of our control, including

the following:

• General economic conditions, including the

continuity, speed and stamina of the current U.S.

economic expansion in general and on our customers

in particular,

• The monetary policy actions and statements of the

Federal Reserve and the Federal Open Market

Committee (FOMC),

• The level of, and direction, timing and magnitude of

movement in, interest rates and the shape of the

interest rate yield curve,

• The functioning and other performance of, and

availability of liquidity in, the capital and other

financial markets,

• Loan demand, utilization of credit commitments and

standby letters of credit, and asset quality,

• Customer demand for non-loan products and services,

• Changes in the competitive and regulatory landscape

and in counterparty creditworthiness and

performance as the financial services industry

restructures in the current environment,

• The impact of the extensive reforms enacted in the

Dodd-Frank legislation and other legislative,

regulatory and administrative initiatives and actions,

including those outlined elsewhere in this Report and

in our other SEC filings, and

• The impact of market credit spreads on asset

valuations.

In addition, our success will depend upon, among other things:

• Focused execution of strategic priorities for organic

customer growth opportunities,

• Further success in growing profitability through the

acquisition and retention of customers and deepening

relationships,

• Driving growth in acquired and underpenetrated

geographic markets, including our Southeast markets,

• Our ability to effectively manage PNC’s balance

sheet and generate net interest income,

• Revenue growth from fee income and our ability to

provide innovative and valued products to our

customers,

• Our ability to utilize technology to develop and

deliver products and services to our customers and

protect PNC’s systems and customer information,

• Our ability to bolster our critical infrastructure and

streamline our core processes,

• Our ability to manage and implement strategic

business objectives within the changing regulatory

environment,

• A sustained focus on expense management,

• Improving our overall asset quality,

• Managing the non-strategic assets portfolio and

impaired assets,

• Continuing to maintain and grow our deposit base as

a low-cost funding source,

• Prudent risk and capital management related to our

efforts to manage risk to acceptable levels and to

meet evolving CCAR compliance, regulatory capital

and liquidity standards,

• Actions we take within the capital and other financial

markets,

• The impact of legal and regulatory-related

contingencies, and

• The appropriateness of reserves needed for critical

accounting estimates and related contingencies.

For additional information, please see the Cautionary

Statement Regarding Forward-Looking Information section in

this Item 7 and Item 1A Risk Factors in this Report.

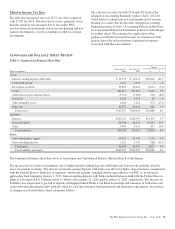

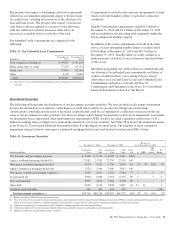

Table 1: Summary Financial Results

Year ended December 31 2014 2013

Net income (millions) $4,207 $4,212

Diluted earnings per common share from net

income $ 7.30 $ 7.36

Return from net income on:

Average common shareholders’ equity 9.91% 10.85%

Average assets 1.28% 1.38%

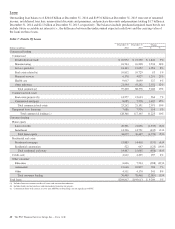

Income Statement Highlights

Our performance in 2014 included the following:

• Net income for 2014 of $4.2 billion was stable

compared with 2013, as a 4% decrease in revenue

was mostly offset by a reduction in provision for

credit losses and a 2% decline in noninterest expense.

Lower revenue in the comparison was driven by a

7% decline in net interest income, as noninterest

income was essentially unchanged. For additional

detail, please see the Consolidated Income Statement

Review section in this Item 7.

• Net interest income of $8.5 billion for 2014

decreased 7% compared with 2013, as lower yields

on loans and investment securities, a decline in

investment securities balances and a reduction in

purchase accounting accretion were partially offset

by commercial and commercial real estate loan

growth.

• Net interest margin decreased to 3.08 % for 2014

compared to 3.57 % for 2013. The decline reflected

the impact of lower loan and securities yields in the

ongoing low rate environment, lower purchase

accounting accretion and the impact of higher interest-

earning deposits with the Federal Reserve Bank.

The PNC Financial Services Group, Inc. – Form 10-K 33