PNC Bank 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

These simulations assume that as assets and liabilities mature,

they are replaced or repriced at then current market rates. We

also consider forward projections of purchase accounting

accretion when forecasting net interest income.

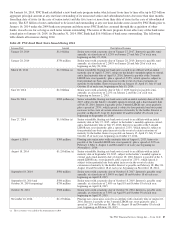

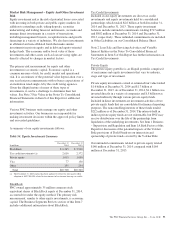

The following graph presents the LIBOR/Swap yield curves

for the base rate scenario and each of the alternate scenarios

one year forward.

Table 51: Alternate Interest Rate Scenarios: One Year

Forward

1M

Interest Rate

0.0

Base Rates PNC Economist Market Forward Slope Flattening

1.0

2.0

3.0

4.0

2Y 3Y 5Y 10Y

The fourth quarter 2014 interest sensitivity analyses indicate that

our Consolidated Balance Sheet is positioned to benefit from an

increase in interest rates and an upward sloping interest rate

yield curve. We believe that we have the deposit funding base

and balance sheet flexibility to adjust, where appropriate and

permissible, to changing interest rates and market conditions.

Market Risk Management – Customer-Related Trading

Risk

We engage in fixed income securities, derivatives and foreign

exchange transactions to support our customers’ investing and

hedging activities. These transactions, related hedges and the

credit valuation adjustment (CVA) related to our customer

derivatives portfolio are marked-to-market daily and reported

as customer-related trading activities. We do not engage in

proprietary trading of these products.

We use value-at-risk (VaR) as the primary means to measure

and monitor market risk in customer-related trading activities.

We calculate a diversified VaR at a 95% confidence interval.

VaR is used to estimate the probability of portfolio losses

based on the statistical analysis of historical market risk

factors. A diversified VaR reflects empirical correlations

across different asset classes.

During 2014, our 95% VaR ranged between $.8 million and

$3.9 million, averaging $2.1 million. During 2013, our 95%

VaR ranged between $1.7 million and $5.5 million, averaging

$3.5 million.

To help ensure the integrity of the models used to calculate

VaR for each portfolio and enterprise-wide, we use a process

known as backtesting. The backtesting process consists of

comparing actual observations of gains or losses against the

VaR levels that were calculated at the close of the prior day.

This assumes that market exposures remain constant

throughout the day and that recent historical market variability

is a good predictor of future variability. Our customer-related

trading activity includes customer revenue and intraday

hedging which helps to reduce losses, and may reduce the

number of instances of actual losses exceeding the prior day

VaR measure. There were two instances during 2014 under

our diversified VaR measure where actual losses exceeded the

prior day VaR measure. In comparison, there was one such

instance during 2013. We use a 500 day look back period for

backtesting and include customer-related trading revenue.

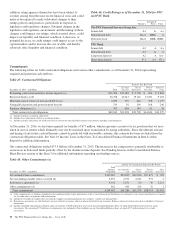

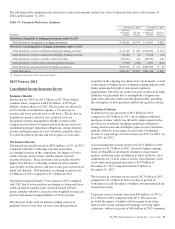

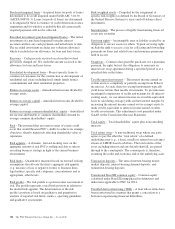

The following graph shows a comparison of enterprise-wide

gains and losses against prior day diversified VaR for the

period indicated.

Table 52: Enterprise – Wide Gains/Losses Versus Value-at-

Risk

(10)

(5)

0

5

10

15

20

Millions

P&L

(20)

(15)

(10)

VaR

12/31/13

1/31/14

2/28/14

3/31/14

4/30/14

5/31/14

6/30/14

7/31/14

8/31/14

9/30/14

10/31/14

11/30/14

12/31/14

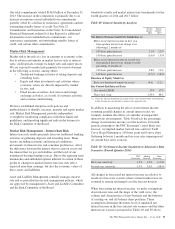

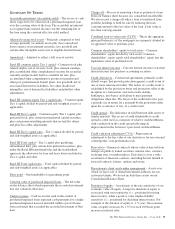

Total customer-related trading revenue was as follows:

Table 53: Customer-Related Trading Revenue (a)

Year ended December 31

In millions 2014 2013

Net interest income $ 31 $ 30

Noninterest income 147 234

Total customer-related trading revenue $178 $264

Securities trading (b) $ 33 $ 21

Foreign exchange 96 98

Financial derivatives and other 49 145

Total customer-related trading revenue $178 $264

(a) Customer-related trading revenues exclude underwriting fees for both periods

presented.

(b) Includes changes in fair value for certain loans accounted for at fair value.

Customer-related trading revenues for 2014 decreased $86

million compared with 2013. The decrease was primarily due

to market interest rate changes impacting credit valuations for

customer-related derivatives activities and reduced derivatives

client sales revenues, which were partially offset by improved

securities and foreign exchange client sales results.

92 The PNC Financial Services Group, Inc. – Form 10-K