PNC Bank 2014 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

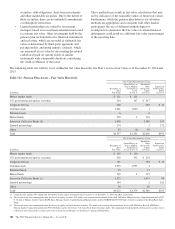

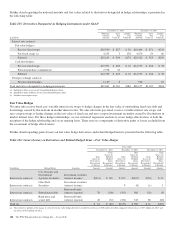

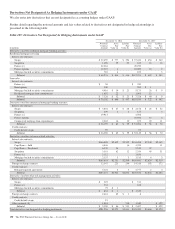

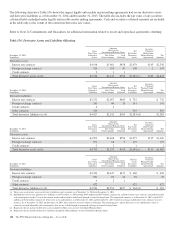

Derivatives Not Designated As Hedging Instruments under GAAP

We also enter into derivatives that are not designated as accounting hedges under GAAP.

Further detail regarding the notional amounts and fair values related to derivatives not designated in hedge relationships is

presented in the following table:

Table 129: Derivatives Not Designated As Hedging Instruments under GAAP

December 31, 2014 December 31, 2013

In millions

Notional/

Contract

Amount

Asset

Fair

Value (a)

Liability

Fair

Value (b)

Notional/

Contract

Amount

Asset

Fair

Value (a)

Liability

Fair

Value (b)

Derivatives used for residential mortgage banking activities:

Residential mortgage servicing

Interest rate contracts:

Swaps $ 32,459 $ 777 $ 394 $ 37,424 $ 654 $ 360

Swaptions 1,498 29 22 845 18 18

Futures (c) 22,084 49,250

Futures options 12,225 4 24,000 10 2

Mortgage-backed securities commitments 710 4 832 3

Subtotal $ 68,976 $ 814 $ 416 $112,351 $ 682 $ 383

Loan sales

Interest rate contracts:

Futures (c) $ 58 $ 350

Bond options 300 200 $ 1

Mortgage-backed securities commitments 4,916 $ 10 $ 21 5,173 26 $ 9

Residential mortgage loan commitments 1,852 22 1,605 13

Subtotal $ 7,126 $ 32 $ 21 $ 7,328 $ 40 $ 9

Subtotal $ 76,102 $ 846 $ 437 $119,679 $ 722 $ 392

Derivatives used for commercial mortgage banking activities:

Interest rate contracts:

Swaps $ 3,801 $ 67 $ 48 $ 2,158 $ 23 $ 52

Swaptions 439 2 1 125 3

Futures (c) 19,913 4,598

Futures options 45,500 15 4

Commercial mortgage loan commitments 2,042 16 10 673 20 11

Subtotal $ 26,195 $ 85 $ 59 $ 53,054 $ 58 $ 70

Credit contracts:

Credit default swaps 95 95

Subtotal $ 26,290 $ 85 $ 59 $ 53,149 $ 58 $ 70

Derivatives used for customer-related activities:

Interest rate contracts:

Swaps $146,008 $2,632 $2,559 $134,408 $2,540 $2,445

Caps/floors – Sold 4,846 16 4,789 11

Caps/floors – Purchased 6,339 34 5,519 37

Swaptions 3,361 62 12 2,354 49 51

Futures (c) 3,112 1,856

Mortgage-backed securities commitments 2,137 3 3 1,515 4 3

Subtotal $165,803 $2,731 $2,590 $150,441 $2,630 $2,510

Foreign exchange contracts 12,547 223 240 14,316 192 172

Credit contracts:

Risk participation agreements 5,124 2 4 4,777 2 4

Subtotal $183,474 $2,956 $2,834 $169,534 $2,824 $2,686

Derivatives used for other risk management activities:

Interest rate contracts:

Swaps $ 225 $ 511

Futures (c) 533 838

Mortgage-backed securities commitments 75 $ 1

Subtotal $ 833 $ 1 $ 1,349

Foreign exchange contracts 2,661 85 $ 1 8

Credit contracts:

Credit default swaps 15

Other contracts (d) 1,881 510 1,340 $ 422

Subtotal $ 5,390 $ 86 $ 511 $ 2,697 $ 422

Total derivatives not designated as hedging instruments $291,256 $3,973 $3,841 $345,059 $3,604 $3,570

190 The PNC Financial Services Group, Inc. – Form 10-K