PNC Bank 2014 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

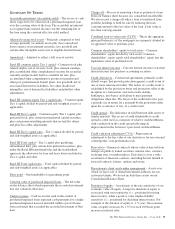

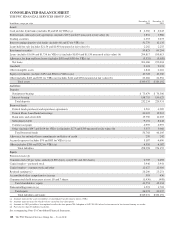

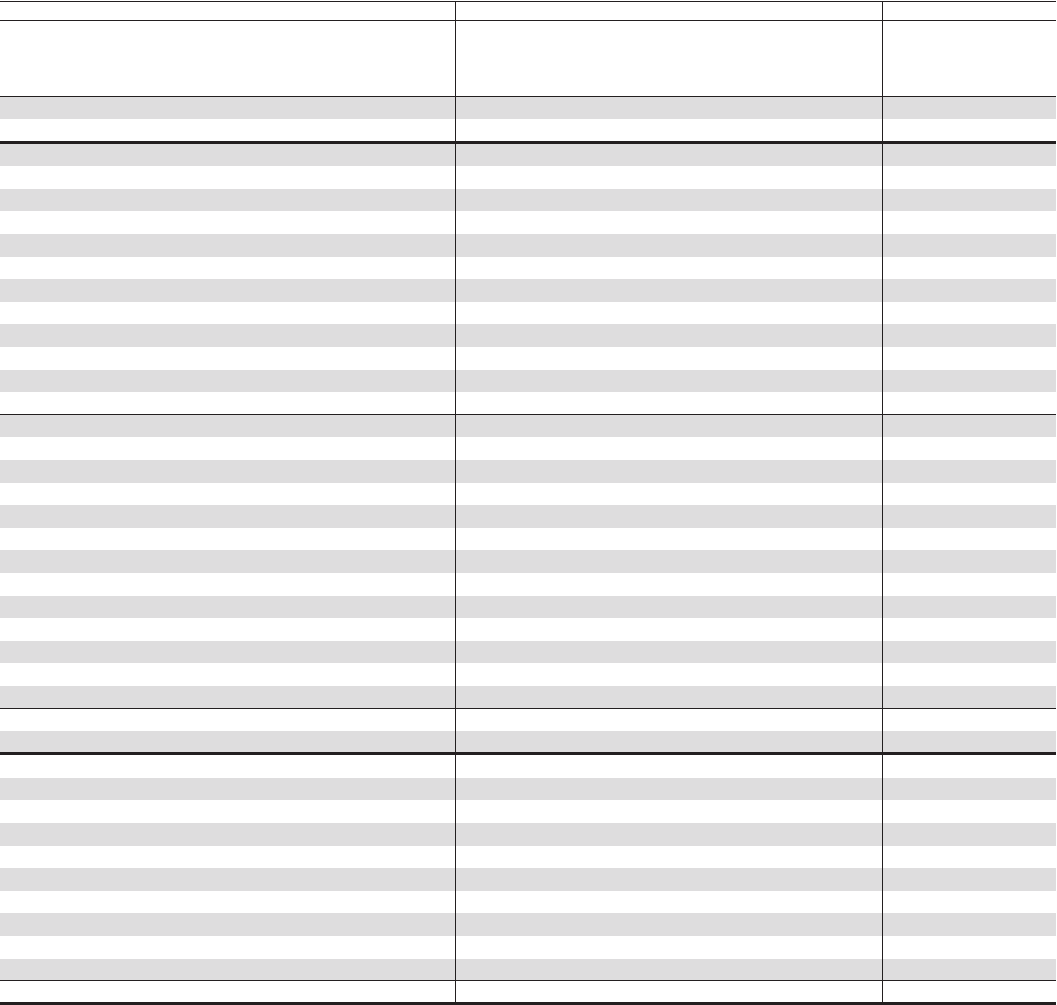

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

THE PNC FINANCIAL SERVICES GROUP, INC.

Shareholders’ Equity

In millions

Shares

Outstanding

Common

Stock

Common

Stock

Capital

Surplus -

Preferred

Stock

Capital

Surplus -

Common

Stock and

Other

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Treasury

Stock

Noncontrolling

Interests

Total

Equity

Balance at December 31, 2011 (a) 527 $2,683 $1,637 $12,072 $18,253 $(105) $ (487) $3,193 $37,246

Cumulative effect of adopting ASU 2014-01 (b) (43) 5 (38)

Balance at January 1, 2012 527 $2,683 $1,637 $12,072 $18,210 $(105) $ (487) $3,198 $37,208

Net income (b) 3,001 (7) 2,994

Other comprehensive income, net of tax 939 939

Cash dividends declared

Common (820) (820)

Preferred (177) (177)

Preferred stock discount accretion 4 (4)

Common stock activity 1 7 45 52

Treasury stock activity (c) 51 (82) (31)

Preferred stock issuance – Series P (d) 1,482 1,482

Preferred stock issuance – Series Q (e) 467 467

Other 25 (419) (394)

Balance at December 31, 2012 (a) (f) 528 $2,690 $3,590 $12,193 $20,210 $ 834 $ (569) $2,772 $41,720

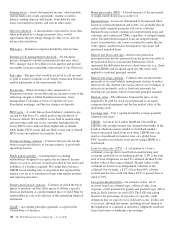

Net income (loss) (b) 4,201 11 4,212

Other comprehensive income (loss), net of tax (398) (398)

Cash dividends declared

Common (911) (911)

Preferred (237) (237)

Preferred stock discount accretion 5 (5)

Redemption of noncontrolling interests (g) (7) (368) (375)

Common stock activity 2 8 97 105

Treasury stock activity 3 (47) 161 114

Preferred stock redemption – Series L (h) (150) (150)

Preferred stock issuance – Series R (i) 496 496

Other (j) 173 (712) (539)

Balance at December 31, 2013 (a) 533 $2,698 $3,941 $12,416 $23,251 $ 436 $ (408) $1,703 $44,037

Cumulative effect of adopting ASC 860-50 (k) 2 2

Balance at January 1, 2014 533 $2,698 $3,941 $12,416 23,253 $ 436 $ (408) $1,703 44,039

Net income 4,184 23 4,207

Other comprehensive income, net of tax 67 67

Cash dividends declared

Common (1,000) (1,000)

Preferred (232) (232)

Preferred stock discount accretion 5 (5)

Common stock activity 1 7 81 88

Treasury stock activity (11) 14 (1,022) (1,008)

Other 116 (203) (87)

Balance at December 31, 2014 (a) 523 $2,705 $3,946 $12,627 $26,200 $ 503 $(1,430) $1,523 $46,074

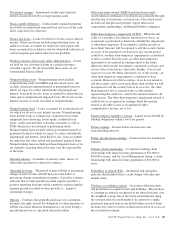

(a) The par value of our preferred stock outstanding was less than $.5 million at each date and, therefore, is excluded from this presentation.

(b) Amounts for 2012 and 2013 periods have been updated to reflect the first quarter 2014 adoption of ASU 2014-01 related to investments in low income housing tax credits. See Note 1

Accounting Policies for further detail of the adoption.

(c) Net treasury stock activity totaled less than .5 million shares issued or redeemed.

(d) 15,000 Series P preferred shares with a $1 par value were issued on April 24, 2012.

(e) 4,500 Series Q preferred shares with a $1 par value were issued on September 21, 2012 and 300 shares were issued on October 9, 2012.

(f) 5,001 Series M preferred shares with a $1 par value were issued and redeemed on December 10, 2012.

(g) Relates to the redemption of REIT preferred securities in the first quarter of 2013. See Note 12 Capital Securities of a Subsidiary Trust and Perpetual Trust Securities for additional

information.

(h) 1,500 Series L preferred shares with a $1 par value were redeemed on April 19, 2013.

(i) 5,000 Series R preferred shares with a $1 par value were issued on May 7, 2013.

(j) Includes an impact to noncontrolling interests for deconsolidation of limited partnership or non-managing member interests related to tax credit investments in the amount of $675

million during the second quarter of 2013.

(k) Amount represents the cumulative impact of our January 1, 2014 irrevocable election to prospectively measure all classes of commercial MSRs at fair value. See Note 1 Accounting

Policies and Note 8 Goodwill and Other Intangible Assets for more information on this election.

See accompanying Notes To Consolidated Financial Statements.

The PNC Financial Services Group, Inc. – Form 10-K 109