PNC Bank 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

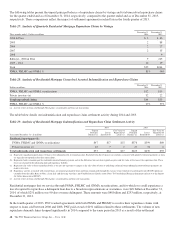

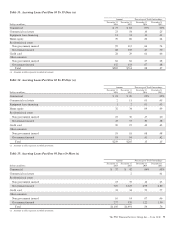

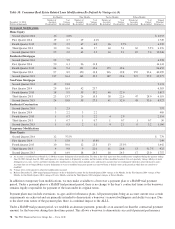

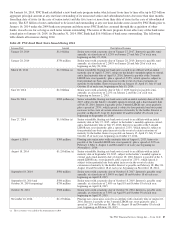

Table 38: Consumer Real Estate Related Loan Modifications Re-Default by Vintage (a) (b)

Six Months Nine Months Twelve Months Fifteen Months

December 31, 2014

Dollars in thousands

Number of

Accounts

Re-defaulted

%of

Vintage

Re-defaulted

Number of

Accounts

Re-defaulted

%of

Vintage

Re-defaulted

Number of

Accounts

Re-defaulted

%of

Vintage

Re-defaulted

Number of

Accounts

Re-defaulted

%of

Vintage

Re-defaulted

Unpaid

Principal

Balance (c)

Permanent Modifications

Home Equity

Second Quarter 2014 16 2.8% $ 1,053

First Quarter 2014 19 2.7 29 4.2% 1,749

Fourth Quarter 2013 29 2.5 47 4.0 66 5.7% 4,539

Third Quarter 2013 30 2.6 44 3.7 60 5.1 65 5.5% 6,376

Second Quarter 2013 25 2.0 43 3.5 63 5.1 87 7.0 10,046

Residential Mortgages

Second Quarter 2014 29 7.9 4,538

First Quarter 2014 50 6.1 96 11.8 14,143

Fourth Quarter 2013 84 9.4 121 13.6 173 19.4 24,450

Third Quarter 2013 97 8.9 150 13.8 216 19.8 255 23.4 40,999

Second Quarter 2013 137 16.4 163 19.5 187 22.4 227 27.2 42,977

Non-Prime Mortgages

Second Quarter 2014 12 13.8 2,174

First Quarter 2014 29 16.4 42 23.7 6,383

Fourth Quarter 2013 18 9.9 35 19.2 40 22.0 5,817

Third Quarter 2013 23 13.7 26 15.5 38 22.6 47 28.0 6,119

Second Quarter 2013 24 18.8 35 27.3 41 32.0 43 33.6 8,927

Residential Construction

Second Quarter 2014 3 2.5 757

First Quarter 2014 3 2.2 3 2.2 469

Fourth Quarter 2013 1 0.7 3 2.2 4 2.9 2,354

Third Quarter 2013 1 0.7 1 0.7 1 0.7 1 0.7 50

Second Quarter 2013 1 0.5 2 1.1 4 2.1 6 3.2 1,166

Temporary Modifications

Home Equity

Second Quarter 2014 12 37.5% $ 779

First Quarter 2014 3 15.8 3 15.8% 249

Fourth Quarter 2013 10 19.6 12 23.5 13 25.5% 1,442

Third Quarter 2013 4 9.8 9 22.0 11 26.8 13 31.7% 925

Second Quarter 2013 11 14.9 18 24.3 18 24.3 17 23.0 1,757

(a) An account is considered in re-default if it is 60 days or more delinquent after modification. The data in this table represents loan modifications completed during the quarters ending

June 30, 2013 through June 30, 2014 and represents a vintage look at all quarterly accounts and the number of those modified accounts (for each quarterly vintage) 60 days or more

delinquent at six, nine, twelve, and fifteen months after modification. Account totals include active and inactive accounts that were delinquent when they achieved inactive status.

Accounts that are no longer 60 days or more delinquent, or were re-modified since prior period, are removed from re-default status in the period in which they are cured or re-

modified.

(b) Vintage refers to the quarter in which the modification occurred.

(c) Reflects December 31, 2014 unpaid principal balances of the re-defaulted accounts for the Second Quarter 2014 vintage at Six Months, for the First Quarter 2014 vintage at Nine

Months, for the Fourth Quarter 2013 vintage at Twelve Months, and for the Third Quarter 2013 and prior vintages at Fifteen Months.

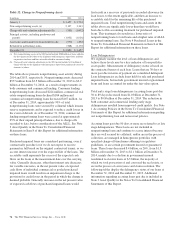

In addition to temporary loan modifications, we may make available to a borrower a payment plan or a HAMP trial payment

period. Under a payment plan or a HAMP trial payment period, there is no change to the loan’s contractual terms so the borrower

remains legally responsible for payment of the loan under its original terms.

Payment plans may include extensions, re-ages and/or forbearance plans. All payment plans bring an account current once certain

requirements are achieved and are primarily intended to demonstrate a borrower’s renewed willingness and ability to re-pay. Due

to the short term nature of the payment plan, there is a minimal impact to the ALLL.

Under a HAMP trial payment period, we establish an alternate payment, generally at an amount less than the contractual payment

amount, for the borrower during this short time period. This allows a borrower to demonstrate successful payment performance

78 The PNC Financial Services Group, Inc. – Form 10-K