PNC Bank 2014 Annual Report Download - page 251

Download and view the complete annual report

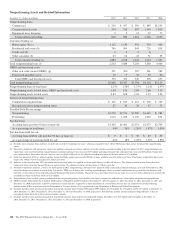

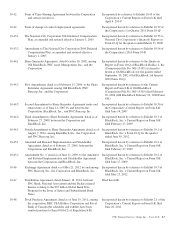

Please find page 251 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 1 – After shareholder approval of the 2006 Incentive

Award Plan at the 2006 annual meeting of PNC’s shareholders

on April 25, 2006 (see Note 2 below), no further grants were

permitted under the 1997 Long-Term Incentive Award Plan,

with certain exceptions that are no longer applicable.

Note 2 – The 2006 Incentive Award Plan was adopted by the

Board on February 15, 2006 and approved by the PNC

shareholders at the 2006 annual meeting on April 25, 2006.

The plan initially authorized up to 40,000,000 shares of

common stock for issuance under the plan, subject to

adjustment in certain circumstances. If and to the extent that

stock options and stock appreciation rights (“SARs”) granted

under the plan, or granted under the prior plan and outstanding

on the approval date of the plan, terminate, expire or are

cancelled, forfeited, exchanged or surrendered after the

effective date of the plan without being exercised or if any

share awards, share units, dividend equivalents or other share-

based awards are forfeited or terminated, or otherwise not paid

in full, after the effective date of the plan, the shares subject to

such grants become available again for purposes of the plan.

Shares available for issuance under this plan are also reduced

by the number of any shares used in payment of bonuses

under the 1996 Executive Incentive Award Plan.

The plan was most recently amended and restated

incorporating amendments adopted by the Board and

approved by PNC’s shareholders at the 2011 annual meeting

of shareholders, effective as of March 11, 2011. These

amendments incorporate, among other things, an increase to

the overall limit on the number of shares that may be awarded

under the plan to 46,000,000, and a new requirement that each

award of a share (other than pursuant to a stock option or

SAR) granted under the plan after that effective date will

reduce the aggregate plan limit by 2.5 shares, while each

award of a share pursuant to a stock option or SAR will reduce

the aggregate plan limit by one share.

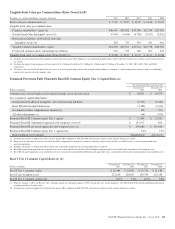

Note 3 – Under the 2006 Incentive Award Plan, awards or

portions of awards that, by their terms, are payable only in

cash do not reduce the number of shares that remain available

for issuance under the plan (the number in column (c)).

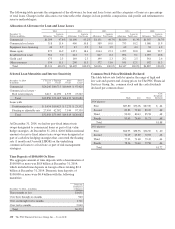

During 2014, a total of 397,929 cash-payable share units plus

cash-payable dividend equivalents with respect to 268,488 of

those share units were granted under the plan. This number

includes an incremental change in the cash-payable portion of

the 2012 incentive performance unit award grant described in

Note 4 below (net of forfeitures), a separate 2014

incentive performance unit award grant payable solely in cash,

2013 and 2014 grants of share units (all of which include

rights to cash dividend equivalents) payable solely in cash and

fractional units payable solely in cash. Payments are subject to

the conditions of the individual grants, including, where

applicable, the achievement of any performance goals or

service requirement established for such grants. The

comparable amount for 2013 was 505,343 cash-payable share

units plus cash-payable dividend equivalents with respect to

391,520 cash-payable restricted share units, and the

comparable amount for 2012 was 543,959 cash-payable share

units plus cash-payable dividend equivalents with respect to

418,665 cash-payable restricted share units.

Note 4 – These incentive performance unit awards provide for

the issuance of shares of common stock (up to a target number

of shares) based on the degree to which corporate performance

goals established by the Personnel and Compensation

Committee have been achieved, subject to potential negative

adjustment based on certain risk-related performance metrics,

and, if a premium level of such performance is achieved, for

further payment in cash. The numbers in column (a) of this

table for these awards reflect the maximum number of shares

that could be issued pursuant to grants outstanding at

December 31, 2014 upon achievement of the performance

goals and other conditions of the grants. At the premium level

of performance, a further maximum payout of cash

equivalents for 100%, 25% and 25%, respectively, of the same

number of share units for the 2012 grant, 2013 grant and 2014

grant, respectively, plus the incremental change described in

Note 3, could also be payable subject to the other conditions

of the grants. Grants under the 2006 Incentive Award Plan

were made in the first quarter of 2012, 2013 and 2014.

Note 5 – These stock-payable restricted stock units include

2011, 2012, 2013 and 2014 grants of performance-based

restricted share units (with the units payable solely in stock

and related dividend equivalents payable solely in cash) that

have a service condition, an external and also in the later

grants an internal risk-related performance condition and a

market condition and also include grants of other stock-

payable restricted share units, some of which are time-based,

others which are performance-based and some of which also

include related dividend equivalents payable solely in cash.

The number in column (a) includes the maximum number of

shares that could be issued pursuant to grants of this type of

award outstanding at December 31, 2014 upon achievement of

the performance and market conditions, where applicable, and

other conditions of the grants. Cash-payable dividend

equivalents were granted with respect to most of these stock-

payable restricted stock units. Where stock-payable restricted

share units include a fractional share interest, such fractional

share interest is payable only in cash share equivalents.

During 2014, a total of 39 cash share equivalents were paid in

the aggregate for fractional share interests, including any for

award grants described in Note 4.

Note 6 – The 1996 Executive Incentive Award Plan is a

shareholder-approved plan that enables PNC to pay annual

bonuses to its senior executive officers based upon the

achievement of specified levels of performance. The plan as

amended and restated as of January 1, 2007 was adopted by

the Board on February 14, 2007 and approved by the PNC

shareholders at the 2007 annual meeting on April 24, 2007.

The plan does not specify a fixed share amount for awards

under the plan. Rather, it provides for maximum bonus awards

The PNC Financial Services Group, Inc. – Form 10-K 233