PNC Bank 2014 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

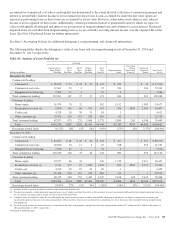

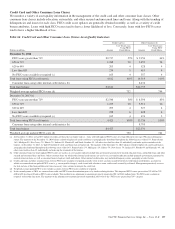

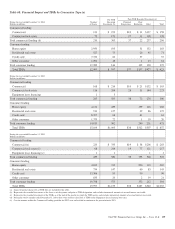

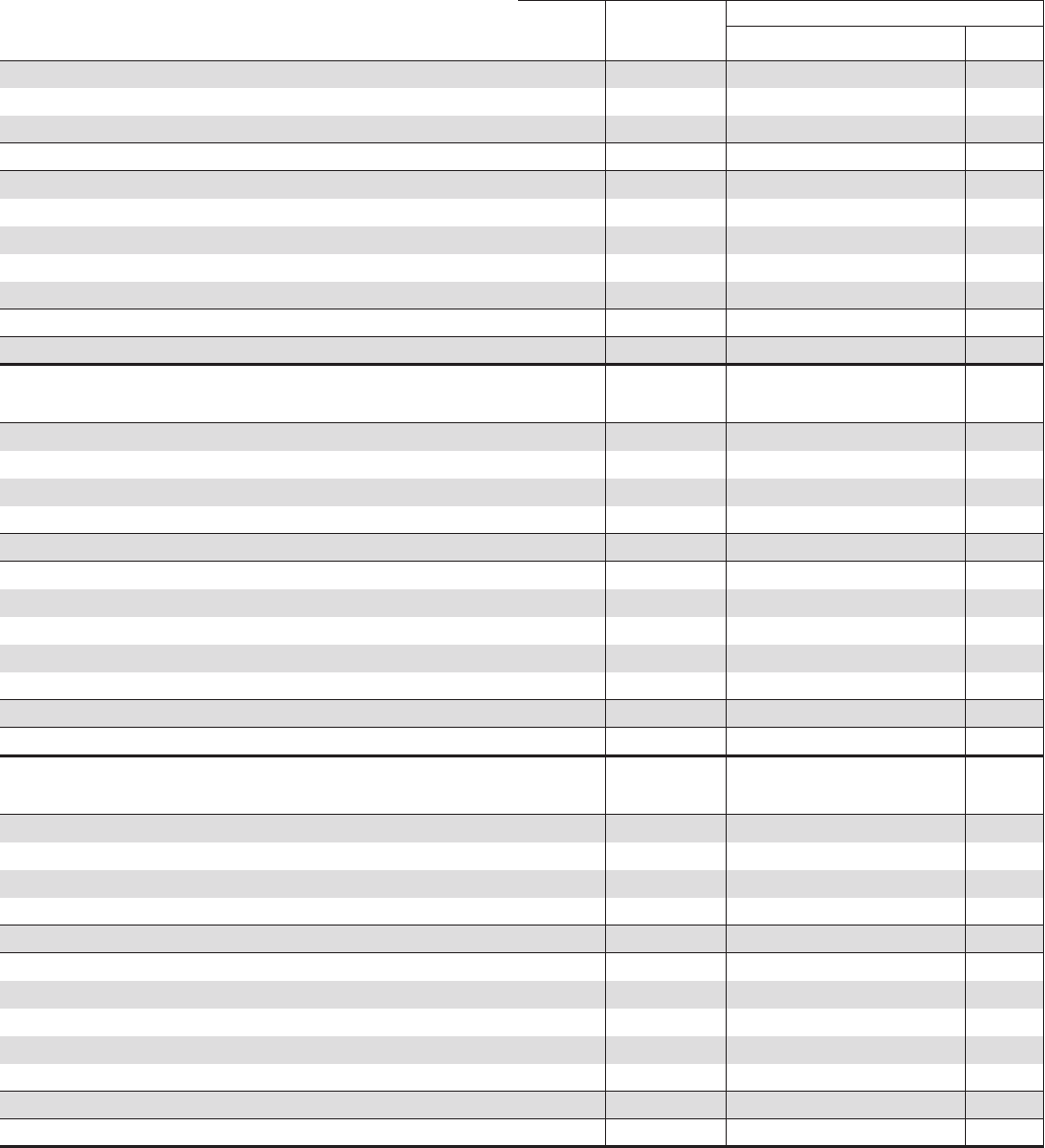

Table 68: Financial Impact and TDRs by Concession Type (a)

Number

of Loans

Pre-TDR

Recorded

Investment (b)

Post-TDR Recorded Investment (c)

During the year ended December 31, 2014

Dollars in millions

Principal

Forgiveness

Rate

Reduction Other Total

Commercial lending

Commercial 131 $ 192 $10 $ 11 $137 $ 158

Commercial real estate 79 171 27 11 100 138

Total commercial lending (d) 210 363 37 22 237 296

Consumer lending

Home equity 2,950 193 51 132 183

Residential real estate 527 73 26 45 71

Credit card 7,720 60 57 57

Other consumer 1,092 18 1 13 14

Total consumer lending 12,289 344 135 190 325

Total TDRs 12,499 $ 707 $37 $157 $427 $ 621

During the year ended December 31, 2013

Dollars in millions

Commercial lending

Commercial 168 $ 216 $10 $ 21 $132 $ 163

Commercial real estate 116 284 28 51 144 223

Equipment lease financing 1 3

Total commercial lending 285 503 38 72 276 386

Consumer lending

Home equity 4,132 289 139 126 265

Residential real estate 911 127 39 86 125

Credit card 8,397 64 61 61

Other consumer 1,379 22 1 19 20

Total consumer lending 14,819 502 240 231 471

Total TDRs 15,104 $1,005 $38 $312 $507 $ 857

During the year ended December 31, 2012

Dollars in millions

Commercial lending

Commercial (e) 220 $ 335 $19 $ 58 $206 $ 283

Commercial real estate (e) 68 244 19 77 121 217

Equipment lease financing (e) 1 1 1 1

Total commercial lending 289 580 38 135 328 501

Consumer lending

Home equity 4,813 313 200 110 310

Residential real estate 754 147 60 83 143

Credit card 13,306 93 90 90

Other consumer 835 20 2 19 21

Total consumer lending 19,708 573 352 212 564

Total TDRs 19,997 $1,153 $38 $487 $540 $1,065

(a) Impact of partial charge-offs at TDR date are included in this table.

(b) Represents the recorded investment of the loans as of the quarter end prior to TDR designation, and excludes immaterial amounts of accrued interest receivable.

(c) Represents the recorded investment of the TDRs as of the end of the quarter in which the TDR occurs, and excludes immaterial amounts of accrued interest receivable.

(d) During the twelve months ended December 31, 2014, there were no loans classified as TDRs in the Equipment lease financing loan class.

(e) Certain amounts within the Commercial lending portfolio for 2012 were reclassified to conform to the presentation in 2013.

The PNC Financial Services Group, Inc. – Form 10-K 139