PNC Bank 2014 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

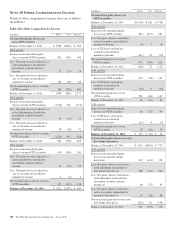

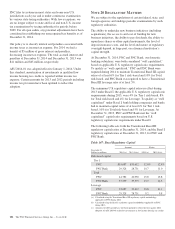

A reconciliation between the statutory and effective tax rates

follows:

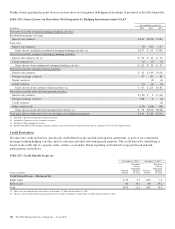

Table 144: Reconciliation of Statutory and Effective Tax

Rates

Year ended December 31 2014 2013 2012

Statutory tax rate 35.0% 35.0% 35.0%

Increases (decreases) resulting from

State taxes net of federal benefit 1.2 1.1 1.3

Tax-exempt interest (a) (2.2) (1.9) (2.3)

Life insurance (1.7) (1.7) (2.3)

Dividend received deduction (a) (1.5) (1.2) (1.6)

Tax credits (a) (4.4) (3.7) (4.6)

Other (a) (1.3) (1.7) .4

Effective tax rate 25.1% 25.9% 25.9%

(a) Amounts for 2013 and 2012 have been updated to reflect the first quarter 2014

adoption of ASU 2014-01 related to investments in low income housing tax credits.

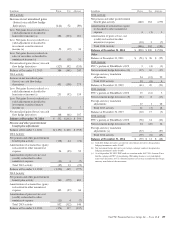

The net operating loss carryforwards at December 31, 2014

and 2013 follow:

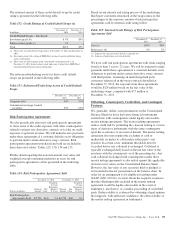

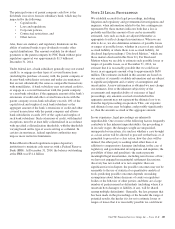

Table 145: Net Operating Loss Carryforwards and Tax

Credit Carryforwards

In millions

December 31

2014

December 31

2013

Net Operating Loss Carryforwards:

Federal $ 997 $1,116

State 2,594 2,958

Tax Credit Carryforwards:

Federal $ 35 $ 221

State 7 7

The federal net operating loss carryforwards expire in 2032.

The state net operating loss carryforwards will expire from

2015 to 2031. The majority of the tax credit carryforwards

expire in 2032.

The federal net operating loss carryforwards and tax credit

carryforwards above are substantially from the 2012

acquisition of RBC Bank (USA) and are subject to a federal

annual Section 382 limitation under the Internal Revenue

Code of 1986; and acquired state operating loss carryforwards

are subject to similar limitations that exist for state tax

purposes. The majority of the decrease to state net operating

loss carryforwards is attributable to the estimated utilization

on 2014 tax return filings. It is anticipated that the company

will be able to fully utilize its carryforwards for federal tax

purposes, but a valuation allowance of $65 million has been

recorded against certain state tax carryforwards as of

December 31, 2014. See Note 2 Acquisition and Divestiture

Activity in our 2013 Form 10-K for additional discussion of

our 2012 acquisition of RBC Bank (USA).

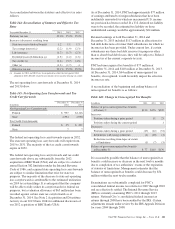

As of December 31, 2014, PNC had approximately $77 million

of earnings attributed to foreign subsidiaries that have been

indefinitely reinvested for which no incremental U.S. income

tax provision has been recorded. If a U.S. deferred tax liability

were to be recorded, the estimated tax liability on those

undistributed earnings would be approximately $24 million.

Retained earnings at both December 31, 2014 and

December 31, 2013 included $117 million in allocations for

bad debt deductions of former thrift subsidiaries for which no

income tax has been provided. Under current law, if certain

subsidiaries use these bad debt reserves for purposes other

than to absorb bad debt losses, they will be subject to Federal

income tax at the current corporate tax rate.

PNC had unrecognized tax benefits of $77 million at

December 31, 2014 and $110 million at December 31, 2013.

At December 31, 2014, $64 million of unrecognized tax

benefits, if recognized, would favorably impact the effective

income tax rate.

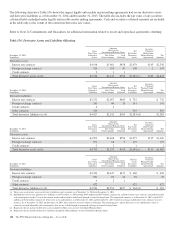

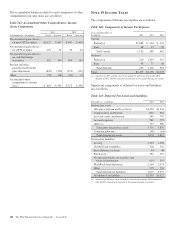

A reconciliation of the beginning and ending balance of

unrecognized tax benefits is as follows:

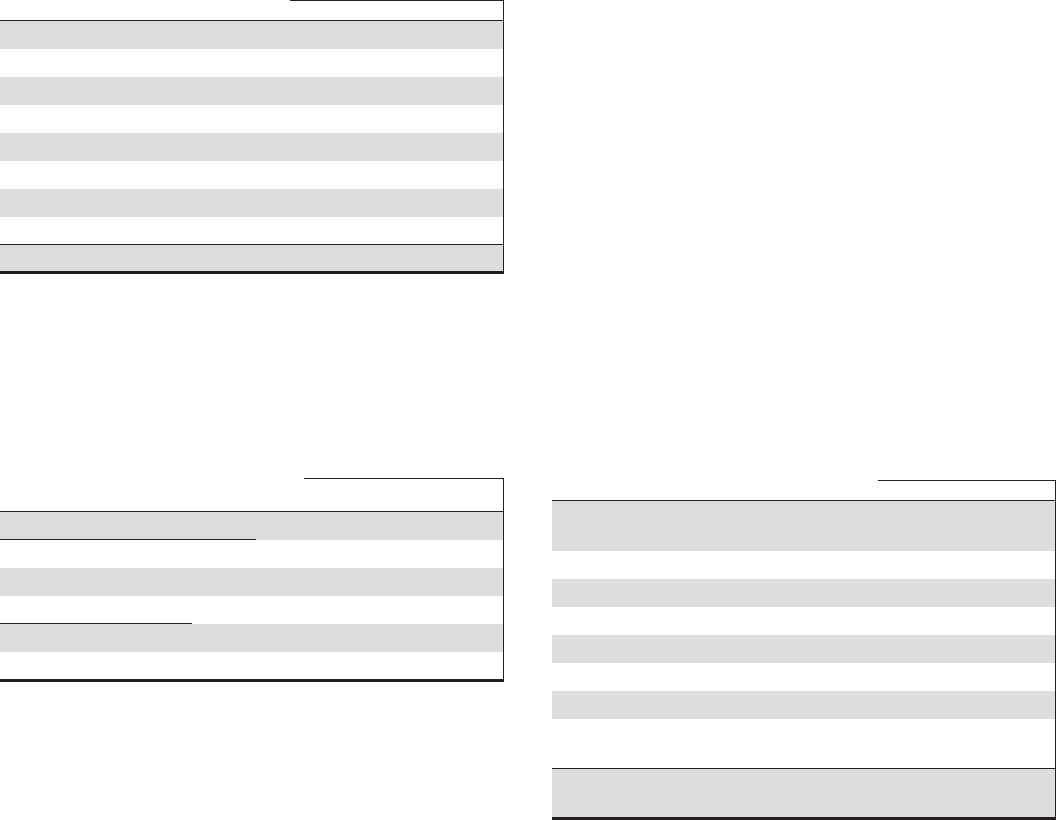

Table 146: Change in Unrecognized Tax Benefits

In millions 2014 2013 2012

Balance of gross unrecognized tax benefits

at January 1 $110 $176 $209

Increases:

Positions taken during a prior period 11 23

Positions taken during the current period 1

Decreases:

Positions taken during a prior period (27) (22) (51)

Settlements with taxing authorities (1) (48) (1)

Reductions resulting from lapse of statute

of limitations (5) (7) (5)

Balance of gross unrecognized tax benefits

at December 31 $ 77 $110 $176

It is reasonably possible that the balance of unrecognized tax

benefits could increase or decrease in the next twelve months

due to completion of tax authorities’ exams or the expiration

of statutes of limitations. Management estimates that the

balance of unrecognized tax benefits could decrease by $54

million within the next twelve months.

Examinations are substantially completed for PNC’s

consolidated federal income tax returns for 2007 through 2010

and are effectively settled. The Internal Revenue Service

(IRS) is currently examining PNC’s 2011 through 2013

returns. National City’s consolidated federal income tax

returns through 2008 have been audited by the IRS. Certain

adjustments remain under review by the IRS Appeals Division

for years 2004 through 2008.

The PNC Financial Services Group, Inc. – Form 10-K 201