PNC Bank 2014 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

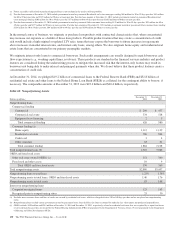

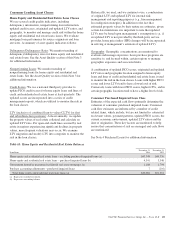

Commercial Real Estate Loan Class

We manage credit risk associated with our commercial real

estate projects and commercial mortgage activities similar to

commercial loans by analyzing PD and LGD. Additionally,

risks connected with commercial real estate projects and

commercial mortgage activities tend to be correlated to the

loan structure and collateral location, project progress and

business environment. As a result, these attributes are also

monitored and utilized in assessing credit risk.

As with the commercial class, a formal schedule of periodic

review is also performed to assess market/geographic risk and

business unit/industry risk. Often as a result of these

overviews, more in-depth reviews and increased scrutiny are

placed on areas of higher risk, including adverse changes in

risk ratings, deteriorating operating trends, and/or areas that

concern management. These reviews are designed to assess

risk and take actions to mitigate our exposure to such risks.

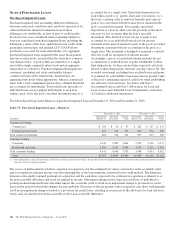

Equipment Lease Financing Loan Class

We manage credit risk associated with our equipment lease

financing loan class similar to commercial loans by analyzing

PD and LGD.

Based upon the dollar amount of the lease and of the level of

credit risk, we follow a formal schedule of periodic review.

Generally, this occurs quarterly, although we have established

practices to review such credit risk more frequently if

circumstances warrant. Our review process entails analysis of

the following factors: equipment value/residual value,

exposure levels, jurisdiction risk, industry risk, guarantor

requirements, and regulatory compliance.

Commercial Purchased Impaired Loan Class

Estimates of the expected cash flows primarily determine the

valuation of commercial purchased impaired loans.

Commercial cash flow estimates are influenced by a number

of credit related items, which include but are not limited to:

estimated collateral value, receipt of additional collateral,

secondary trading prices, circumstances of possible and/or

ongoing liquidation, capital availability, business operations

and payment patterns.

We attempt to proactively manage these factors by using various

procedures that are customized to the risk of a given loan. These

procedures include a review by our Special Asset Committee

(SAC), ongoing outreach, contact, and assessment of obligor

financial conditions, collateral inspection and appraisal.

See Note 4 Purchased Loans for additional information.

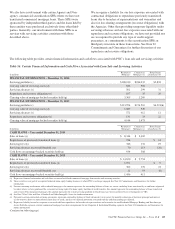

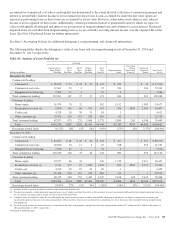

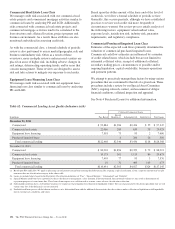

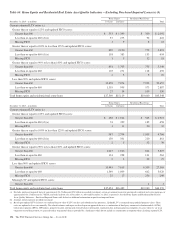

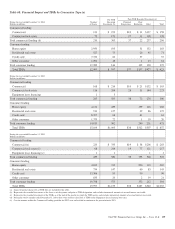

Table 62: Commercial Lending Asset Quality Indicators (a)(b)

Criticized Commercial Loans

In millions Pass Rated

Special

Mention (c) Substandard (d) Doubtful (e) Total Loans

December 31, 2014

Commercial $ 92,884 $1,984 $2,424 $ 55 $ 97,347

Commercial real estate 22,066 285 639 35 23,025

Equipment lease financing 7,518 73 93 2 7,686

Purchased impaired loans 4 280 26 310

Total commercial lending $122,468 $2,346 $3,436 $118 $128,368

December 31, 2013

Commercial $ 83,903 $1,894 $2,352 $ 72 $ 88,221

Commercial real estate 19,175 301 1,113 86 20,675

Equipment lease financing 7,403 77 93 3 7,576

Purchased impaired loans 10 31 469 163 673

Total commercial lending $110,491 $2,303 $4,027 $324 $117,145

(a) Based upon PDs and LGDs. We apply a split rating classification to certain loans meeting threshold criteria. By assigning a split classification, a loan’s exposure amount may be split

into more than one classification category in the above table.

(b) Loans are included above based on the Regulatory Classification definitions of “Pass”, “Special Mention”, “Substandard” and “Doubtful”.

(c) Special Mention rated loans have a potential weakness that deserves management’s close attention. If left uncorrected, these potential weaknesses may result in deterioration of

repayment prospects at some future date. These loans do not expose us to sufficient risk to warrant a more adverse classification at this time.

(d) Substandard rated loans have a well-defined weakness or weaknesses that jeopardize the collection or liquidation of debt. They are characterized by the distinct possibility that we will

sustain some loss if the deficiencies are not corrected.

(e) Doubtful rated loans possess all the inherent weaknesses of a Substandard loan with the additional characteristics that the weakness makes collection or liquidation in full improbable

due to existing facts, conditions, and values.

132 The PNC Financial Services Group, Inc. – Form 10-K