PNC Bank 2014 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

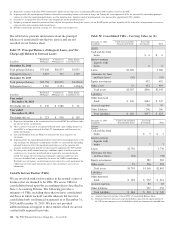

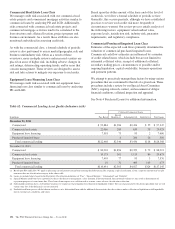

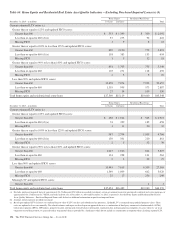

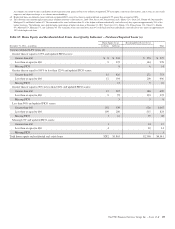

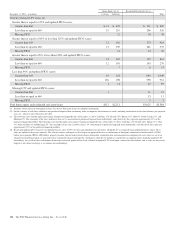

Consumer Lending Asset Classes

Home Equity and Residential Real Estate Loan Classes

We use several credit quality indicators, including

delinquency information, nonperforming loan information,

updated credit scores, originated and updated LTV ratios, and

geography, to monitor and manage credit risk within the home

equity and residential real estate loan classes. We evaluate

mortgage loan performance by source originators and loan

servicers. A summary of asset quality indicators follows:

Delinquency/Delinquency Rates: We monitor trending of

delinquency/delinquency rates for home equity and residential

real estate loans. See the Asset Quality section of this Note 3

for additional information.

Nonperforming Loans: We monitor trending of

nonperforming loans for home equity and residential real

estate loans. See the Asset Quality section of this Note 3 for

additional information.

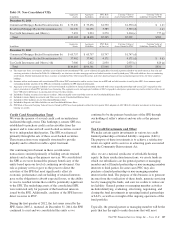

Credit Scores: We use a national third-party provider to

update FICO credit scores for home equity loans and lines of

credit and residential real estate loans at least quarterly. The

updated scores are incorporated into a series of credit

management reports, which are utilized to monitor the risk in

the loan classes.

LTV (inclusive of combined loan-to-value (CLTV) for first

and subordinate lien positions): At least annually, we update

the property values of real estate collateral and calculate an

updated LTV ratio. For open-end credit lines secured by real

estate in regions experiencing significant declines in property

values, more frequent valuations may occur. We examine

LTV migration and stratify LTV into categories to monitor the

risk in the loan classes.

Historically, we used, and we continue to use, a combination

of original LTV and updated LTV for internal risk

management and reporting purposes (e.g., line management,

loss mitigation strategies). In addition to the fact that

estimated property values by their nature are estimates, given

certain data limitations it is important to note that updated

LTVs may be based upon management’s assumptions (e.g.,if

an updated LTV is not provided by the third-party service

provider, home price index (HPI) changes will be incorporated

in arriving at management’s estimate of updated LTV).

Geography: Geographic concentrations are monitored to

evaluate and manage exposures. Loan purchase programs are

sensitive to, and focused within, certain regions to manage

geographic exposures and associated risks.

A combination of updated FICO scores, originated and updated

LTV ratios and geographic location assigned to home equity

loans and lines of credit and residential real estate loans is used

to monitor the risk in the loan classes. Loans with higher FICO

scores and lower LTVs tend to have a lower level of risk.

Conversely, loans with lower FICO scores, higher LTVs, and in

certain geographic locations tend to have a higher level of risk.

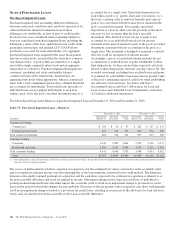

Consumer Purchased Impaired Loan Class

Estimates of the expected cash flows primarily determine the

valuation of consumer purchased impaired loans. Consumer

cash flow estimates are influenced by a number of credit

related items, which include, but are not limited to: estimated

real estate values, payment patterns, updated FICO scores, the

current economic environment, updated LTV ratios and the

date of origination. These key factors are monitored to help

ensure that concentrations of risk are managed and cash flows

are maximized.

See Note 4 Purchased Loans for additional information.

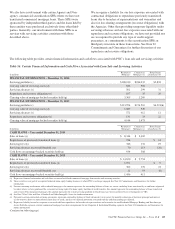

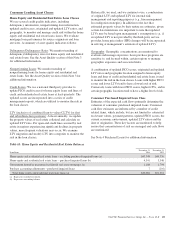

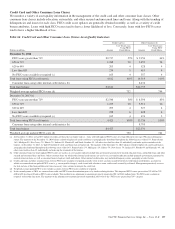

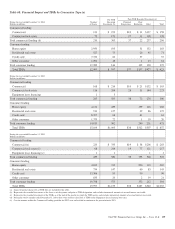

Table 63: Home Equity and Residential Real Estate Balances

In millions

December 31

2014

December 31

2013

Home equity and residential real estate loans – excluding purchased impaired loans (a) $43,348 $44,376

Home equity and residential real estate loans – purchased impaired loans (b) 4,541 5,548

Government insured or guaranteed residential real estate mortgages (a) 1,188 1,704

Purchase accounting adjustments – purchased impaired loans 7 (116)

Total home equity and residential real estate loans (a) $49,084 $51,512

(a) Represents recorded investment.

(b) Represents outstanding balance.

The PNC Financial Services Group, Inc. – Form 10-K 133