PNC Bank 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Market Risk Management – Equity And Other Investment

Risk

Equity investment risk is the risk of potential losses associated

with investing in both private and public equity markets. In

addition to extending credit, taking deposits, securities

underwriting and trading financial instruments, we make and

manage direct investments in a variety of transactions,

including management buyouts, recapitalizations and growth

financings in a variety of industries. We also have investments

in affiliated and non-affiliated funds that make similar

investments in private equity and in debt and equity-oriented

hedge funds. The economic and/or book value of these

investments and other assets such as loan servicing rights are

directly affected by changes in market factors.

The primary risk measurement for equity and other

investments is economic capital. Economic capital is a

common measure of risk for credit, market and operational

risk. It is an estimate of the potential value depreciation over a

one year horizon commensurate with solvency expectations of

an institution rated single-A by the credit rating agencies.

Given the illiquid nature of many of these types of

investments, it can be a challenge to determine their fair

values. See Note 7 Fair Value in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information.

Various PNC business units manage our equity and other

investment activities. Our businesses are responsible for

making investment decisions within the approved policy limits

and associated guidelines.

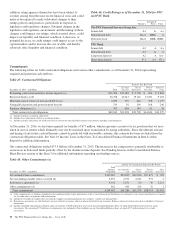

A summary of our equity investments follows:

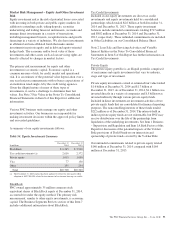

Table 54: Equity Investments Summary

In millions

December 31

2014

December 31

2013

BlackRock $ 6,265 $ 5,940

Tax credit investments (a) 2,616 2,572

Private equity 1,615 1,656

Visa 77 158

Other 155 234

Total $10,728 $10,560

(a) The December 31, 2013 amount has been updated to reflect the first quarter 2014

adoption of ASU 2014-01 related to investments in low income housing tax credits.

BlackRock

PNC owned approximately 35 million common stock

equivalent shares of BlackRock equity at December 31, 2014,

accounted for under the equity method. The primary risk

measurement, similar to other equity investments, is economic

capital. The Business Segments Review section of this Item 7

includes additional information about BlackRock.

Tax Credit Investments

Included in our equity investments are direct tax credit

investments and equity investments held by consolidated

partnerships which totaled $2.6 billion at both December 31,

2014 and December 31, 2013. These equity investment

balances include unfunded commitments totaling $717 million

and $802 million at December 31, 2014 and December 31,

2013, respectively. These unfunded commitments are included

in Other Liabilities on our Consolidated Balance Sheet.

Note 2 Loan Sale and Servicing Activities and Variable

Interest Entities in the Notes To Consolidated Financial

Statements in Item 8 of this Report has further information on

Tax Credit Investments.

Private Equity

The private equity portfolio is an illiquid portfolio comprised

of mezzanine and equity investments that vary by industry,

stage and type of investment.

Private equity investments carried at estimated fair value totaled

$1.6 billion at December 31, 2014 and $1.7 billion at

December 31, 2013. As of December 31, 2014, $1.1 billion was

invested directly in a variety of companies and $.5 billion was

invested indirectly through various private equity funds.

Included in direct investments are investment activities of two

private equity funds that are consolidated for financial reporting

purposes. The noncontrolling interests of these funds totaled

$212 million as of December 31, 2014. The interests held in

indirect private equity funds are not redeemable, but PNC may

receive distributions over the life of the partnership from

liquidation of the underlying investments. See Item 1 Business

– Supervision and Regulation and Item 1A Risk Factors of this

Report for discussion of the potential impacts of the Volcker

Rule provisions of Dodd-Frank on our interests in and

sponsorship of private funds covered by the Volcker Rule.

Our unfunded commitments related to private equity totaled

$140 million at December 31, 2014 compared with $164

million at December 31, 2013.

The PNC Financial Services Group, Inc. – Form 10-K 93