PNC Bank 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our total commitments totaled $146.8 billion at December 31,

2013. The increase in the comparison is primarily due to an

increase in exposure on net unfunded loan commitments

partially offset by a decline in reinsurance agreements and net

outstanding standby letters of credit. See Note 22

Commitments and Guarantees in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information on net unfunded loan commitments, our

reinsurance agreements, net outstanding standby letters of

credit, and certain other commitments.

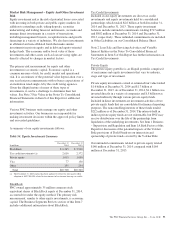

Market Risk Management

Market risk is the risk of a loss in earnings or economic value

due to adverse movements in market factors such as interest

rates, credit spreads, foreign exchange rates and equity prices.

We are exposed to market risk primarily by our involvement

in the following activities, among others:

• Traditional banking activities of taking deposits and

extending loans,

• Equity and other investments and activities whose

economic values are directly impacted by market

factors, and

• Fixed income securities, derivatives and foreign

exchange activities, as a result of customer activities

and securities underwriting.

We have established enterprise-wide policies and

methodologies to identify, measure, monitor and report market

risk. Market Risk Management provides independent

oversight by monitoring compliance with these limits and

guidelines, and reporting significant risks in the business to

the Risk Committee of the Board.

Market Risk Management – Interest Rate Risk

Interest rate risk results primarily from our traditional banking

activities of gathering deposits and extending loans. Many

factors, including economic and financial conditions,

movements in interest rates and consumer preferences, affect

the difference between the interest that we earn on assets and

the interest that we pay on liabilities and the level of our

noninterest-bearing funding sources. Due to the repricing term

mismatches and embedded options inherent in certain of these

products, changes in market interest rates not only affect

expected near-term earnings, but also the economic values of

these assets and liabilities.

Asset and Liability Management centrally manages interest

rate risk as prescribed in our risk management policies, which

are approved by management’s Asset and Liability Committee

and the Risk Committee of the Board.

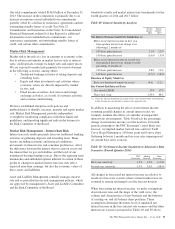

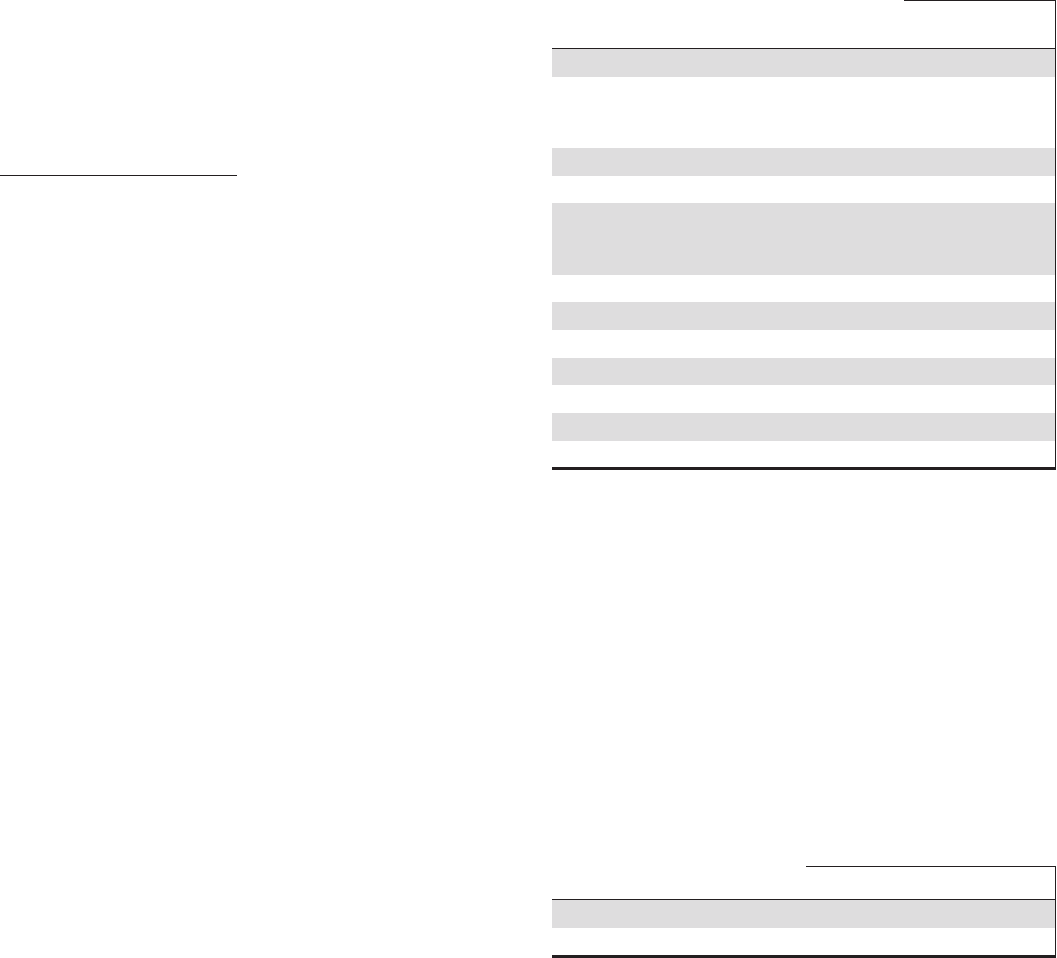

Sensitivity results and market interest rate benchmarks for the

fourth quarters of 2014 and 2013 follow:

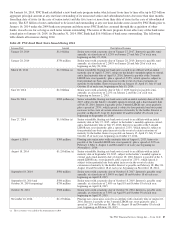

Table 49: Interest Sensitivity Analysis

Fourth

Quarter

2014

Fourth

Quarter

2013

Net Interest Income Sensitivity Simulation (a)

Effect on net interest income in first year

from gradual interest rate change over

following 12 months of:

100 basis point increase 2.1% 2.2%

100 basis point decrease (1.0)% (.9)%

Effect on net interest income in second year

from gradual interest rate change over the

preceding 12 months of:

100 basis point increase 5.8% 7.4%

100 basis point decrease (5.7)% (3.8)%

Duration of Equity Model (a)

Base case duration of equity (in years) (4.6) (1.2)

Key Period-End Interest Rates

One-month LIBOR .17% .17%

Three-year swap 1.30% .88%

(a) Given the inherent limitations in certain of these measurement tools and techniques,

results become less meaningful as interest rates approach zero.

In addition to measuring the effect on net interest income

assuming parallel changes in current interest rates, we

routinely simulate the effects of a number of nonparallel

interest rate environments. Table 50 reflects the percentage

change in net interest income over the next two 12-month

periods assuming (i) the PNC Economist’s most likely rate

forecast, (ii) implied market forward rates and (iii) Yield

Curve Slope Flattening (a 100 basis point yield curve slope

flattening between 1-month and ten-year rates superimposed

on current base rates) scenario.

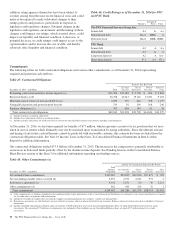

Table 50: Net Interest Income Sensitivity to Alternative Rate

Scenarios (Fourth Quarter 2014)

PNC

Economist

Market

Forward

Slope

Flattening

First year sensitivity 1.3% 1.0% (1.0)%

Second year sensitivity 5.3% 3.6% (4.8)%

All changes in forecasted net interest income are relative to

results in a base rate scenario where current market rates are

assumed to remain unchanged over the forecast horizon.

When forecasting net interest income, we make assumptions

about interest rates and the shape of the yield curve, the

volume and characteristics of new business and the behavior

of existing on- and off-balance sheet positions. These

assumptions determine the future level of simulated net

interest income in the base interest rate scenario and the other

interest rate scenarios presented in Tables 49 and 50 above.

The PNC Financial Services Group, Inc. – Form 10-K 91