PNC Bank 2014 Annual Report Download - page 116

Download and view the complete annual report

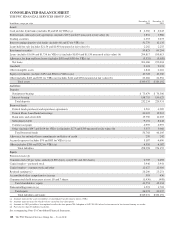

Please find page 116 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Funding Sources

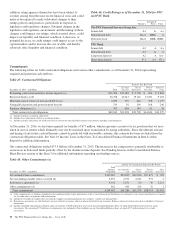

Total funding sources increased $13.0 billion to $267.0 billion

at December 31, 2013 compared with December 31, 2012.

Total deposits increased $7.8 billion at December 31, 2013

compared with December 31, 2012 due to increases in money

market, demand, and savings accounts, partially offset by

decreases in retail certificates of deposit. Interest-bearing

deposits represented 68% of total deposits at December 31,

2013 compared to 67% at December 31, 2012

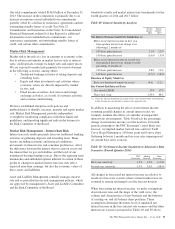

Average total deposits increased $10.6 billion to $212.2

billion in 2013 compared with the prior year, primarily due to

an increase of $15.0 billion in average transaction deposits,

which grew to $176.9 billion in 2013. Higher average interest-

bearing demand deposits, average money market deposits and

average noninterest-bearing deposits drove the increase in

average transaction deposits. These increases were partially

offset by a decrease of $4.3 billion in average retail

certificates of deposit attributable to runoff of maturing

accounts. Average total deposits represented 69% of average

total assets for 2013 and 68% for 2012.

Total borrowed funds increased $5.2 billion to $46.1 billion at

December 31, 2013 as higher Federal Home Loan Bank

borrowings and bank notes and senior debt were partially

offset by a decrease in commercial paper.

Average borrowed funds were $40.0 billion in 2013 compared

with $41.8 billion in 2012. The decrease was primarily due to

lower average commercial paper, lower average Federal Home

Loan Bank (FHLB) borrowings and lower average federal

funds purchased and repurchase agreements.

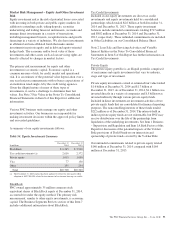

Shareholders’ Equity

Total shareholders’ equity increased $3.4 billion, to $42.3

billion at December 31, 2013 compared with December 31,

2012, primarily reflecting an increase in retained earnings of

$3.0 billion (driven by net income of $4.2 billion and the

impact of $1.1 billion of common and preferred dividends

declared) and an increase of $.6 billion in capital surplus due

to the net issuances of preferred stock and common stock and

other. These increases were partially offset by the decline of

accumulated other comprehensive income of $.4 billion. This

decline was primarily due to the impact of an increase in

market interest rates and widening asset spreads on securities

available for sale and derivatives that are part of cash flow

hedging strategies, partially offset by the impact of pension

and other postretirement benefit plan adjustments. Common

shares outstanding were 533 million at December 31, 2013

and 528 million at December 31, 2012.

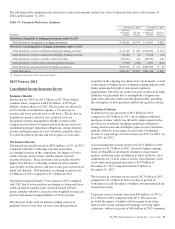

Risk-Based Capital

Regulatory Basel I capital ratios at December 31, 2013 were

10.5% for Tier 1 common, 11.1% for leverage, 12.4% for Tier

1 risk-based and 15.8% for total risk-based capital. At

December 31, 2012, the Basel I regulatory capital ratios were

9.6% for Tier 1 common, 10.4% for leverage, 11.6% for Tier

1 risk-based and 14.7% for total risk-based capital. The Basel

I capital ratios increased in all comparisons primarily due to

growth in retained earnings. The net issuance of preferred

stock during 2013 partially offset by the redemption of trust

preferred securities favorably impacted the December 31,

2013 Basel I Tier 1 risk-based and Basel I total risk-based

capital ratios. Basel I risk-weighted assets increased $11.3

billion to $272.2 billion at December 31, 2013 compared to

December 31, 2012.

98 The PNC Financial Services Group, Inc. – Form 10-K