PNC Bank 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

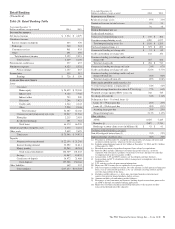

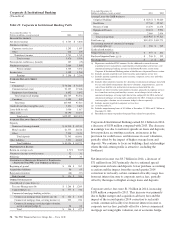

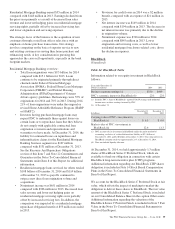

Corporate & Institutional Banking

(Unaudited)

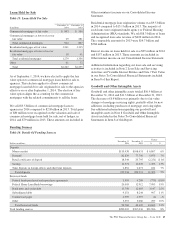

Table 21: Corporate & Institutional Banking Table

Year ended December 31

Dollars in millions, except as noted 2014 2013

I

NCOME

S

TATEMENT

Net interest income $ 3,733 $ 3,804

Noninterest income

Corporate service fees 1,295 1,097

Other 448 605

Noninterest income 1,743 1,702

Total revenue 5,476 5,506

Provision for credit losses (benefit) 107 (25)

Noninterest expense 2,064 1,999

Pretax earnings 3,305 3,532

Income taxes 1,199 1,268

Earnings $ 2,106 $ 2,264

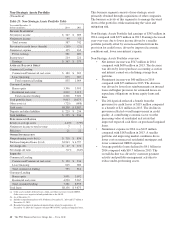

A

VERAGE

B

ALANCE

S

HEET

Loans

Commercial $ 78,688 $ 72,256

Commercial real estate 21,127 17,668

Equipment lease financing 6,892 6,642

Total commercial lending 106,707 96,566

Consumer 1,198 947

Total loans 107,905 97,513

Goodwill and other intangible assets 3,826 3,804

Loans held for sale 1,006 1,017

Other assets 10,190 10,636

Total assets $122,927 $112,970

A

VERAGE

B

ALANCE

S

HEET

(C

ONTINUED

)

Deposits

Noninterest-bearing demand $ 44,210 $ 41,514

Money market 21,377 18,168

Other 7,958 7,124

Total deposits 73,545 66,806

Other liabilities 7,551 14,465

Total liabilities $ 81,096 $ 81,271

P

ERFORMANCE

R

ATIOS

Return on average assets 1.71% 2.00%

Noninterest income to total revenue 32 31

Efficiency 38 36

C

OMMERCIAL

M

ORTGAGE

S

ERVICING

P

ORTFOLIO

–S

ERVICED

F

OR

PNC

AND

O

THERS

(in billions)

Beginning of period $ 308 $ 282

Acquisitions/additions 96 83

Repayments/transfers (68) (57)

End of period $ 336 $ 308

O

THER

I

NFORMATION

Consolidated revenue from: (a)

Treasury Management (b) $ 1,288 $ 1,260

Capital Markets (c) $ 777 $ 722

Commercial mortgage banking activities

Commercial mortgage loans held for sale (d) $ 126 $ 133

Commercial mortgage loan servicing income (e) 222 226

Commercial mortgage servicing rights valuation,

net of economic hedge (f) 38 68

Total $ 386 $ 427

Year ended December 31

Dollars in millions, except as noted 2014 2013

Average Loans (by C&IB business)

Corporate Banking $ 54,341 $ 50,620

Real Estate 27,740 22,287

Business Credit 13,270 11,678

Equipment Finance 10,474 9,994

Other 2,080 2,934

Total average loans $107,905 $ 97,513

Total loans (g) $113,935 $101,773

Net carrying amount of commercial mortgage

servicing rights (g) $ 506 $ 549

Credit-related statistics:

Nonperforming assets (g) (h) $ 557 $ 804

Purchased impaired loans (g) (i) $ 246 $ 515

Net charge-offs $ 8 $ 105

(a) Represents consolidated PNC amounts. See the additional revenue discussion

regarding treasury management, capital markets-related products and services, and

commercial mortgage banking activities in the Product Revenue section of the

Corporate & Institutional Banking portion of this Business Segments Review section.

(b) Includes amounts reported in net interest income and corporate service fees.

(c) Includes amounts reported in net interest income, corporate service fees and other

noninterest income.

(d) Includes other noninterest income for valuations on commercial mortgage loans held

for sale and related commitments, derivative valuations, origination fees, gains on

sale of loans held for sale and net interest income on loans held for sale.

(e) Includes net interest income and noninterest income, primarily in corporate services

fees, from loan servicing and ancillary services, net of changes in fair value on

commercial mortgage servicing rights due to time and payoffs for 2014 and net of

commercial mortgage servicing rights amortization for 2013. Commercial mortgage

servicing rights valuation, net of economic hedge is shown separately.

(f) Includes amounts reported in corporate services fees.

(g) As of December 31.

(h) Includes nonperforming loans of $.5 billion at December 31, 2014 and $.7 billion at

December 31, 2013.

(i) Recorded investment of purchased impaired loans related to acquisitions.

Corporate & Institutional Banking earned $2.1 billion in 2014,

a decrease of $158 million compared with 2013. The decrease

in earnings was due to narrower spreads on loans and deposits,

lower purchase accounting accretion, an increase in the

provision for credit losses, and decreases in asset valuations,

partially offset by the impact of higher average loans and

deposits. We continue to focus on building client relationships

where the risk-return profile is attractive, including the

Southeast.

Net interest income was $3.7 billion in 2014, a decrease of

$71 million from 2013 primarily due to continued spread

compression on loans and deposits, lower purchase accounting

accretion and the impact from the second quarter 2014

correction to reclassify certain commercial facility usage fees

from net interest income to corporate service fees, partially

offset by the impact of higher average loans and deposits.

Corporate service fees were $1.3 billion in 2014, increasing

$198 million compared to 2013. This increase was primarily

due to higher merger and acquisition advisory fees and the

impact of the second quarter 2014 correction to reclassify

certain commercial facility fees from net interest income to

corporate service fees, partially offset by a lower commercial

mortgage servicing rights valuation, net of economic hedge.

54 The PNC Financial Services Group, Inc. – Form 10-K