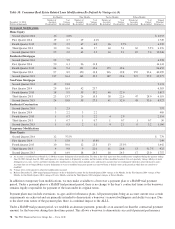

PNC Bank 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

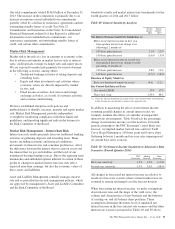

Liquidity Risk Management

Liquidity risk has two fundamental components. The first is

potential loss assuming we were unable to meet our funding

requirements at a reasonable cost. The second is the potential

inability to operate our businesses because adequate

contingent liquidity is not available. We manage liquidity risk

at the consolidated company level (bank, parent company, and

nonbank subsidiaries combined) to help ensure that we can

obtain cost-effective funding to meet current and future

obligations under both normal “business as usual” and

stressful circumstances, and to help ensure that we maintain

an appropriate level of contingent liquidity.

Management monitors liquidity through a series of early

warning indicators that may indicate a potential market, or

PNC-specific, liquidity stress event. In addition, management

performs a set of liquidity stress tests over multiple time

horizons with varying levels of severity and maintains a

contingency funding plan to address a potential stress event.

In the most severe liquidity stress simulation, we assume that

PNC’s liquidity position is under pressure, while the market in

general is under systemic pressure. The simulation considers,

among other things, the impact of restricted access to both

secured and unsecured external sources of funding,

accelerated run-off of customer deposits, valuation pressure

on assets and heavy demand to fund contingent obligations.

Parent company liquidity guidelines are designed to help

ensure that sufficient liquidity is available to meet our parent

company obligations over the succeeding 24-month period.

Liquidity-related risk limits are established within our

Enterprise Liquidity Management Policy and supporting

policies. Management committees, including the Asset and

Liability Committee, and the Board of Directors and its Risk

Committee regularly review compliance with key established

limits.

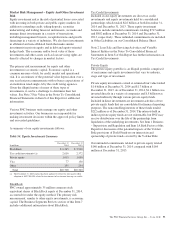

In addition to these liquidity monitoring measures and tools

described above, PNC also monitors its liquidity by reference

to the LCR, a new regulatory minimum liquidity requirement

designed to ensure that covered banking organizations

maintain an adequate level of liquidity to meet net liquidity

needs over the course of a 30-day stress scenario. The LCR is

calculated by dividing the amount of an institution’s high

quality, unencumbered liquid assets (HQLA), as defined and

calculated in accordance with the haircuts and limitations of

the LCR rules, by its estimated net cash outflow, with net cash

outflows determined by applying assumed outflow factors in

the LCR rules. The resulting quotient is expressed as a

percentage. For PNC and PNC Bank, the LCR became

effective January 1, 2015. The minimum required LCR and

the requirement to calculate the LCR on a daily basis will be

phased-in over a period of years. For 2015, PNC and PNC

Bank are required to calculate the LCR on a month-end basis

and the minimum LCR that PNC and PNC Bank are required

to maintain is 80%.

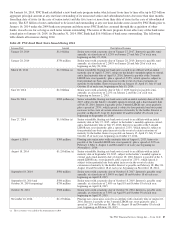

As of January 31, 2015, PNC and PNC Bank exceeded the

minimum LCR requirement in effect for 2015. The estimated

January 31, 2015 LCR calculation and the underlying

components are based on PNC’s current interpretation and

understanding of the final LCR rules and are subject to,

among other things, further regulatory guidance.

We provide additional information regarding regulatory

liquidity requirements and their potential impact on PNC in

the Supervision and Regulation section of Item 1 Business and

Item 1A Risk Factors of this Report.

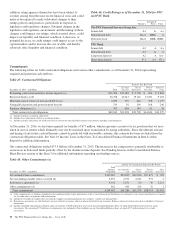

Bank Level Liquidity – Uses

At the bank level, primary contractual obligations include

funding loan commitments, satisfying deposit withdrawal

requests and maturities and debt service related to bank

borrowings. As of December 31, 2014, there were

approximately $7.2 billion of bank borrowings with

contractual maturities of less than one year. We also maintain

adequate bank liquidity to meet future potential loan demand

and provide for other business needs, as necessary. See the

Bank Level Liquidity – Sources section below.

Bank Level Liquidity – Sources

Our largest source of bank liquidity on a consolidated basis is

the deposit base generated by our retail and commercial

businesses. Total deposits increased to $232.2 billion at

December 31, 2014 from $220.9 billion at December 31, 2013,

primarily driven by growth in transaction deposits. Assets

determined by PNC to be liquid (liquid assets) and unused

borrowing capacity from a number of sources are also available

to maintain our liquidity position. Borrowed funds come from a

diverse mix of short-term and long-term funding sources.

At December 31, 2014, our liquid assets consisted of short-

term investments (Federal funds sold, resale agreements,

trading securities and interest-earning deposits with banks)

totaling $36.0 billion and securities available for sale totaling

$44.2 billion. The level of liquid assets fluctuates over time

based on many factors, including market conditions, loan and

deposit growth and balance sheet management activities. Of

our total liquid assets of $80.2 billion, we had $6.1 billion of

securities available for sale and trading securities pledged as

collateral to secure public and trust deposits, repurchase

agreements and for other purposes. In addition to the liquid

assets we pledged, $4.8 billion of securities held to maturity

were also pledged as collateral for these purposes.

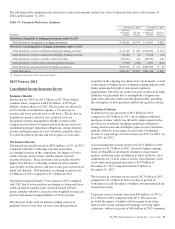

In addition to the customer deposit base, which has

historically provided the single largest source of relatively

stable and low-cost funding, the bank also obtains liquidity

through the issuance of traditional forms of funding including

long-term debt (senior notes and subordinated debt and FHLB

advances) and short-term borrowings (Federal funds

purchased, securities sold under repurchase agreements,

commercial paper issuances and other short-term borrowings).

86 The PNC Financial Services Group, Inc. – Form 10-K