PNC Bank 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

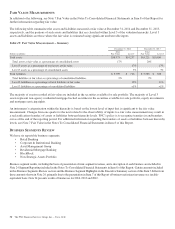

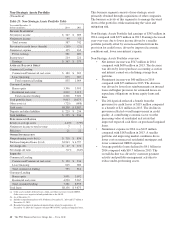

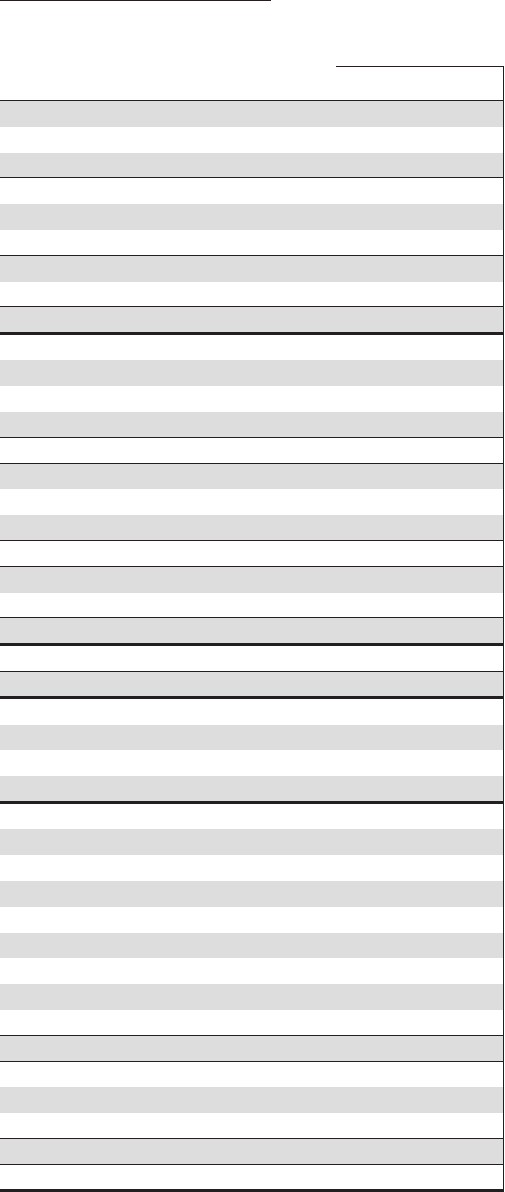

Non-Strategic Assets Portfolio

(Unaudited)

Table 25: Non-Strategic Assets Portfolio Table

Year ended December 31

Dollars in millions 2014 2013

I

NCOME

S

TATEMENT

Net interest income $ 547 $ 689

Noninterest income 40 53

Total revenue 587 742

Provision for credit losses (benefit) (119) (21)

Noninterest expense 125 163

Pretax earnings 581 600

Income taxes 214 221

Earnings $ 367 $ 379

A

VERAGE

B

ALANCE

S

HEET

Commercial Lending:

Commercial/Commercial real estate $ 180 $ 382

Lease financing 675 687

Total commercial lending 855 1,069

Consumer Lending:

Home equity 3,396 3,993

Residential real estate 4,812 5,613

Total consumer lending 8,208 9,606

Total portfolio loans 9,063 10,675

Other assets (a) (725) (688)

Total assets $8,338 $ 9,987

Deposits and other liabilities $ 225 $ 236

Total liabilities $ 225 $ 236

P

ERFORMANCE

R

ATIOS

Return on average assets 4.40% 3.79%

Noninterest income to total revenue 7 7

Efficiency 21 22

O

THER

I

NFORMATION

Nonperforming assets (b) (c) $ 710 $ 834

Purchased impaired loans (b) (d) $3,943 $ 4,797

Net charge-offs $ 47 $ 172

Net charge-off ratio .52 % 1.61%

Loans (b)

Commercial Lending

Commercial/Commercial real estate $ 130 $ 236

Lease financing 625 680

Total commercial lending 755 916

Consumer Lending

Home equity 3,091 3,692

Residential real estate 4,290 5,267

Total consumer lending 7,381 8,959

Total loans $8,136 $ 9,875

(a) Other assets includes deferred taxes, ALLL and other real estate owned (OREO).

Other assets were negative in both periods due to the ALLL.

(b) As of December 31.

(c) Includes nonperforming loans of $.6 billion at December 31, 2014 and $.7 billion at

December 31, 2013.

(d) Recorded investment of purchased impaired loans related to acquisitions. At

December 31, 2014, this segment contained 80% of PNC’s purchased impaired loans.

This business segment consists of non-strategic assets

primarily obtained through acquisitions of other companies.

The business activity of this segment is to manage the wind-

down of the portfolios while maximizing the value and

mitigating risk.

Non-Strategic Assets Portfolio had earnings of $367 million in

2014 compared with $379 million in 2013. Earnings decreased

year-over-year due to lower income driven by a smaller

portfolio partially offset by an increased benefit from the

provision for credit losses, driven by improved economic

conditions and, lower non-interest expense.

Non-Strategic Assets Portfolio overview:

• Net interest income was $547 million in 2014

compared with $689 million in 2013. The decrease

was driven by lower purchase accounting accretion

and interest earned on a declining average loan

portfolio.

• Noninterest income was $40 million in 2014

compared with $53 million in 2013. The decrease

was driven by lower loss reimbursements on insured

loans and higher provision for estimated losses on

repurchase obligations on home equity loans and

lines.

• The 2014 period reflected a benefit from the

provision for credit losses of $119 million compared

to a benefit of $21 million in 2013. The decline in

provision reflected overall improvement in credit

quality. A contributing economic factor was the

increasing value of residential real estate that

improved expected cash flows on purchased impaired

loans.

• Noninterest expense in 2014 was $125 million

compared with $163 million in 2013. A smaller

portfolio and improving market conditions drove

lower cost on nonaccrual residential mortgages and

lower commercial OREO expense.

• Average portfolio loans declined to $9.1 billion in

2014 compared with $10.7 billion in 2013. The

overall decline was driven by customer payment

activity and portfolio management activities to

reduce under-performing assets.

60 The PNC Financial Services Group, Inc. – Form 10-K