PNC Bank 2014 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

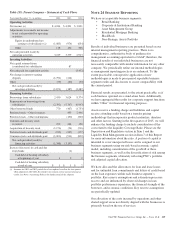

and Washington, DC. Certain of the Jade loans have

been identified in an indictment and subsequent

superseding indictment charging persons associated

with Jade with conspiracy to commit bank fraud,

substantive violations of the federal bank fraud

statute, and money laundering. PNC is cooperating

with the U.S. Attorney’s Office for the District of

Maryland.

Our practice is to cooperate fully with regulatory and

governmental investigations, audits and other inquiries,

including those described in this Note 21.

Other

In addition to the proceedings or other matters described

above, PNC and persons to whom we may have

indemnification obligations, in the normal course of business,

are subject to various other pending and threatened legal

proceedings in which claims for monetary damages and other

relief are asserted. We do not anticipate, at the present time,

that the ultimate aggregate liability, if any, arising out of such

other legal proceedings will have a material adverse effect on

our financial position. However, we cannot now determine

whether or not any claims asserted against us or others to

whom we may have indemnification obligations, whether in

the proceedings or other matters described above or otherwise,

will have a material adverse effect on our results of operations

in any future reporting period, which will depend on, among

other things, the amount of the loss resulting from the claim

and the amount of income otherwise reported for the reporting

period.

See Note 22 Commitments and Guarantees for additional

information regarding the Visa indemnification and our other

obligations to provide indemnification, including to current

and former officers, directors, employees and agents of PNC

and companies we have acquired.

N

OTE

22 C

OMMITMENTS AND

G

UARANTEES

Credit Extension Commitments

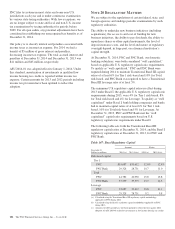

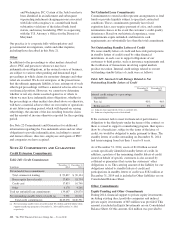

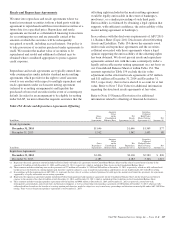

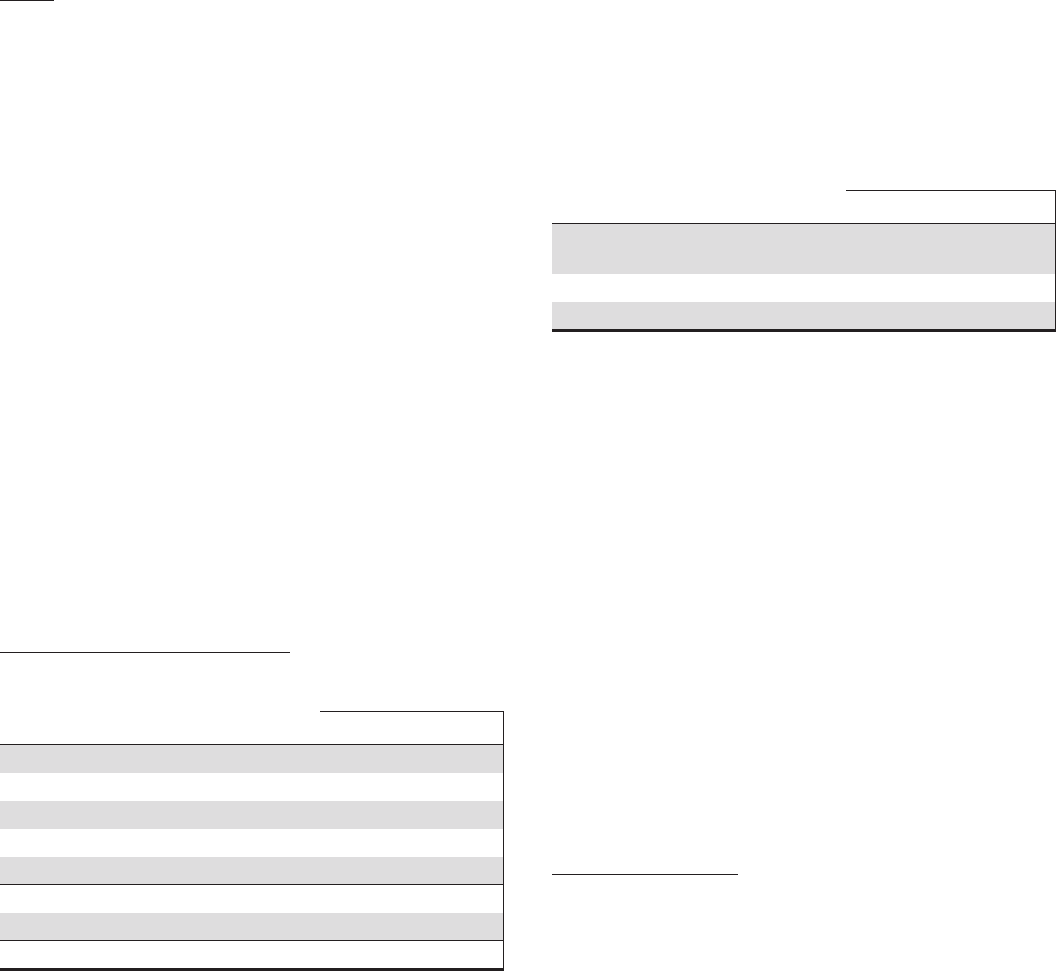

Table 148: Credit Commitments

In millions

December 31

2014

December 31

2013

Net unfunded loan commitments

Total commercial lending $ 99,837 $ 90,104

Home equity lines of credit 17,839 18,754

Credit card 17,833 16,746

Other 4,178 4,266

Total net unfunded loan commitments 139,687 129,870

Net outstanding standby letters of credit (a) 9,991 10,521

Total credit commitments $149,678 $140,391

(a) Net outstanding standby letters of credit include $5.2 billion and $6.6 billion which

support remarketing programs at December 31, 2014 and December 31, 2013,

respectively.

Net Unfunded Loan Commitments

Commitments to extend credit represent arrangements to lend

funds or provide liquidity subject to specified contractual

conditions. These commitments generally have fixed

expiration dates, may require payment of a fee, and contain

termination clauses in the event the customer’s credit quality

deteriorates. Based on our historical experience, some

commitments expire unfunded, and therefore cash

requirements are substantially less than the total commitment.

Net Outstanding Standby Letters of Credit

We issue standby letters of credit and have risk participations

in standby letters of credit issued by other financial

institutions, in each case to support obligations of our

customers to third parties, such as insurance requirements and

the facilitation of transactions involving capital markets

product execution. Internal credit ratings related to our net

outstanding standby letters of credit were as follows:

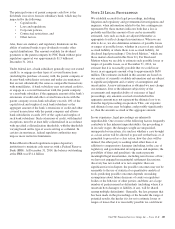

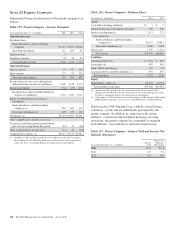

Table 149: Internal Credit Ratings Related to Net

Outstanding Standby Letters of Credit

December 31

2014

December 31

2013

Internal credit ratings (as a percentage

of portfolio):

Pass (a) 95% 96%

Below pass (b) 5% 4%

(a) Indicates that expected risk of loss is currently low.

(b) Indicates a higher degree of risk of default.

If the customer fails to meet its financial or performance

obligation to the third party under the terms of the contract or

there is a need to support a remarketing program, then upon a

draw by a beneficiary, subject to the terms of the letter of

credit, we would be obligated to make payment to them. The

standby letters of credit outstanding on December 31, 2014

had terms ranging from less than 1 year to 8 years.

As of December 31, 2014, assets of $1.0 billion secured

certain specifically identified standby letters of credit. In

addition, a portion of the remaining standby letters of credit

issued on behalf of specific customers is also secured by

collateral or guarantees that secure the customers’ other

obligations to us. The carrying amount of the liability for our

obligations related to standby letters of credit and

participations in standby letters of credit was $182 million at

December 31, 2014 and is included in Other liabilities on our

Consolidated Balance Sheet.

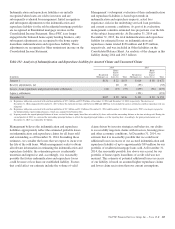

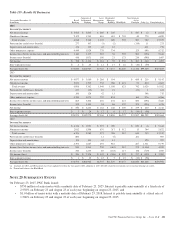

Other Commitments

Equity Funding and Other Commitments

During 2014, financial support to private equity investments

including existing direct portfolio companies and indirect

private equity investments of $63 million was provided. This

amount is included in Equity Investments on our Consolidated

Balance Sheet. Of this amount, $24 million was provided to

212 The PNC Financial Services Group, Inc. – Form 10-K