PNC Bank 2014 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

Reinsurance Agreements

We have two wholly-owned captive insurance subsidiaries

which provide reinsurance to third-party insurers related to

insurance sold to or placed on behalf of our customers. These

subsidiaries enter into various types of reinsurance agreements

with third-party insurers where the subsidiary assumes the risk

of loss through either an excess of loss or quota share

agreement up to 100% reinsurance. In excess of loss

agreements, these subsidiaries assume the risk of loss for an

excess layer of coverage up to specified limits, once a defined

first loss percentage is met. In quota share agreements, the

subsidiaries and third-party insurers share the responsibility

for payment of all claims.

These subsidiaries provide reinsurance for accidental death &

dismemberment, credit life, accident & health, lender placed

hazard and borrower and lender paid mortgage insurance, of

which all programs are in run-off. Aggregate maximum

exposure up to the specified limits for all reinsurance contracts

is as follows:

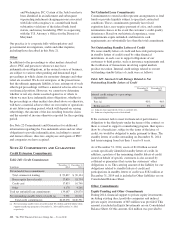

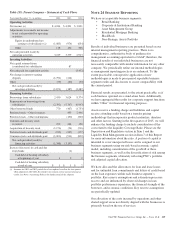

Table 152: Reinsurance Agreements Exposure (a)

In millions

December 31

2014

December 31

2013

Accidental Death & Dismemberment $1,774 $1,902

Credit Life, Accident & Health 467 621

Lender Placed Hazard (b) (c) 2,056 2,679

Borrower and Lender Paid Mortgage

Insurance 45 133

Maximum Exposure $4,342 $5,335

Percentage of reinsurance agreements:

Excess of Loss – Mortgage Insurance 1% 2%

Quota Share 99% 98%

Maximum Exposure to Quota Share

Agreements with 100% Reinsurance $ 466 $ 620

(a) Reinsurance agreements exposure balances represent estimates based on availability

of financial information from insurance carriers.

(b) Through the purchase of catastrophe reinsurance connected to the Lender Placed

Hazard Exposure, should a catastrophic event occur, PNC will benefit from this

reinsurance. No credit for the catastrophe reinsurance protection is applied to the

aggregate exposure figure.

(c) Program has been placed into run-off for coverage issued or renewed on or after

June 1, 2014 with policy terms one year or less.

A rollforward of the reinsurance reserves for probable losses

for 2014 and 2013 follows:

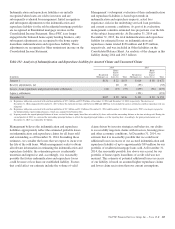

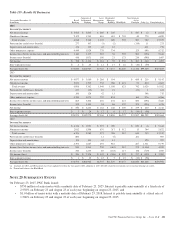

Table 153: Reinsurance Reserves – Rollforward

In millions 2014 2013

January 1 $ 32 $ 61

Paid Losses (20) (45)

Net Provision 11 16

Changes to Agreements (10)

December 31 $13 $32

The reinsurance reserves are declining as the programs are in

run-off. Existing reinsurance agreements with a single third-

party insurer of Borrower Paid Mortgage Insurance were

terminated resulting in release of reinsurance reserves. The

Lender Placed Hazard program has been placed in run-off as

of June 1, 2014, but there was no material impact to

reinsurance reserves. There were no other changes to existing

agreements nor did we enter into any new relationships.

There is a reasonable possibility that losses could be more

than or less than the amount reserved due to ongoing

uncertainty in various economic, social and other factors that

could impact the frequency and severity of claims covered by

these reinsurance agreements. At December 31, 2014, the

reasonably possible loss above our accrual was not material.

216 The PNC Financial Services Group, Inc. – Form 10-K