PNC Bank 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

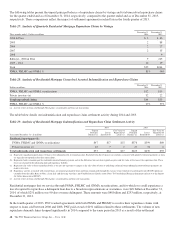

agreements in the fourth quarter of 2013. Additionally, the

liability for estimated losses on indemnification and

repurchase claims for residential mortgages decreased to $107

million at December 31, 2014 from $131 million at

December 31, 2013.

We believe our indemnification and repurchase liability

appropriately reflects the estimated probable losses on

indemnification and repurchase claims for all residential

mortgage loans sold and outstanding as of December 31, 2014

and December 31, 2013. In making these estimates, we

consider the losses that we expect to incur over the life of the

sold loans. See Note 22 Commitments and Guarantees in the

Notes To Consolidated Financial Statements in Item 8 of this

Report for additional information.

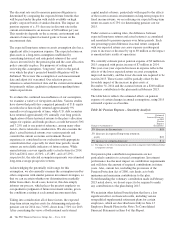

Home Equity Repurchase Obligations

PNC’s repurchase obligations include obligations with respect

to certain brokered home equity loans/lines of credit that were

sold to a limited number of private investors in the financial

services industry by National City prior to our acquisition of

National City. PNC is no longer engaged in the brokered

home equity lending business, and our exposure under these

loan repurchase obligations is limited to repurchases of the

loans sold in these transactions. Repurchase activity

associated with brokered home equity loans/lines of credit is

reported in the Non-Strategic Assets Portfolio segment.

Loan covenants and representations and warranties were

established through loan sale agreements with various investors

to provide assurance that loans PNC sold to the investors were

of sufficient investment quality. Key aspects of such covenants

and representations and warranties include the loan’s

compliance with any applicable loan criteria established for the

transaction, including underwriting standards, delivery of all

required loan documents to the investor or its designated party,

sufficient collateral valuation, and the validity of the lien

securing the loan. As a result of alleged breaches of these

contractual obligations, investors may request PNC to indemnify

them against losses on certain loans or to repurchase loans.

Investor indemnification or repurchase claims are typically

settled on an individual loan basis through make-whole

payments or loan repurchases; however, on occasion we may

negotiate pooled settlements with investors. In connection

with pooled settlements, we typically do not repurchase loans

and the consummation of such transactions generally results in

us no longer having indemnification and repurchase exposure

with the investor in the transaction.

An indemnification and repurchase liability for estimated

losses for which indemnification is expected to be provided or

for loans that are expected to be repurchased was established

at the acquisition of National City. Management’s evaluation

of these indemnification and repurchase liabilities is based

upon trends in indemnification and repurchase claims, actual

loss experience, risks in the underlying serviced loan

portfolios, current economic conditions and the periodic

negotiations that management may enter into with investors to

settle existing and potential future claims.

Indemnification and repurchase liabilities, which are included

in Other liabilities on the Consolidated Balance sheet, are

evaluated by management on a quarterly basis. Initial

recognition and subsequent adjustments to the indemnification

are recognized in Other noninterest income on the

Consolidated Income Statement. For more information

regarding our Home Equity Repurchase Obligations, see Note

22 Commitments and Guarantees in the Notes To

Consolidated Statements in Item 8 of this Report.

R

ISK

M

ANAGEMENT

Enterprise Risk Management

PNC encounters risk as part of the normal course of operating

our business. Accordingly, we design risk management

processes to help manage this risk. We take risks we

understand in order to optimize long term shareholder value.

This Risk Management section describes our risk framework,

including risk appetite and strategy, culture, governance, risk

identification, controls and reporting. The overall Risk

Management section of this Item 7 also provides an analysis

of our key areas of risk, which include but are not limited to

credit, operational, compliance, market, liquidity and model.

Our use of financial derivatives as part of our overall asset and

liability risk management process is also addressed within the

risk management section.

PNC operates within a rapidly evolving regulatory

environment. Accordingly, we are actively focused on the

timely adoption of regulatory pronouncements within our

Enterprise Risk Management (ERM) Framework.

We view risk management as a cohesive combination of the

following risk elements which form PNC’s ERM Framework:

Risk Organization &

Governance

Risk

Monitor-

ing &

Reporting

Risk

Identi-

fication &

Quanti-

fication

Risk Controls &

Limits

Risk

Appetite

Statement

Risk Capacity,

Appetite &

Strategy

R

i

s

k

C

u

l

t

u

r

e

The PNC Financial Services Group, Inc. – Form 10-K 69