PNC Bank 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On April 3, 2014, consistent with our 2014 capital plan, our

Board of Directors approved an increase to PNC’s quarterly

common stock dividend from 44 cents per common share to

48 cents per common share beginning with the May 5, 2014

dividend payment.

In connection with the 2015 CCAR, PNC submitted its 2015

capital plan, as approved by its Board of Directors, to the

Federal Reserve in January 2015. PNC expects to receive the

Federal Reserve’s response (either a non-objection or

objection) to the capital plan submitted as part of the 2015

CCAR in March 2015.

See the Supervision and Regulation section in Item 1 of this

Report for additional information regarding the Federal

Reserve’s CCAR process and the factors the Federal Reserve

takes into consideration in evaluating capital plans, qualitative

and quantitative liquidity risk management standards proposed

by the U.S. banking agencies, and final rules issued by the

Federal Reserve that make certain modifications to the Federal

Reserve’s capital planning and stress testing rules.

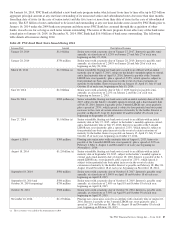

See Table 42 for information on affiliate purchases of notes

issued by PNC Bank during 2014.

On February 6, 2015, PNC used $600 million of parent

company/non-bank subsidiary cash to purchase floating rate

senior notes that were issued by PNC Bank to an affiliate on

that same date.

Parent Company Liquidity – Sources

The principal source of parent company liquidity is the

dividends it receives from its subsidiary bank, which may be

impacted by the following:

• Bank-level capital needs,

• Laws and regulations,

• Corporate policies,

• Contractual restrictions, and

• Other factors.

There are statutory and regulatory limitations on the ability of

national banks to pay dividends or make other capital

distributions or to extend credit to the parent company or its

non-bank subsidiaries. The amount available for dividend

payments by PNC Bank to the parent company without prior

regulatory approval was approximately $1.5 billion at

December 31, 2014. See Note 20 Regulatory Matters in the

Notes To Consolidated Financial Statements in Item 8 of this

Report for a further discussion of these limitations. We

provide additional information on certain contractual

restrictions in Note 12 Capital Securities of a Subsidiary Trust

and Perpetual Trust Securities in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

In addition to dividends from PNC Bank, other sources of

parent company liquidity include cash and investments, as

well as dividends and loan repayments from other subsidiaries

and dividends or distributions from equity investments.

We can also generate liquidity for the parent company and

PNC’s non-bank subsidiaries through the issuance of debt and

equity securities, including certain capital instruments, in

public or private markets and commercial paper. We have an

effective shelf registration statement pursuant to which we can

issue additional debt, equity and other capital instruments.

During 2014, we issued the following parent company debt

under our shelf registration statement:

• $750 million of subordinated notes with a maturity

date of April 29, 2024. Interest is payable semi-

annually, at a fixed rate of 3.90%, on April 29 and

October 29 of each year, beginning on October 29,

2014.

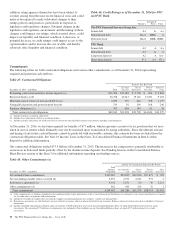

Total parent company senior and subordinated debt and hybrid

capital instruments decreased to $10.1 billion at December 31,

2014 from $10.7 billion at December 31, 2013 due to the

following activity in the period.

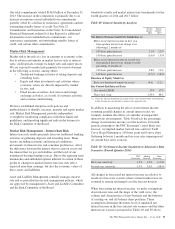

Table 45: Parent Company Senior and Subordinated Debt

and Hybrid Capital Instruments

In billions 2014

January 1 $10.7

Issuances .8

Maturities (1.4)

December 31 $10.1

On October 16, 2014, the parent company established a $5.0

billion commercial paper program to provide additional

liquidity. As of December 31, 2014, there were no issuances

outstanding under this program. Following the establishment

of this parent company program, PNC Funding Corp

terminated its $3.0 billion commercial paper program.

Note 17 Equity in the Notes To Consolidated Financial

Statements in Item 8 of this Report describes the 16,885,192

warrants outstanding, each to purchase one share of PNC

common stock at an exercise price of $67.33 per share. These

warrants were sold by the U.S. Treasury in a secondary public

offering in May 2010 after the U.S. Treasury exchanged its

TARP Warrant. These warrants will expire December 31,

2018, and are considered in the calculation of diluted earnings

per common share in Note 16 Earnings Per Share in the Notes

To Consolidated Financial Statements in Item 8 of this Report.

Status of Credit Ratings

The cost and availability of short-term and long-term funding,

as well as collateral requirements for certain derivative

instruments, is influenced by PNC’s debt ratings.

In general, rating agencies base their ratings on many

quantitative and qualitative factors, including capital

adequacy, liquidity, asset quality, business mix, level and

quality of earnings, and the current legislative and regulatory

environment, including implied government support. In

The PNC Financial Services Group, Inc. – Form 10-K 89