PNC Bank 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

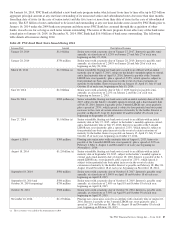

On January 16, 2014, PNC Bank established a new bank note program under which it may from time to time offer up to $25 billion

aggregate principal amount at any one time outstanding of its unsecured senior and subordinated notes due more than nine months

from their date of issue (in the case of senior notes) and due five years or more from their date of issue (in the case of subordinated

notes). The $25 billion of notes authorized to be issued and outstanding at any one time includes notes issued by PNC Bank prior to

January 16, 2014 under the 2004 bank note program and those notes PNC Bank has assumed through the acquisition of other

banks, in each case for so long as such notes remain outstanding. The terms of the new program do not affect any of the bank notes

issued prior to January 16, 2014. At December 31, 2014, PNC Bank had $16.0 billion of bank notes outstanding. The following

table details all issuances during 2014:

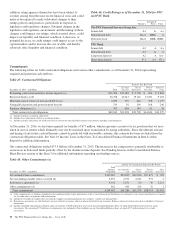

Table 42: PNC Bank Bank Notes Issued During 2014

Issuance Date Amount Description of Issuance

January 28, 2014 $1.0 billion Senior notes with a maturity date of January 27, 2017. Interest is payable semi-

annually, at a fixed rate of 1.125% on January 27 and July 27 of each year,

beginning on July 27, 2014.

January 28, 2014 $750 million Senior notes with a maturity date of January 28, 2019. Interest is payable semi-

annually, at a fixed rate of 2.200% on January 28 and July 28 of each year,

beginning on July 28, 2014.

March 28, 2014 $1.0 billion (a) Senior extendible floating rate bank notes issued to an affiliate with an initial

maturity date of April 15, 2015, subject to the holder’s monthly option to extend,

and a final maturity date of April 15, 2016. Interest is payable at the 3-month

LIBOR rate, reset quarterly, plus a spread of .235%, which spread is subject to

four potential one basis point increases in the event of certain extensions of

maturity by the holder. Interest is payable on January 15, April 15, July 15 and

October 15 of each year, beginning on July 15, 2014.

June 20, 2014 $1.0 billion Senior notes with a maturity date of July 2, 2019. Interest is payable semi-

annually, at a fixed rate of 2.25% on January 2 and July 2 of each year,

beginning on January 2, 2015.

June 20, 2014 $900 million (a) Senior extendible floating rate bank notes with an initial maturity date of July 20,

2015, subject to the holder’s monthly option to extend, and a final maturity date

of July 20, 2016. Interest is payable at the 3-month LIBOR rate, reset quarterly,

plus a spread of .235%, which spread is subject to four potential one basis point

increases in the event of certain extensions of maturity by the holder. Interest is

payable on March 20, June 20, September 20 and December 20 of each year,

beginning on September 20, 2014.

June 27, 2014 $1.0 billion (a) Senior extendible floating rate bank notes issued to an affiliate with an initial

maturity date of July 15, 2015, subject to the holder’s monthly option to extend,

and a final maturity date of July 15, 2016. Interest is payable at the 3-month

LIBOR rate, reset quarterly, plus a spread of .235%, which spread is subject to

four potential one basis point increases in the event of certain extensions of

maturity by the holder. Interest is payable on January 15, April 15, July 15 and

October 15 of each year, beginning on October 15, 2014.

August 1, 2014 $300 million Floating rate senior notes with a maturity date of August 1, 2017. Interest is

payable at the 3-month LIBOR rate, reset quarterly, plus a spread of .30% on

February 1, May 1, August 1 and November 1 of each year beginning on

November 1, 2014.

August 18, 2014 $1.25 billion (a) Senior extendible floating rate bank notes issued to an affiliate with an initial

maturity date of September 18, 2015, subject to the holder’s monthly option to

extend, and a final maturity date of August 18, 2016. Interest is payable at the 3-

month LIBOR rate, reset quarterly, plus a spread of .235%, which spread is

subject to four potential one basis point increases in the event of certain

extensions of maturity by the holder. Interest is payable on February 18, May 18,

August 18 and November 18 of each year, beginning on November 18, 2014.

September 18, 2014 $500 million Senior notes with a maturity date of October 18, 2017. Interest is payable semi-

annually, at a fixed rate of 1.500% on April 18 and October 18 of each year,

beginning on April 18, 2015.

September 18, 2014 and

October 30, 2014 (reopening)

$500 million

$750 million

Senior notes with a maturity date of October 18, 2019. Interest is payable semi-

annually, at a fixed rate of 2.40% on April 18 and October 18 of each year,

beginning on April 18, 2015.

October 30, 2014 $500 million Senior notes with a maturity date of October 30, 2024. Interest is payable semi-

annually, at a fixed rate of 3.30% on April 30 and October 30 of each year,

beginning on April 30, 2015.

November 26, 2014 $1.25 billion Floating rate senior notes issued to an affiliate with a maturity date of August 18,

2016. Interest is payable at the 3-month LIBOR rate, reset quarterly, plus a

spread of .25% on February 18, May 18, August 18 and November 18 of each

year, beginning on February 18, 2015.

(a) These issuances were called in the fourth quarter of 2014.

The PNC Financial Services Group, Inc. – Form 10-K 87