PNC Bank 2014 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

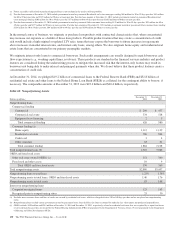

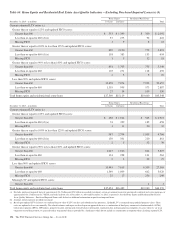

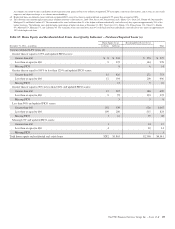

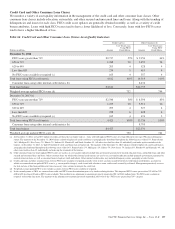

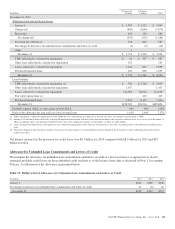

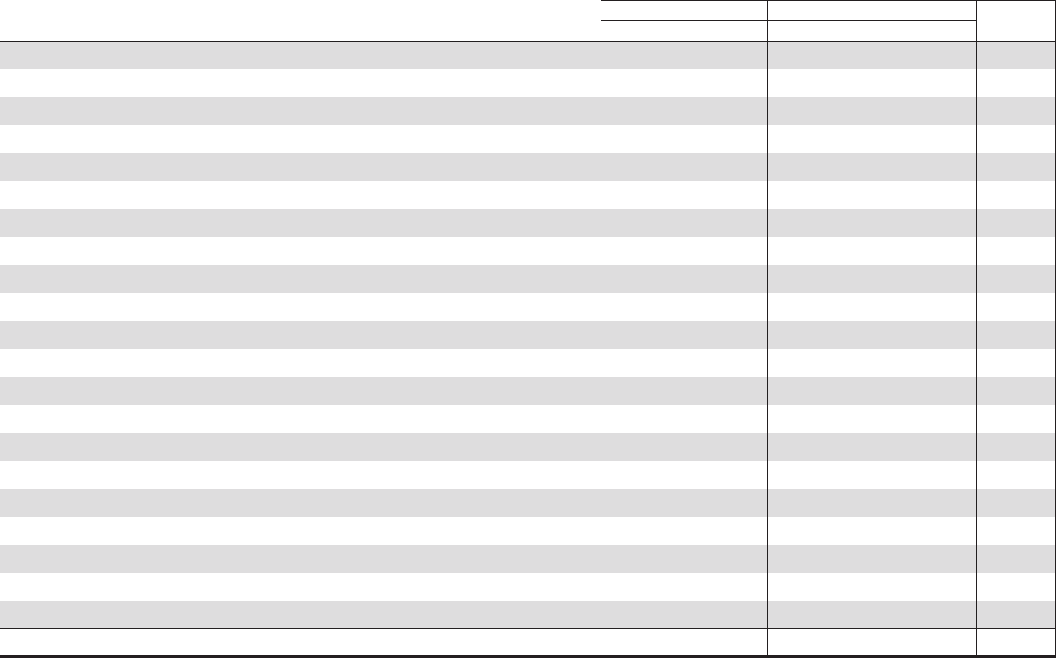

Home Equity (b) (c) Residential Real Estate (b) (c)

TotalDecember 31, 2013 – in millions 1st Liens 2nd Liens

Current estimated LTV ratios (d)

Greater than or equal to 125% and updated FICO scores:

Greater than 660 $ 13 $ 435 $ 361 $ 809

Less than or equal to 660 15 215 296 526

Missing FICO 12 24 36

Greater than or equal to 100% to less than 125% and updated FICO scores:

Greater than 660 21 516 373 910

Less than or equal to 660 15 239 281 535

Missing FICO 14 14 28

Greater than or equal to 90% to less than 100% and updated FICO scores:

Greater than 660 15 202 197 414

Less than or equal to 660 12 101 163 276

Missing FICO 7613

Less than 90% and updated FICO scores:

Greater than 660 93 261 646 1,000

Less than or equal to 660 126 198 590 914

Missing FICO 1 11 47 59

Missing LTV and updated FICO scores:

Greater than 660 1 11 12

Less than or equal to 660 13 13

Missing FICO 33

Total home equity and residential real estate loans $312 $2,211 $3,025 $5,548

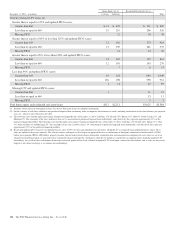

(a) Amounts shown represent outstanding balance. See Note 4 Purchased Loans for additional information.

(b) For the estimate of cash flows utilized in our purchased impaired loan accounting, other assumptions and estimates are made, including amortization of first lien balances, pre-payment

rates, etc., which are not reflected in this table.

(c) The following states had the highest percentage of purchased impaired loans at December 31, 2014: California 17%, Florida 15%, Illinois 11%, Ohio 8%, North Carolina 7%, and

Michigan 5%. The remainder of the states had lower than a 4% concentration of purchased impaired loans individually, and collectively they represent approximately 37% of the

purchased impaired portfolio. The following states had the highest percentage of purchased impaired loans at December 31, 2013: California 17%, Florida 16%, Illinois 11%, Ohio

8%, North Carolina 8% and Michigan 5%. The remainder of the states had lower than a 4% concentration of purchased impaired loans individually, and collectively they represent

approximately 35% of the purchased impaired portfolio.

(d) Based upon updated LTV (inclusive of combined loan-to-value (CLTV) for first and subordinate lien positions). Updated LTV is estimated using modeled property values. These

ratios are updated at least semi-annually. The related estimates and inputs are based upon an approach that uses a combination of third-party automated valuation models (AVMs),

broker price opinions (BPOs), HPI indices, property location, internal and external balance information, origination data and management assumptions. In cases where we are in an

originated second lien position, we generally utilize origination balances provided by a third-party which do not include an amortization assumption when calculating updated LTV.

Accordingly, the results of these calculations do not represent actual appraised loan level collateral or updated LTV based upon a current first lien balance, and as such, are necessarily

imprecise and subject to change as we enhance our methodology.

136 The PNC Financial Services Group, Inc. – Form 10-K