PNC Bank 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

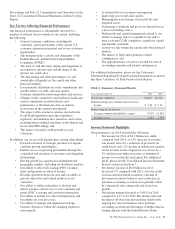

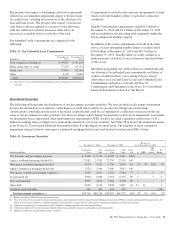

Residential mortgage revenue decreased to $618 million in

2014 from $871 million in 2013, primarily due to lower loan

sales revenue from a reduction in origination volume and

significantly lower net hedging gains on residential mortgage

servicing rights, partially offset by higher loan servicing fee

revenue and the impact of second quarter 2014 gains on sales

of previously underperforming portfolio loans.

Lower residential mortgage revenue in the comparison also

reflected the impact of the 2013 net benefit from release of

reserves for residential mortgage repurchase obligations of

$53 million, as the impact to 2014 was not significant. This

net release of reserves in 2013 was largely the result of

agreements with two government-sponsored enterprises

(GSEs), FHLMC and FNMA, for loans sold into agency

securitizations. See the Recourse And Repurchase Obligations

section of this Item 7 for further detail.

Service charges on deposits increased in 2014, benefitting

from changes in product offerings and higher customer-related

activity.

Other noninterest income decreased to $1.4 billion in 2014

compared to $1.5 billion in 2013. The decline was driven by a

reduction in asset valuations, lower revenue associated with

private equity investments, decreased revenue due to the lower

market value of investments related to deferred compensation

obligations, and lower revenue associated with customer-related

derivative activities, including credit valuations. These decreases

were partially offset by higher gains on sales of other assets.

The decline in revenue from credit valuations for customer-

related derivatives activities was driven primarily by market

interest rate changes impacting the valuations. The 2013

impact of these customer-related derivatives activities was $56

million, while the 2014 impact was not significant.

Higher gains on sales of other assets in the comparison

included $94 million on the fourth quarter 2014 sale of PNC’s

Washington, D.C. regional headquarters building, as well as

increased gains on sales of Visa Class B Common shares,

which were $209 million on sales of 3.5 million shares in

2014 compared to $168 million on the sale of 4 million shares

in 2013. As of December 31, 2014, we held approximately

7 million Visa Class B common shares with a fair value of

approximately $742 million and a recorded investment of

approximately $77 million.

Other noninterest income typically fluctuates from period to

period depending on the nature and magnitude of transactions

completed. Further details regarding our customer-related

trading activities are included in the Market Risk

Management – Customer-Related Trading Risk portion of the

Risk Management section of this Item 7. Further details

regarding private and other equity investments are included in

the Market Risk Management – Equity And Other Investment

Risk section, and further details regarding gains or losses

related to our equity investment in BlackRock are included in

the Business Segments Review section of this Item 7.

In the first quarter of 2015, we expect fee income to be down

mid-single digits, on a percentage basis, compared with the

fourth quarter of 2014 due to seasonality.

For full year 2015, we expect revenue to continue to be under

pressure compared with 2014, as we expect the combined

revenue growth from our businesses to partially offset the

decline in purchase accounting accretion.

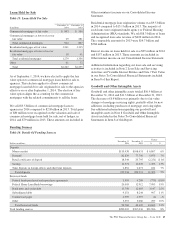

Provision For Credit Losses

The provision for credit losses totaled $273 million in 2014

compared with $643 million in 2013. The decrease in

provision reflected improved overall credit quality, including

lower consumer loan delinquencies. A contributing economic

factor was the increasing value of residential real estate, which

improved expected cash flows from our purchased impaired

loans.

We currently expect our provision for credit losses in the first

quarter of 2015 to be between $50 million and $100 million.

The Credit Risk Management portion of the Risk Management

section of this Item 7 includes additional information

regarding factors impacting the provision for credit losses.

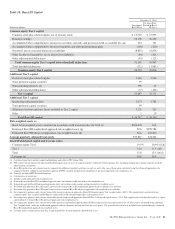

Noninterest Expense

Noninterest expense was $9.5 billion for 2014, a decrease of

$.2 billion, or 2%, from $9.7 billion for 2013, reflecting

overall disciplined expense management. The decline was

driven by a decrease in personnel expense related to lower

headcount and benefits costs, partially offset by investments in

technology and infrastructure. Additionally, noncash charges

of $57 million in 2013 for unamortized discounts related to

redemption of trust preferred securities contributed to the

decline. See Note 14 Capital Securities of Subsidiary Trusts

and Perpetual Trust Securities in Item 8 of our 2013

Form 10-K for additional detail on the 2013 redemption of

trust preferred securities.

During 2014, we completed actions and exceeded our 2014

continuous improvement goal of $500 million in cost savings.

These cost savings are funding investments in our

infrastructure, including those related to cybersecurity and our

datacenters, and investments in our diversified businesses,

including our Retail Banking transformation, consistent with

our strategic priorities.

In 2015, we expect to continue this approach and have a goal

of an additional $400 million in cost savings through our

Continuous Improvement Program, which again we expect

will help to fund our business and technology investments.

For the first quarter of 2015, we expect noninterest expense to

be down by high-single digits on a percentage basis compared

with the fourth quarter of 2014.

38 The PNC Financial Services Group, Inc. – Form 10-K