PNC Bank 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

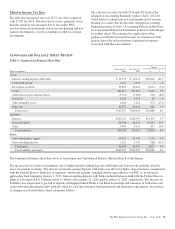

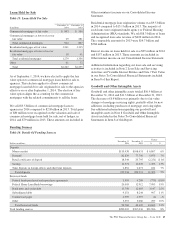

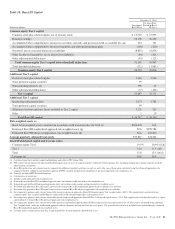

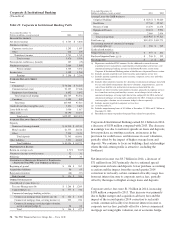

Table 18: Basel III Capital

December 31, 2014

Dollars in millions

Transitional

Basel III (a)

Pro forma Fully

Phased-In Basel

III (b)(c)

Common equity Tier 1 capital

Common stock plus related surplus, net of treasury stock $ 13,903 $ 13,903

Retained earnings 26,200 26,200

Accumulated other comprehensive income for securities currently and previously held as available for sale 144 721

Accumulated other comprehensive income for pension and other postretirement plans (104) (520)

Goodwill, net of associated deferred tax liabilities (8,855) (8,855)

Other disallowed intangibles, net of deferred tax liabilities (84) (421)

Other adjustments/(deductions) (63) (121)

Total common equity Tier 1 capital before threshold deductions 31,141 30,907

Total threshold deductions (212) (1,081)

Common equity Tier 1 capital 30,929 29,826

Additional Tier 1 capital

Preferred stock plus related surplus 3,946 3,946

Trust preferred capital securities 99

Noncontrolling interests (d) 790 43

Other adjustments/(deductions) (77) (104)

Tier 1 capital 35,687 33,711

Additional Tier 2 capital

Qualifying subordinated debt 5,473 4,764

Trust preferred capital securities 99

Allowance for loan and lease losses included in Tier 2 capital 3,521 215

Other 210

Total Basel III capital $ 44,782 $ 38,700

Risk-weighted assets (e)

Basel I risk-weighted assets calculated in accordance with transition rules for 2014 (f) $284,018 N/A

Estimated Basel III standardized approach risk-weighted assets (g) N/A $298,786

Estimated Basel III advanced approaches risk-weighted assets (h) N/A 285,870

Average quarterly adjusted total assets 329,827 328,562

Basel III risk-based capital and leverage ratios

Common equity Tier 1 10.9% 10.0% (i)(k)

Tier 1 12.6 11.3 (i)(l)

Total 15.8 13.5 (j)(m)

Leverage (n) 10.8 10.3

(a) Calculated using the regulatory capital methodology applicable to PNC during 2014.

(b) PNC utilizes the pro forma fully phased-in Basel III capital ratios to assess its capital position (without the benefit of phase-ins), including comparison to similar estimates made by

other financial institutions.

(c) Basel III capital ratios and estimates may be impacted by additional regulatory guidance or analysis and, in the case of those ratios calculated using the advanced approaches, the

ongoing evolution, validation and regulatory approval of PNC’s models integral to the calculation of advanced approaches risk-weighted assets.

(d) Primarily includes REIT Preferred Securities.

(e) Calculated as of period end.

(f) Includes credit and market risk-weighted assets.

(g) Estimated based on Basel III standardized approach rules and includes credit and market risk-weighted assets.

(h) Estimated based on Basel III advanced approaches rules and includes credit, market and operational risk-weighted assets.

(i) Pro forma fully phased-in Basel III capital ratio based on estimated Basel III standardized approach risk-weighted assets and rules.

(j) Pro forma fully phased-in Basel III capital ratio based on estimated Basel III advanced approaches risk-weighted assets and rules.

(k) For comparative purposes only, the pro forma fully phased-in advanced approaches Basel III Common equity Tier 1 capital ratio is 10.4%. This capital ratio is calculated using

Common equity Tier 1 capital and dividing by estimated Basel III advanced approaches risk-weighted assets.

(l) For comparative purposes only, the pro forma fully phased-in advanced approaches Basel III Tier 1 risk-based capital ratio is 11.8%. This capital ratio is calculated using Tier 1 capital

and dividing by estimated Basel III advanced approaches risk-weighted assets.

(m) For comparative purposes only, the pro forma fully phased-in standardized approach Basel III Total capital risk-based capital ratio is 14.1%. This ratio is calculated using additional

Tier 2 capital which, under the standardized approach, reflects allowance for loan and lease losses of up to 1.25% of credit risk related risk-weighted assets and dividing by estimated

Basel III standardized approach risk-weighted assets.

(n) Leverage ratio is calculated based on Tier 1 capital divided by Average quarterly adjusted total assets.

The PNC Financial Services Group, Inc. – Form 10-K 47