PNC Bank 2014 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

13 E

MPLOYEE

B

ENEFIT

P

LANS

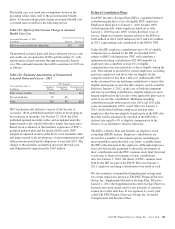

Pension And Postretirement Plans

We have a noncontributory, qualified defined benefit pension plan covering eligible employees. Benefits are determined using a

cash balance formula where earnings credits are a percentage of eligible compensation. Earnings credit percentages for those

employees who were plan participants on December 31, 2009 are frozen at their level earned to that point. Earnings credits for all

employees who become participants on or after January 1, 2010 are a flat 3% of eligible compensation. Plan participants at

December 31, 2009 earn interest based on 30-year Treasury securities with a minimum rate, while new participants on or after

January 1, 2010 are not subject to the minimum rate. Pension contributions are based on an actuarially determined amount

necessary to fund total benefits payable to plan participants.

We also maintain nonqualified supplemental retirement plans for certain employees and provide certain health care and life

insurance benefits for qualifying retired employees (postretirement benefits) through various plans. The nonqualified pension and

postretirement benefit plans are unfunded. PNC currently intends to begin funding some or all of the postretirement medical benefit

obligations through a voluntary employee beneficiary association (VEBA) in mid-to-late 2015. PNC reserves the right to terminate

plans or make plan changes at any time.

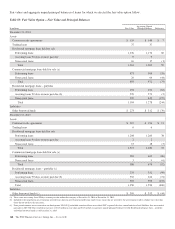

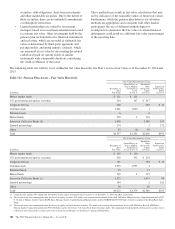

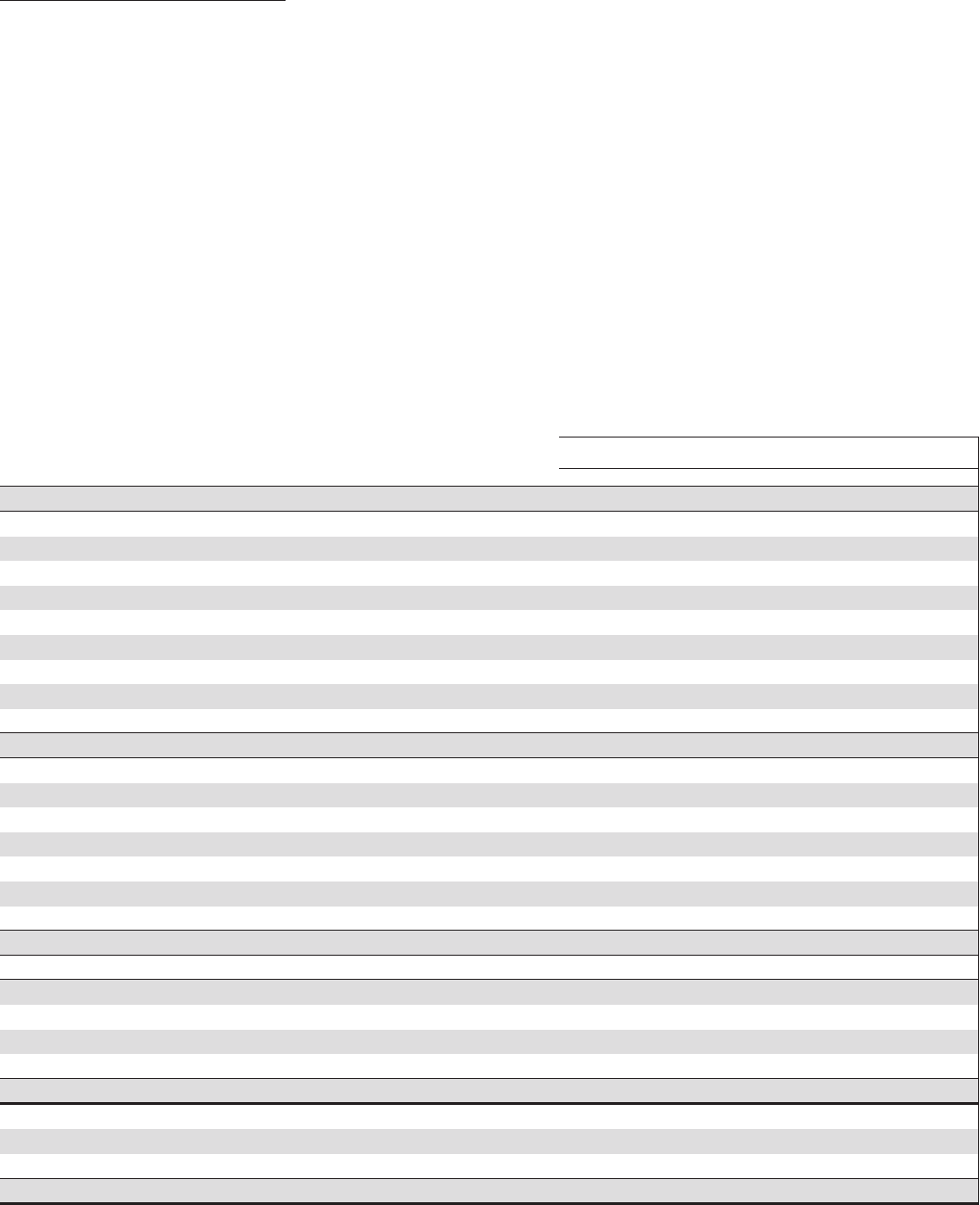

We use a measurement date of December 31 for plan assets and benefit obligations. A reconciliation of the changes in the

projected benefit obligation for qualified pension, nonqualified pension and postretirement benefit plans as well as the change in

plan assets for the qualified pension plan follows.

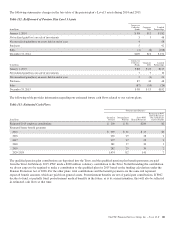

Table 109: Reconciliation of Changes in Projected Benefit Obligation and Change in Plan Assets

Qualified

Pension

Nonqualified

Pension

Postretirement

Benefits

December 31 (Measurement Date) – in millions 2014 2013 2014 2013 2014 2013

Accumulated benefit obligation at end of year $4,427 $3,890 $ 316 $ 287

Projected benefit obligation at beginning of year $3,966 $4,512 $ 292 $ 362 $ 375 $ 394

Service cost 103 1133356

Interest cost 187 170 12 12 16 14

Plan amendments (7)

Actuarial (gains)/losses and changes in assumptions 504 (453) 40 (26) 4 (9)

Participant contributions 813

Federal Medicare subsidy on benefits paid 22

Benefits paid (254) (376) (25) (20) (31) (34)

Settlement payments (39) (11)

Projected benefit obligation at end of year $4,499 $3,966 $ 322 $ 292 $ 379 $ 375

Fair value of plan assets at beginning of year $4,252 $4,009

Actual return on plan assets 359 619

Employer contribution $25 $59 $21 $30

Participant contributions 813

Federal Medicare subsidy on benefits paid 22

Benefits paid (254) (376) (25) (20) (31) (34)

Settlement payments (39) (11)

Fair value of plan assets at end of year $4,357 $4,252

Funded status $ (142) $ 286 $(322) $(292) $(379) $(375)

Amounts recognized on the consolidated balance sheet

Noncurrent asset $ 286

Current liability $ (31) $ (28) $ (25) $ (29)

Noncurrent liability $ (142) (291) (264) (354) (346)

Net amount recognized on the consolidated balance sheet $ (142) $ 286 $(322) $(292) $(379) $(375)

Amounts recognized in accumulated other comprehensive income consist of:

Prior service cost (credit) $ (22) $ (23) $ 1 $ 1 $ (4) $ (6)

Net actuarial loss 673 239 88 52 31 27

Amount recognized in AOCI $ 651 $ 216 $ 89 $ 53 $ 27 $ 21

The PNC Financial Services Group, Inc. – Form 10-K 177