PNC Bank 2014 Annual Report Download - page 73

Download and view the complete annual report

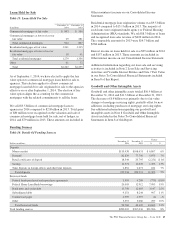

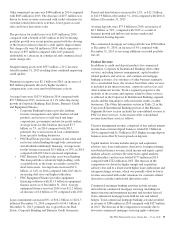

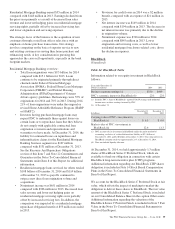

Please find page 73 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other noninterest income was $448 million in 2014 compared

with $605 million in 2013. The decrease of $157 million was

driven by lower revenue associated with credit valuations for

customer-related derivatives activities, lower gains on asset

sales and lower derivatives sales.

The provision for credit losses was $107 million in 2014

compared with a benefit of $25 million in 2013 reflecting

portfolio growth over recent quarters paired with the slowing

of the reserve releases related to credit quality improvement.

Net charge-offs were $8 million in 2014, which represents a

decrease of $97 million compared with 2013 primarily

attributable to a decrease in commercial and commercial real

estate charge-offs.

Nonperforming assets were $557 million, a 31% decrease

from December 31, 2013 resulting from continued improving

credit quality.

Noninterest expense was $2.1 billion in 2014, an increase of

$65 million primarily driven by higher incentive

compensation costs associated with business activity.

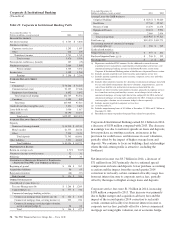

Average loans were $107.9 billion in 2014 compared with

$97.5 billion in 2013, an increase of 11% reflecting strong

growth in Corporate Banking, Real Estate, Business Credit

and Equipment Finance:

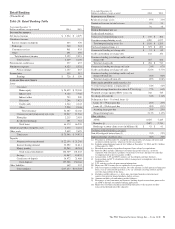

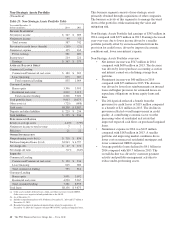

• Corporate Banking business provides lending,

treasury management and capital markets-related

products and services to mid-sized and large

corporations, government and not-for-profit entities.

Average loans for this business increased $3.7

billion, or 7%, in 2014 compared with 2013,

primarily due to an increase in loan commitments

from specialty lending businesses.

• PNC Real Estate provides commercial real estate and

real estate-related lending through both conventional

and affordable multifamily financing. Average loans

for this business increased $5.5 billion, or 24%, in 2014

compared with 2013 due to increased originations.

• PNC Business Credit provides asset-based lending.

The loan portfolio is relatively high yielding, with

acceptable risk as the loans are mainly secured by

short-term assets. Average loans increased $1.6

billion, or 14%, in 2014 compared with 2013 due to

increasing deal sizes and higher utilization.

• PNC Equipment Finance provides equipment

financing solutions with $11.9 billion in equipment

finance assets as of December 31, 2014. Average

equipment finance assets in 2014 were $11.2 billion,

an increase of $.6 billion or 5% compared with 2013.

Loan commitments increased 8%, or $16.2 billion, to $212.3

billion at December 31, 2014 compared to $196.1 billion at

December 31, 2013, primarily due to growth in our Real

Estate, Corporate Banking and Business Credit businesses.

Period-end loan balances increased by 12%, or $12.2 billion,

to $113.9 billion at December 31, 2014 compared with $101.8

billion at December 31, 2013.

Average deposits were $73.5 billion in 2014, an increase of

$6.7 billion, or 10%, compared with 2013 as a result of

business growth and inflows into money market and

noninterest-bearing deposits.

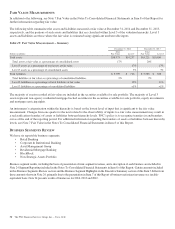

The commercial mortgage servicing portfolio was $336 billion

at December 31, 2014, an increase of 9% compared with

December 31, 2013 as servicing additions exceeded portfolio

run-off.

Product Revenue

In addition to credit and deposit products for commercial

customers, Corporate & Institutional Banking offers other

services, including treasury management, capital markets-

related products and services, and commercial mortgage

banking activities, for customers of other business segments.

On a consolidated basis, the revenue from these other services

is included in net interest income, corporate service fees and

other noninterest income. From a segment perspective, the

majority of the revenue and expense related to these services

is reflected in the Corporate & Institutional Banking segment

results and the remainder is reflected in the results of other

businesses. The Other Information section in Table 21 in the

Corporate & Institutional Banking portion of this Business

Segments Review section includes the consolidated revenue to

PNC for these services. A discussion of the consolidated

revenue from these services follows.

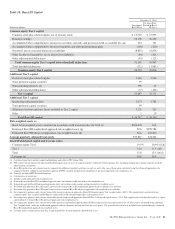

Treasury management revenue, comprised of fees and net interest

income from customer deposit balances, totaled $1.3 billion in

2014 compared with $1.3 billion in 2013. Higher average deposit

balances were offset by lower spreads on deposits.

Capital markets revenue includes merger and acquisition

advisory fees, loan syndications, derivatives, foreign exchange,

asset-backed finance revenue, fixed income and equity capital

markets advisory activities. Revenue from capital markets-

related products and services totaled $777 million in 2014

compared with $722 million in 2013. The increase in the

comparison was driven by higher merger and acquisition

advisory fees and to a lesser extent higher loan syndications and

foreign exchange revenue, which was partially offset by lower

revenue associated with credit valuations for customer-related

derivatives activities and related derivatives sales.

Commercial mortgage banking activities include revenue

derived from commercial mortgage servicing (including net

interest income and noninterest income) and revenue derived

from commercial mortgage loans held for sale and related

hedges. Total commercial mortgage banking activities resulted

in revenue of $386 million in 2014 compared with $427 million

in 2013. The decrease in the comparison was mainly due to

lower net commercial mortgage servicing rights valuations.

The PNC Financial Services Group, Inc. – Form 10-K 55