PNC Bank 2014 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

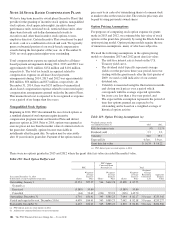

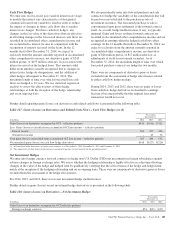

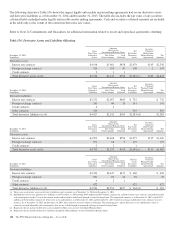

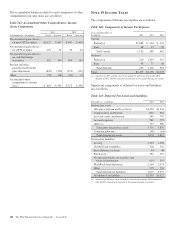

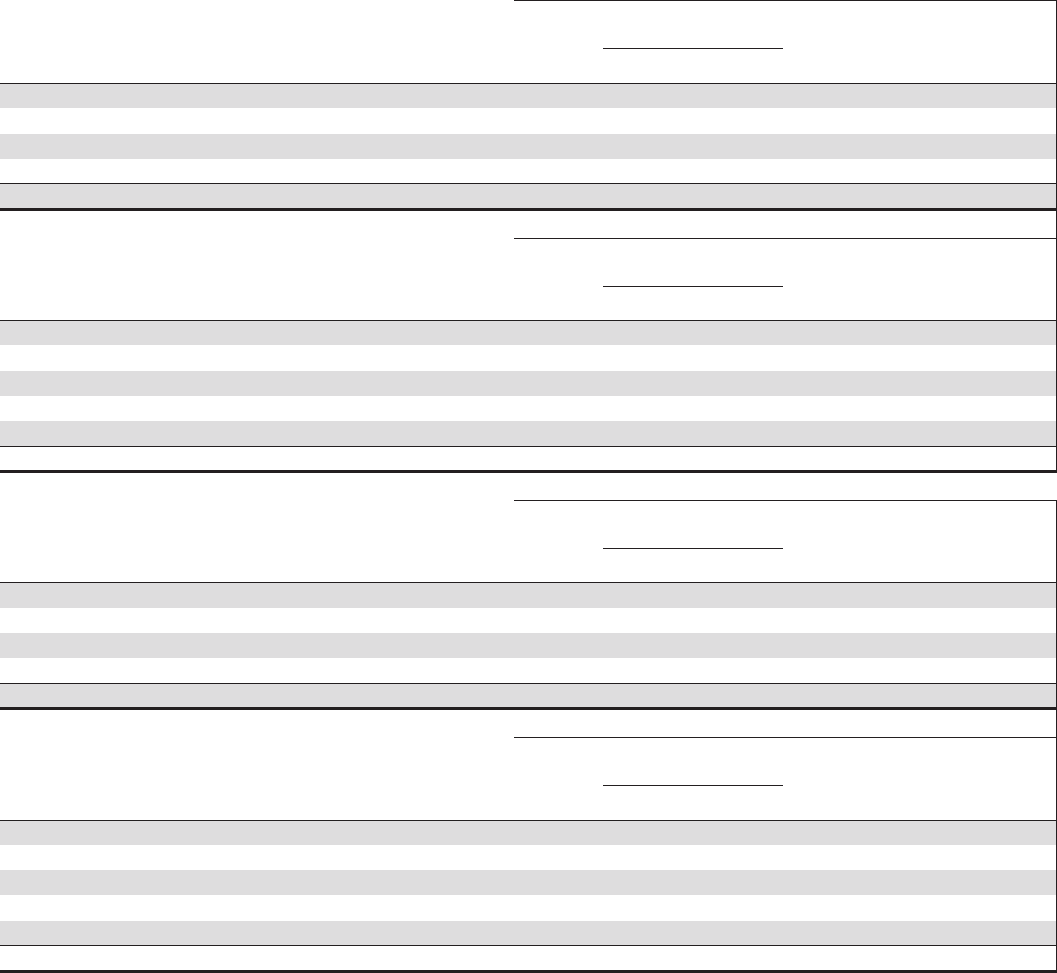

The following derivative Table 136 shows the impact legally enforceable master netting agreements had on our derivative assets

and derivative liabilities as of December 31, 2014 and December 31, 2013. The table also includes the fair value of any securities

collateral held or pledged under legally enforceable master netting agreements. Cash and securities collateral amounts are included

in the table only to the extent of the related net derivative fair values.

Refer to Note 22 Commitments and Guarantees for additional information related to resale and repurchase agreements offsetting.

Table 136: Derivative Assets and Liabilities Offsetting

Gross

Fair Value

Derivative

Assets

Amounts

Offset on the

Consolidated Balance Sheet Net

Fair Value

Derivative

Assets

Securities

Collateral

Held Under

Master Netting

Agreements

Net

Amounts

December 31, 2014

In millions

Fair Value

Offset Amount

Cash

Collateral

Derivative assets

Interest rate contracts $4,918 $1,981 $458 $2,479 $143 $2,336

Foreign exchange contracts 314 159 47 108 1 107

Credit contracts 2 1 1

Total derivative assets (a) (b) $5,234 $2,141 $506 $2,587 (c) $144 $2,443

Gross

Fair Value

Derivative

Liabilities

Amounts

Offset on the

Consolidated Balance Sheet Net

Fair Value

Derivative

Liabilities

Securities

Collateral

Pledged Under

Master Netting

Agreements

Net

Amounts

December 31, 2014

In millions

Fair Value

Offset Amount

Cash

Collateral

Derivative liabilities

Interest rate contracts $3,272 $2,057 $483 $ 732 $ 732

Foreign exchange contracts 241 80 20 141 141

Credit contracts 4 4

Other contracts 510 510 510

Total derivative liabilities (a) (b) $4,027 $2,141 $503 $1,383 (d) $1,383

Gross

Fair Value

Derivative

Assets

Amounts

Offset on the

Consolidated Balance Sheet Net

Fair Value

Derivative

Assets

Securities

Collateral

Held Under

Master Netting

Agreements

Net

Amounts

December 31, 2013

In millions

Fair Value

Offset Amount

Cash

Collateral

Derivative assets

Interest rate contracts $4,599 $2,468 $556 $1,575 $115 $1,460

Foreign exchange contracts 192 64 9 119 119

Credit contracts 2 1 1 1

Total derivative assets (a) (b) $4,793 $2,533 $565 $1,695 (c) $115 $1,580

Gross

Fair Value

Derivative

Liabilities

Amounts

Offset on the

Consolidated Balance Sheet Net Fair

Value

Derivative

Liabilities

Securities

Collateral

Pledged Under

Master Netting

Agreements

Net

Amounts

December 31, 2013

In millions

Fair Value

Offset Amount

Cash

Collateral

Derivative liabilities

Interest rate contracts $3,326 $2,447 $473 $ 406 $ 406

Foreign exchange contracts 182 83 23 76 76

Credit contracts 4 3 1

Other contracts 422 422 422

Total derivative liabilities (a) (b) $3,934 $2,533 $497 $ 904 (d) $ 904

(a) There were no derivative assets or derivative liabilities equity contracts as of December 31, 2014 and December 31, 2013.

(b) Included derivative assets and derivative liabilities as of December 31, 2014 totaling $807 million and $657 million, respectively, related to interest rate contracts executed bilaterally

with counterparties in the U.S. over-the-counter market and novated to and cleared through a central clearing house. The comparable amounts as of December 31, 2013 totaled $331

million and $224 million, respectively. Derivative assets and liabilities as of December 31, 2014 and December 31, 2013 related to exchange-traded interest rate contracts were not

material. As of December 31, 2014 and December 31, 2013, these contracts were not subject to offsetting. The remaining gross and net derivative assets and liabilities relate to

contracts executed bilaterally with counterparties that are not settled through an organized exchange or central clearing house.

(c) Represents the net amount of derivative assets included in Other assets on our Consolidated Balance Sheet.

(d) Represents the net amount of derivative liabilities included in Other liabilities on our Consolidated Balance Sheet.

194 The PNC Financial Services Group, Inc. – Form 10-K