PNC Bank 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

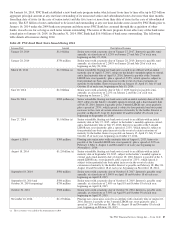

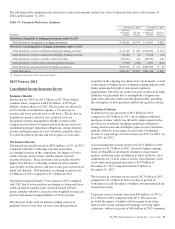

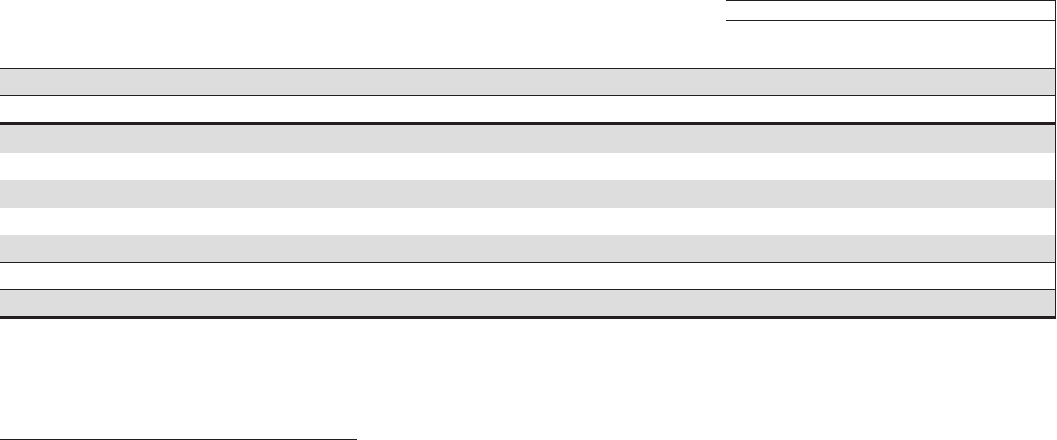

The following table summarizes the notional or contractual amounts and net fair value of financial derivatives at December 31,

2014 and December 31, 2013.

Table 55: Financial Derivatives Summary

December 31, 2014 December 31, 2013

In millions

Notional/

Contractual

Amount

Net Fair

Value (a)

Notional/

Contractual

Amount

Net Fair

Value (a)

Derivatives designated as hedging instruments under GAAP

Total derivatives designated as hedging instruments $ 49,061 $1,075 $ 36,197 $ 825

Derivatives not designated as hedging instruments under GAAP

Total derivatives used for residential mortgage banking activities $ 76,102 $ 409 $119,679 $ 330

Total derivatives used for commercial mortgage banking activities 26,290 26 53,149 (12)

Total derivatives used for customer-related activities 183,474 122 169,534 138

Total derivatives used for other risk management activities 5,390 (425) 2,697 (422)

Total derivatives not designated as hedging instruments $291,256 $ 132 $345,059 $ 34

Total Derivatives $340,317 $1,207 $381,256 $ 859

(a) Represents the net fair value of assets and liabilities.

2013 V

ERSUS

2012

Consolidated Income Statement Review

Summary Results

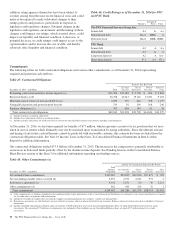

Net income for 2013 was $4.2 billion, or $7.36 per diluted

common share, compared with $3.0 billion, or $5.28 per

diluted common share, for 2012. The increase was driven by

an 8% decline in noninterest expense, a 3% increase in

revenue and lower provision for credit losses. The decline in

noninterest expense reflected our continued focus on

disciplined expense management. Higher revenue in the

comparison was driven by improvement in the provision for

residential mortgage repurchase obligations, strong client fee

income and higher gains on asset valuations, partially offset

by lower net interest income and lower gains on asset sales.

Net Interest Income

Net interest income decreased by $493 million, or 5%, in 2013

compared with 2012, reflecting a decline in purchase

accounting accretion in the comparison, the impact of lower

yields on loans and securities, and the impact of lower

securities balances. These decreases were partially offset by

higher loan balances, reflecting commercial and consumer

loan growth over the period, and lower rates paid on borrowed

funds and deposits. Total purchase accounting accretion was

$.8 billion for 2013 compared to $1.1 billion in 2012.

Net interest margin declined 37 basis points in 2013 compared

with 2012 due to lower purchase accounting accretion and lower

yields on interest-earning assets, which decreased 48 basis

points, partially offset by a decrease in the weighted-average rate

paid on total interest-bearing liabilities of 14 basis points.

The decrease in the yield on interest-earning assets was

primarily due to lower rates on new loans and purchased

securities in the ongoing low interest rate environment, as well

as the impact of higher levels of interest-earning deposits with

banks maintained in light of anticipated regulatory

requirements. The decrease in the rate paid on interest-bearing

liabilities was primarily due to redemptions of higher-rate

bank notes and senior debt and subordinated debt, including

the redemption of trust preferred and hybrid capital securities.

Noninterest Income

Noninterest income increased to $6.9 billion in 2013

compared to $5.9 billion in 2012, due to higher residential

mortgage revenue, which was driven by improvement in the

provision for residential mortgage repurchase obligations,

strong client fee income and higher gains on asset valuations,

partially offset by lower gains on asset sales. Noninterest

income as a percentage of total revenue was 43% for 2013, up

from 38% for 2012.

Asset management revenue increased to $1.3 billion in 2013

compared to $1.2 billion in 2012, driven by higher earnings

from our BlackRock investment, stronger average equity

markets and strong sales resulting in positive net flows, after

adjustments for cyclical client activities. Discretionary client

assets under management increased to $127 billion at

December 31, 2013 compared with $112 billion at

December 31, 2012.

The increase in consumer service fees to $1.3 billion in 2013

compared to $1.1 billion in 2012 was due to growth in

brokerage fees and the impact of higher customer-initiated fee

based transactions.

Corporate services revenue increased $44 million, or 4%, to

$1.2 billion in 2013 compared with 2012. This increase

included the impact of higher valuation gains from rising

interest rates on net commercial mortgage servicing rights

valuations, which were gains of $68 million in 2013 compared

The PNC Financial Services Group, Inc. – Form 10-K 95