PNC Bank 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our stock transfer agent and registrar is:

Computershare Trust Company, N.A.

250 Royall Street

Canton, MA 02021

800-982-7652

Registered shareholders may contact the above phone number

regarding dividends and other shareholder services.

We include here by reference the information that appears

under the Common Stock Performance Graph caption at the

end of this Item 5.

(a)(2) None.

(b) Not applicable.

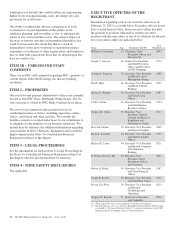

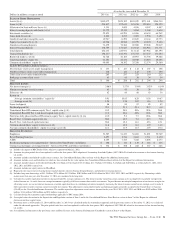

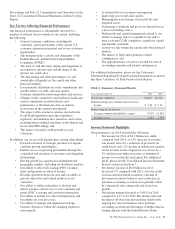

(c) Details of our repurchases of PNC common stock

during the fourth quarter of 2014 are included in the

following table:

In thousands, except per share data

2014 period

Total shares

purchased (a)

Average

price

paid per

share

Total shares

purchased as

part of

publicly

announced

programs (b)

Maximum

number of

shares that

may yet be

purchased

under the

programs (b)

October 1 – 31 2,772 $82.77 2,734 11,417

November 1 – 30 1,311 $87.63 1,309 10,108

December 1 – 31 2,026 $90.38 2,022 8,086

Total 6,109 $86.33 6,065

(a) Includes PNC common stock purchased in connection with our various employee

benefit plans generally related to forfeitures of unvested restricted stock awards and

shares used to cover employee payroll tax withholding requirements. Note 13

Employee Benefit Plans and Note 14 Stock Based Compensation Plans in the Notes

To Consolidated Financial Statements in Item 8 of this Report include additional

information regarding our employee benefit and equity compensation plans that use

PNC common stock.

(b) On October 4, 2007, our Board of Directors authorized the repurchase of up to

25 million shares of PNC common stock. The repurchases are made in open market

or privately negotiated transactions and the repurchase program will remain in effect

until fully utilized or until modified, superseded or terminated. The timing and exact

amount of common stock repurchases will depend on a number of factors including,

among others, market and general economic conditions, economic capital and

regulatory capital considerations, alternative uses of capital, the potential impact on

our credit ratings, and contractual and regulatory limitations, including the results of

the supervisory assessment of capital adequacy and capital planning processes

undertaken by the Federal Reserve and our primary bank regulators as part of the

CCAR process.

Our 2014 capital plan, submitted as part of the CCAR process and approved by the

Federal Reserve, included share repurchase programs of up to $1.5 billion for the

four quarter period beginning with the second quarter of 2014. This amount does not

include share repurchases in connection with various employee benefit plans

referenced in note (a). In the fourth quarter of 2014, in accordance with the 2014

capital plan, we repurchased 6.065 million shares of common stock on the open

market, with an average price of $86.41 per share and an aggregate repurchase price

of $524 million.

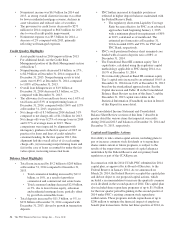

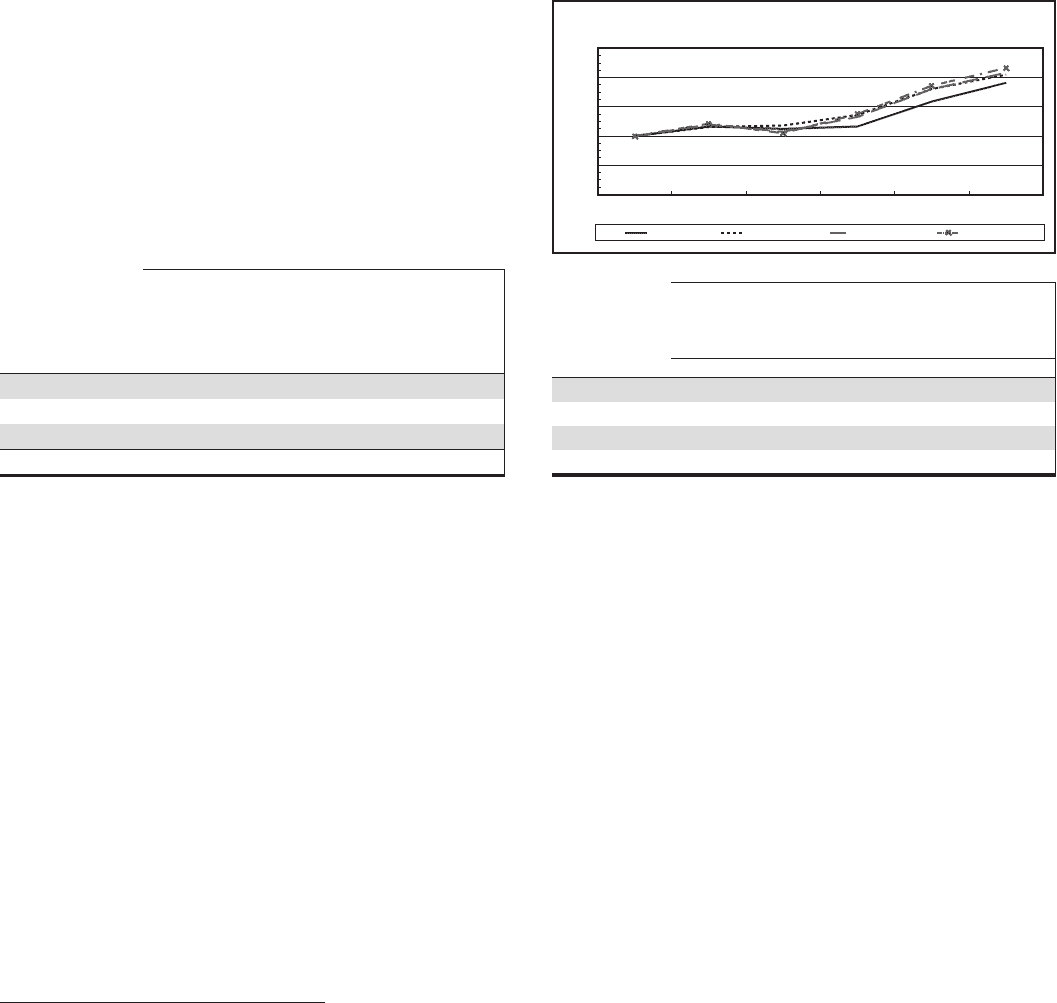

Common Stock Performance Graph

This graph shows the cumulative total shareholder return (i.e.,

price change plus reinvestment of dividends) on our common

stock during the five-year period ended December 31, 2014,

as compared with: (1) a selected peer group as set forth below

and referred to as the “Peer Group;” (2) an overall stock

market index, the S&P 500 Index; and (3) a published industry

index, the S&P 500 Banks. The yearly points marked on the

horizontal axis of the graph correspond to December 31 of

that year. The stock performance graph assumes that $100 was

invested on January 1, 2010 for the five-year period and that

any dividends were reinvested. The table below the graph

shows the resultant compound annual growth rate for the

performance period.

Dec09

Dollars

Comparison of Cumulative Five Year Total Return

0

PNC S&P 500 Index S&P 500 Banks Peer Group

150

100

50

200

250

Dec10 Dec11 Dec12 Dec14Dec13

Base

Period

Assumes $100 investment at Close of

Market on December 31, 2009

Total Return = Price change plus

reinvestment

of dividends

5-Year

Compound

Growth

Rate

Dec. 09 Dec. 10 Dec. 11 Dec. 12 Dec. 13 Dec. 14

PNC 100 115.81 112.26 116.38 158.80 191.07 13.83%

S&P 500 Index 100 115.06 117.48 136.27 180.39 205.07 15.45%

S&P 500 Banks 100 119.84 107.00 132.74 180.15 208.10 15.79%

Peer Group 100 120.80 104.59 137.49 186.35 216.01 16.65%

The Peer Group for the preceding chart and table consists of the

following companies: BB&T Corporation; Comerica Inc.; Fifth

Third Bancorp; KeyCorp; The PNC Financial Services Group,

Inc.; SunTrust Banks, Inc.; U.S. Bancorp; Regions Financial

Corporation; Wells Fargo & Company; Capital One Financial,

Inc.; Bank of America Corporation; M&T Bank; and JP

Morgan Chase and Company. This Peer Group was approved

for 2014 by the Board’s Personnel and Compensation

Committee. Such Committee has approved a peer group of

twelve for 2015, consisting of all of the same companies as

those in the 2014 Peer Group other than Comerica Inc.

Each yearly point for the Peer Group is determined by

calculating the cumulative total shareholder return for each

company in the Peer Group from December 31, 2009 to

December 31 of that year (End of Month Dividend

Reinvestment Assumed) and then using the median of these

returns as the yearly plot point.

In accordance with the rules of the SEC, this section,

captioned “Common Stock Performance Graph,” shall not be

incorporated by reference into any of our future filings made

under the Securities Exchange Act of 1934 or the Securities

Act of 1933. The Common Stock Performance Graph,

including its accompanying table and footnotes, is not deemed

to be soliciting material or to be filed under the Exchange Act

or the Securities Act.

The PNC Financial Services Group, Inc. – Form 10-K 29