PNC Bank 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

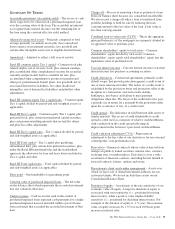

Value-at-risk (VaR) – A statistically-based measure of risk

that describes the amount of potential loss which may be

incurred due to adverse market movements. The measure is of

the maximum loss which should not be exceeded on 95 out of

100 days for a 95% VaR.

Watchlist – A list of criticized loans, credit exposure or other

assets compiled for internal monitoring purposes. We define

criticized exposure for this purpose as exposure with an

internal risk rating of other assets especially mentioned,

substandard, doubtful or loss.

Yield curve – A graph showing the relationship between the

yields on financial instruments or market indices of the same

credit quality with different maturities. For example, a

“normal” or “positive” yield curve exists when long-term

bonds have higher yields than short-term bonds. A “flat” yield

curve exists when yields are the same for short-term and long-

term bonds. A “steep” yield curve exists when yields on long-

term bonds are significantly higher than on short-term bonds.

An “inverted” or “negative” yield curve exists when short-

term bonds have higher yields than long-term bonds.

C

AUTIONARY

S

TATEMENT

R

EGARDING

F

ORWARD

-L

OOKING

I

NFORMATION

We make statements in this Report, and we may from time to

time make other statements, regarding our outlook for

earnings, revenues, expenses, capital and liquidity levels and

ratios, asset levels, asset quality, financial position, and other

matters regarding or affecting PNC and its future business and

operations that are forward-looking statements within the

meaning of the Private Securities Litigation Reform Act.

Forward-looking statements are typically identified by words

such as “believe,” “plan,” “expect,” “anticipate,” “see,”

“look,” “intend,” “outlook,” “project,” “forecast,” “estimate,”

“goal,” “will,” “should” and other similar words and

expressions. Forward-looking statements are subject to

numerous assumptions, risks and uncertainties, which change

over time.

Forward-looking statements speak only as of the date made.

We do not assume any duty and do not undertake to update

forward-looking statements. Actual results or future events

could differ, possibly materially, from those anticipated in

forward-looking statements, as well as from historical

performance.

Our forward-looking statements are subject to the following

principal risks and uncertainties.

• Our businesses, financial results and balance sheet values

are affected by business and economic conditions,

including the following:

– Changes in interest rates and valuations in debt,

equity and other financial markets.

– Disruptions in the liquidity and other functioning of

U.S. and global financial markets.

– The impact on financial markets and the economy of

any changes in the credit ratings of U.S. Treasury

obligations and other U.S. government-backed debt,

as well as issues surrounding the levels of U.S. and

European government debt and concerns regarding

the creditworthiness of certain sovereign

governments, supranationals and financial

institutions in Europe.

– Actions by the Federal Reserve, U.S. Treasury and

other government agencies, including those that

impact money supply and market interest rates.

– Changes in customers’, suppliers’ and other

counterparties’ performance and creditworthiness.

– Slowing or reversal of the current U.S. economic

expansion.

– Continued residual effects of recessionary conditions

and uneven spread of positive impacts of recovery on

the economy and our counterparties, including adverse

impacts on levels of unemployment, loan utilization

rates, delinquencies, defaults and counterparty ability

to meet credit and other obligations.

– Changes in customer preferences and behavior,

whether due to changing business and economic

conditions, legislative and regulatory initiatives, or

other factors.

• Our forward-looking financial statements are subject to

the risk that economic and financial market conditions

will be substantially different than we are currently

expecting. These statements are based on our current view

that the U.S. economic expansion will speed up to an

above trend growth rate near 3.5 percent in 2015, boosted

by lower oil/energy prices, and that short-term interest

rates and bond yields will rise only slowly in the latter

half of 2015. These forward-looking statements also do

not, unless otherwise indicated, take into account the

impact of potential legal and regulatory contingencies.

• PNC’s ability to take certain capital actions, including

paying dividends and any plans to increase common stock

dividends, repurchase common stock under current or

future programs, or issue or redeem preferred stock or other

regulatory capital instruments, is subject to the review of

such proposed actions by the Federal Reserve as part of

PNC’s comprehensive capital plan for the applicable period

in connection with the regulators’ Comprehensive Capital

Analysis and Review (CCAR) process and to the

acceptance of such capital plan and non-objection to such

capital actions by the Federal Reserve.

• PNC’s regulatory capital ratios in the future will depend

on, among other things, the company’s financial

performance, the scope and terms of final capital

regulations then in effect (particularly those implementing

the Basel Capital Accords), and management actions

affecting the composition of PNC’s balance sheet. In

addition, PNC’s ability to determine, evaluate and

The PNC Financial Services Group, Inc. – Form 10-K 103