PNC Bank 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

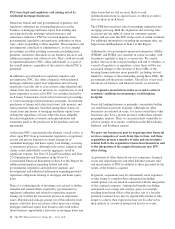

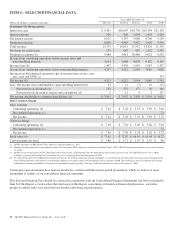

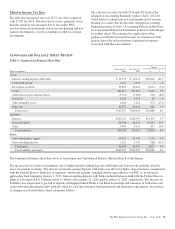

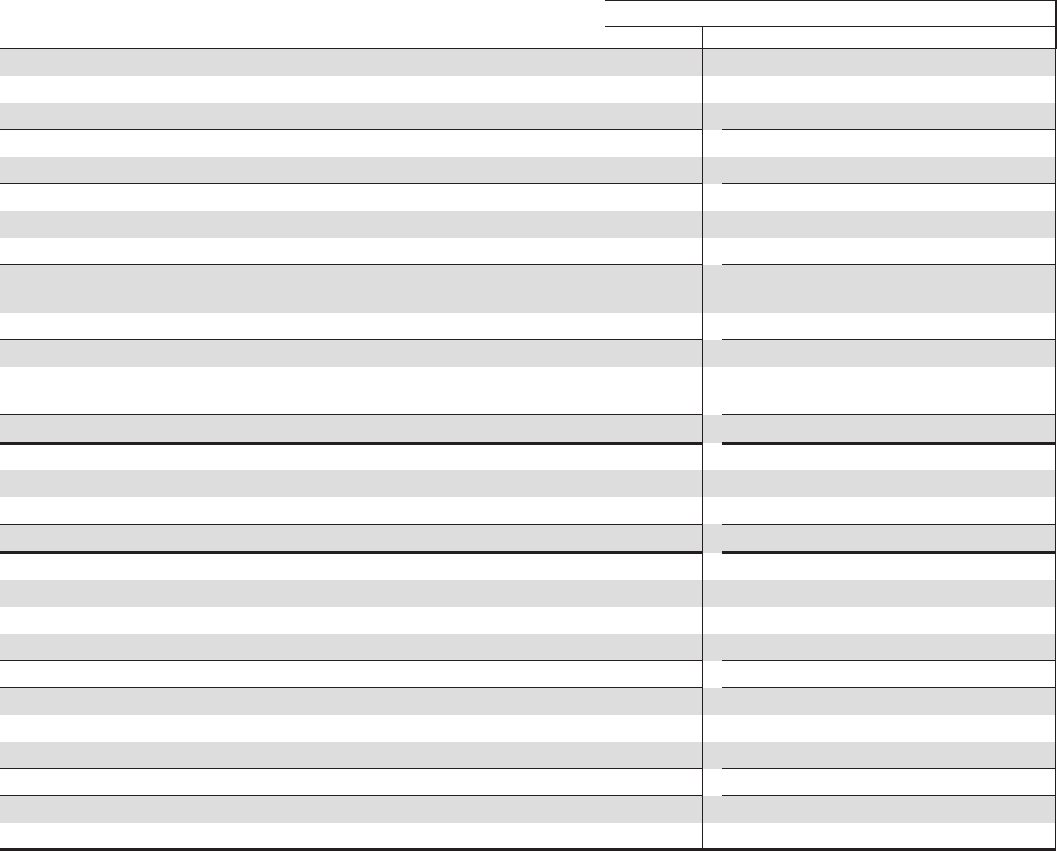

ITEM 6 – SELECTED FINANCIAL DATA

Year ended December 31

Dollars in millions, except per share data 2014 (a) 2013 (a) 2012 (a) 2011 2010

S

UMMARY

O

F

O

PERATIONS

Interest income $ 9,431 $10,007 $10,734 $10,194 $11,150

Interest expense 906 860 1,094 1,494 1,920

Net interest income 8,525 9,147 9,640 8,700 9,230

Noninterest income 6,850 6,865 5,872 5,626 5,946

Total revenue 15,375 16,012 15,512 14,326 15,176

Provision for credit losses 273 643 987 1,152 2,502

Noninterest expense (b) 9,488 9,681 10,486 9,022 8,529

Income from continuing operations before income taxes and

noncontrolling interests 5,614 5,688 4,039 4,152 4,145

Income taxes (b) 1,407 1,476 1,045 1,087 1,127

Income from continuing operations before noncontrolling interests 4,207 4,212 2,994 3,065 3,018

Income from discontinued operations (net of income taxes of zero, zero,

zero, zero and $338) (c) 373

Net income (b) 4,207 4,212 2,994 3,065 3,391

Less: Net income (loss) attributable to noncontrolling interests (b) 23 11 (7) 16 (11)

Preferred stock dividends (d) 232 237 177 56 146

Preferred stock discount accretion and redemptions (d) 5 12 4 2 255

Net income attributable to common shareholders (d) $ 3,947 $ 3,952 $ 2,820 $ 2,991 $ 3,001

P

ER

C

OMMON

S

HARE

Basic earnings

Continuing operations (b) $ 7.44 $ 7.45 $ 5.33 $ 5.69 $ 5.06

Discontinued operations (c) .72

Net income $ 7.44 $ 7.45 $ 5.33 $ 5.69 $ 5.78

Diluted earnings

Continuing operations (b) $ 7.30 $ 7.36 $ 5.28 $ 5.62 $ 5.00

Discontinued operations (c) .72

Net income $ 7.30 $ 7.36 $ 5.28 $ 5.62 $ 5.72

Book value (b) $ 77.61 $ 72.07 $ 66.95 $ 61.44 $ 56.22

Cash dividends declared $ 1.88 $ 1.72 $ 1.55 $ 1.15 $ .40

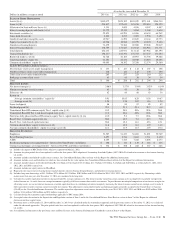

(a) Includes the impact of RBC Bank (USA), which we acquired on March 2, 2012.

(b) Amounts for prior periods have been updated to reflect the first quarter 2014 adoption of Accounting Standards Update (ASU) 2014-01 related to investments in low income housing

tax credits.

(c) Includes results of operations for PNC Global Investment Servicing Inc. (GIS) through June 30, 2010 and the related after-tax gain on sale. We sold GIS effective July 1, 2010,

resulting in a gain of $639 million, or $328 million after taxes, recognized during the third quarter of 2010.

(d) We redeemed the Series N (TARP) Preferred Stock on February 10, 2010. In connection with the redemption, we accelerated the accretion of the remaining issuance discount on the

Series N Preferred Stock and recorded a corresponding reduction in retained earnings of $250 million in the first quarter of 2010. This resulted in a noncash reduction in net income

attributable to common shareholders and related basic and diluted earnings per share. The Series N Preferred Stock was issued on December 31, 2008.

Certain prior period amounts have been reclassified to conform with the current period presentation, which we believe is more

meaningful to readers of our consolidated financial statements.

This Selected Financial Data should be reviewed in conjunction with the Consolidated Financial Statements and Notes included in

Item 8 of this Report as well as the other disclosure in this Report concerning our historical financial performance, our future

prospects and the risks associated with our business and financial performance.

30 The PNC Financial Services Group, Inc. – Form 10-K