PNC Bank 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

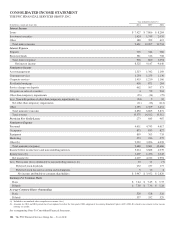

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

T

HE

PNC F

INANCIAL

S

ERVICES

G

ROUP

,I

NC

.

B

USINESS

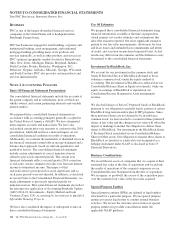

PNC is one of the largest diversified financial services

companies in the United States and is headquartered in

Pittsburgh, Pennsylvania.

PNC has businesses engaged in retail banking, corporate and

institutional banking, asset management, and residential

mortgage banking, providing many of its products and

services nationally, as well as other products and services in

PNC’s primary geographic markets located in Pennsylvania,

Ohio, New Jersey, Michigan, Illinois, Maryland, Indiana,

North Carolina, Florida, Kentucky, Washington, D.C.,

Delaware, Virginia, Alabama, Missouri, Georgia, Wisconsin

and South Carolina. PNC also provides certain products and

services internationally.

N

OTE

1A

CCOUNTING

P

OLICIES

Basis Of Financial Statement Presentation

Our consolidated financial statements include the accounts of

the parent company and its subsidiaries, most of which are

wholly-owned, and certain partnership interests and variable

interest entities.

We prepared these consolidated financial statements in

accordance with accounting principles generally accepted in

the United States of America (GAAP). We have eliminated

intercompany accounts and transactions. We have also

reclassified certain prior year amounts to conform to the 2014

presentation, which did not have a material impact on our

consolidated financial condition or results of operations.

Additionally, we evaluate the materiality of identified errors in

the financial statements using both an income statement and a

balance sheet approach, based on relevant quantitative and

qualitative factors. The consolidated financial statements

include certain adjustments to correct immaterial errors

related to previously reported periods. The current year

financial statements reflect a second quarter 2014 correction

to reclassify certain commercial facility fees from net interest

income to noninterest income. The impact of this

reclassification to prior periods was not significant, and as

such, prior periods were not adjusted. In addition, as disclosed

in certain Notes to the Consolidated Financial Statements, we

made adjustments to previously reported periods for

immaterial errors. Prior period financial statements also reflect

the retrospective application of Accounting Standards Update

(ASU) 2014-01, Investments – Equity Method and Joint

Ventures (Topic 323): Accounting for Investments in Qualified

Affordable Housing Projects.

We have also considered the impact of subsequent events on

these consolidated financial statements.

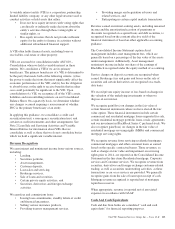

Use Of Estimates

We prepared these consolidated financial statements using

financial information available at the time of preparation,

which requires us to make estimates and assumptions that

affect the amounts reported. Our most significant estimates

pertain to our fair value measurements, allowances for loan

and lease losses and unfunded loan commitments and letters

of credit, and accretion on purchased impaired loans. Actual

results may differ from the estimates and the differences may

be material to the consolidated financial statements.

Investment In BlackRock, Inc.

We account for our investment in the common stock and

Series B Preferred Stock of BlackRock (deemed to be in-

substance common stock) under the equity method of

accounting. The investment in BlackRock is reflected on our

Consolidated Balance Sheet in Equity investments, while our

equity in earnings of BlackRock is reported on our

Consolidated Income Statement in Asset management

revenue.

We also hold shares of Series C Preferred Stock of BlackRock

pursuant to our obligation to partially fund a portion of certain

BlackRock long-term incentive plan (LTIP) programs. Since

these preferred shares are not deemed to be in-substance

common stock, we have elected to account for these preferred

shares at fair value and the changes in fair value will offset the

impact of marking-to-market the obligation to deliver these

shares to BlackRock. Our investment in the BlackRock Series

C Preferred Stock is included on our Consolidated Balance

Sheet in Other assets. Our obligation to transfer these shares to

BlackRock is classified as a derivative not designated as a

hedging instrument under GAAP as disclosed in Note 15

Financial Derivatives.

Business Combinations

We record the net assets of companies that we acquire at their

estimated fair value at the date of acquisition and we include

the results of operations of the acquired companies on our

Consolidated Income Statement from the date of acquisition.

We recognize, as goodwill, the excess of the acquisition price

over the estimated fair value of the net assets acquired.

Special Purpose Entities

Special purpose entities (SPEs) are defined as legal entities

structured for a particular purpose. We use special purpose

entities in various legal forms to conduct normal business

activities. We review the structure and activities of special

purpose entities for possible consolidation under the

applicable GAAP guidance.

112 The PNC Financial Services Group, Inc. – Form 10-K