PNC Bank 2014 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

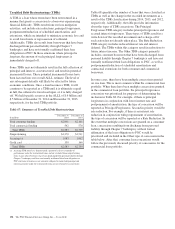

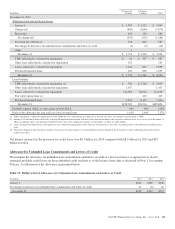

Troubled Debt Restructurings (TDRs)

A TDR is a loan whose terms have been restructured in a

manner that grants a concession to a borrower experiencing

financial difficulty. TDRs result from our loss mitigation

activities, and include rate reductions, principal forgiveness,

postponement/reduction of scheduled amortization, and

extensions, which are intended to minimize economic loss and

to avoid foreclosure or repossession of collateral.

Additionally, TDRs also result from borrowers that have been

discharged from personal liability through Chapter 7

bankruptcy and have not formally reaffirmed their loan

obligations to PNC. In those situations where principal is

forgiven, the amount of such principal forgiveness is

immediately charged off.

Some TDRs may not ultimately result in the full collection of

principal and interest, as restructured, and result in potential

incremental losses. These potential incremental losses have

been factored into our overall ALLL estimate. The level of

any subsequent defaults will likely be affected by future

economic conditions. Once a loan becomes a TDR, it will

continue to be reported as a TDR until it is ultimately repaid

in full, the collateral is foreclosed upon, or it is fully charged

off. We held specific reserves in the ALLL of $.4 billion and

$.5 billion at December 31, 2014 and December 31, 2013,

respectively, for the total TDR portfolio.

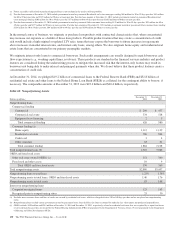

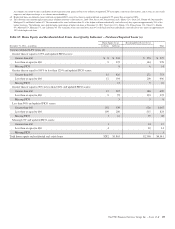

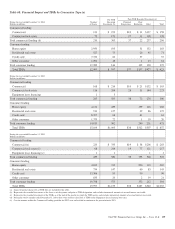

Table 67: Summary of Troubled Debt Restructurings

In millions

December 31

2014

December 31

2013

Total consumer lending $2,041 $2,161

Total commercial lending 542 578

Total TDRs $2,583 $2,739

Nonperforming $1,370 $1,511

Accruing (a) 1,083 1,062

Credit card 130 166

Total TDRs $2,583 $2,739

(a) Accruing TDR loans have demonstrated a period of at least six months of

performance under the restructured terms and are excluded from nonperforming

loans. Loans where borrowers have been discharged from personal liability through

Chapter 7 bankruptcy and have not formally reaffirmed their loan obligations to

PNC and loans to borrowers not currently obligated to make both principal and

interest payments under the restructured terms are not returned to accrual status.

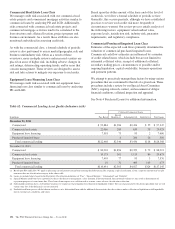

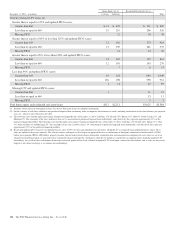

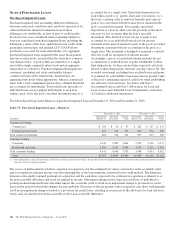

Table 68 quantifies the number of loans that were classified as

TDRs as well as the change in the recorded investments as a

result of the TDR classification during 2014, 2013, and 2012,

respectively. Additionally, the table provides information

about the types of TDR concessions. The Principal

Forgiveness TDR category includes principal forgiveness and

accrued interest forgiveness. These types of TDRs result in a

write down of the recorded investment and a charge-off if

such action has not already taken place. The Rate Reduction

TDR category includes reduced interest rate and interest

deferral. The TDRs within this category result in reductions to

future interest income. The Other TDR category primarily

includes consumer borrowers that have been discharged from

personal liability through Chapter 7 bankruptcy and have not

formally reaffirmed their loan obligations to PNC, as well as

postponement/reduction of scheduled amortization and

contractual extensions for both consumer and commercial

borrowers.

In some cases, there have been multiple concessions granted

on one loan. This is most common within the commercial loan

portfolio. When there have been multiple concessions granted

in the commercial loan portfolio, the principal forgiveness

concession was prioritized for purposes of determining the

inclusion in Table 68. For example, if there is principal

forgiveness in conjunction with lower interest rate and

postponement of amortization, the type of concession will be

reported as Principal Forgiveness. Second in priority would be

rate reduction. For example, if there is an interest rate

reduction in conjunction with postponement of amortization,

the type of concession will be reported as a Rate Reduction. In

the event that multiple concessions are granted on a consumer

loan, concessions resulting from discharge from personal

liability through Chapter 7 bankruptcy without formal

affirmation of the loan obligations to PNC would be

prioritized and included in the Other type of concession in the

table below. After that, consumer loan concessions would

follow the previously discussed priority of concessions for the

commercial loan portfolio.

138 The PNC Financial Services Group, Inc. – Form 10-K