PNC Bank 2014 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

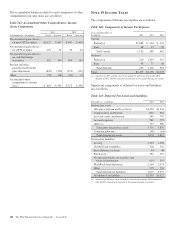

PNC files tax returns in most states and some non-U.S.

jurisdictions each year and is under continuous examination

by various state taxing authorities. With few exceptions, we

are no longer subject to state and local and non-U.S. income

tax examinations by taxing authorities for periods before

2009. For all open audits, any potential adjustments have been

considered in establishing our unrecognized tax benefits as of

December 31, 2014.

Our policy is to classify interest and penalties associated with

income taxes as income tax expense. For 2014, we had a

benefit of $5 million of gross interest and penalties,

decreasing income tax expense. The total accrued interest and

penalties at December 31, 2014 and December 31, 2013 was

$41 million and $45 million, respectively.

ASU 2014-01 was adopted effective January 1, 2014. Under

this standard, amortization of investments in qualified low

income housing tax credits is reported within income tax

expense. Certain amounts for 2013 and 2012 periods including

income tax provision have been updated to reflect the

adoption.

N

OTE

20 R

EGULATORY

M

ATTERS

We are subject to the regulations of certain federal, state, and

foreign agencies and undergo periodic examinations by such

regulatory authorities.

The ability to undertake new business initiatives (including

acquisitions), the access to and cost of funding for new

business initiatives, the ability to pay dividends, the ability to

repurchase shares or other capital instruments, the level of

deposit insurance costs, and the level and nature of regulatory

oversight depend, in large part, on a financial institution’s

capital strength.

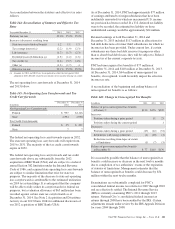

At December 31, 2014, PNC and PNC Bank, our domestic

banking subsidiary, were both considered “well capitalized,”

based on applicable U.S. regulatory capital ratio requirements.

To qualify as “well capitalized,” PNC and PNC Bank were

required during 2014 to maintain Transitional Basel III capital

ratios of at least 6% for Tier 1 risk-based and 10% for Total

risk-based, and PNC Bank was required to have a Transitional

Basel III leverage ratio of at least 5%.

The minimum U.S. regulatory capital ratios in effect during

2013 under Basel I, the applicable U.S. regulatory capital ratio

requirements during 2013, were 4% for Tier 1 risk-based, 8%

for Total risk-based and 4% for Leverage. To qualify as “well

capitalized” under Basel I, bank holding companies and banks

had to maintain capital ratios of at least 6% for Tier 1 risk-

based, 10% for Total risk-based and 5% for Leverage. At

December 31, 2013, PNC and PNC Bank met the “well

capitalized” capital ratio requirements based on U.S.

regulatory capital ratio requirements under Basel I.

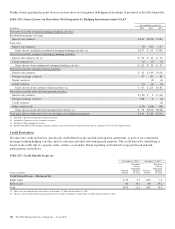

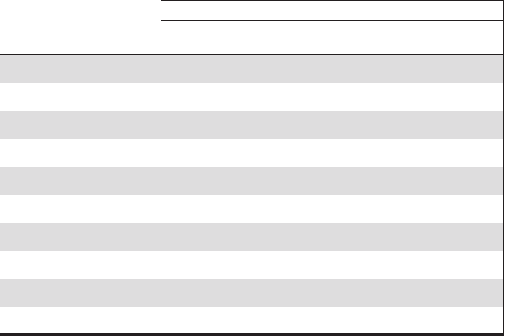

The following table sets forth the Transitional Basel III

regulatory capital ratios at December 31, 2014, and the Basel I

regulatory capital ratios at December 31, 2013, for PNC and

PNC Bank.

Table 147: Basel Regulatory Capital

Amount Ratios

December 31

Dollars in millions 2014 (a) 2013 (b)(c) 2014 (a) 2013 (b)(c)

Risk-based capital

Tier 1

PNC $35,687 $33,612 12.6% 12.4%

PNC Bank 29,328 28,731 10.7 11.0

Total

PNC 44,782 42,950 15.8 15.8

PNC Bank 37,559 37,575 13.7 14.3

Leverage

PNC 35,687 33,612 10.8 11.1

PNC Bank 29,328 28,731 9.2 9.8

(a) Calculated using the Transitional Basel III regulatory capital methodology

applicable to PNC during 2014.

(b) Calculated using the Basel I regulatory capital methodology applicable to PNC

during 2013.

(c) Amounts for 2013 period have not been updated to reflect the first quarter 2014

adoption of ASU 2014-01 related to investments in low income housing tax credits.

202 The PNC Financial Services Group, Inc. – Form 10-K