PNC Bank 2014 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Governors of the Federal Reserve System and

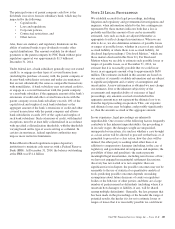

PNC Bank entered into a consent order with the

Office of the Comptroller of the Currency.

Collectively, these consent orders describe certain

foreclosure-related practices and controls that the

regulators found to be deficient and require PNC

and PNC Bank to, among other things, develop

and implement plans and programs to enhance

PNC’s residential mortgage servicing and

foreclosure processes, retain an independent

consultant to review certain residential mortgage

foreclosure actions, take certain remedial actions,

and oversee compliance with the orders and the

new plans and programs. The two orders do not

foreclose the potential for civil money penalties

from either of these regulators, although the range

of potential penalties communicated to PNC by

the regulators in connection with the agreements

described below is not material to PNC.

In connection with these orders, PNC established a

Compliance Committee of the Boards of PNC and

PNC Bank to monitor and coordinate PNC’s and

PNC Bank’s implementation of the commitments

under the orders. PNC and PNC Bank are

executing Action Plans designed to meet the

requirements of the orders. Consistent with the

orders, PNC also engaged an independent

consultant to conduct a review of certain

residential foreclosure actions, including those

identified through borrower complaints, and

identify whether any remedial actions for

borrowers are necessary.

In early 2013, PNC and PNC Bank, along with

twelve other residential mortgage servicers,

reached agreements with the OCC and the Federal

Reserve to amend these consent orders. Pursuant

to the amended consent orders, in order to

accelerate the remediation process, PNC agreed to

make a payment of approximately $70 million for

distribution to potentially affected borrowers in the

review population and to provide approximately

$111 million in additional loss mitigation or other

foreclosure prevention relief, which may be

satisfied pursuant to the amended consent orders

by a variety of borrower relief actions or by

additional cash payments or resource

commitments to borrower counseling or education.

Fulfillment of these commitments will satisfy all

of PNC’s and PNC Bank’s obligations under the

consent orders in connection with the independent

foreclosure review. We do not expect any

additional financial charges related to the

amendment to the consent orders to be material.

PNC’s and PNC Bank’s obligations to comply

with the remaining provisions of the consent

orders remain.

• In February 2012, the Department of Justice,

other federal regulators and 49 state attorneys

general announced agreements with the five

largest mortgage servicers. Written agreements

were filed with the U.S. District Court for the

Southern District of New York in March 2012.

Under these agreements, the mortgage servicers

will make cash payments to federal and state

governments, provide various forms of financial

relief to borrowers, and implement new

mortgage servicing standards. These

governmental authorities are continuing their

review of, and have engaged in discussions with,

other mortgage servicers, including PNC, that

were subject to the interagency horizontal

review, which could result in the imposition of

substantial payments and other forms of relief

(similar to that agreed to by the five largest

servicers) on some or all of these mortgage

servicers, including PNC. Whether and to what

extent any such relief may be imposed on PNC is

not yet known.

• PNC has received subpoenas from the U.S.

Attorney’s Office for the Southern District of

New York. The first two subpoenas, served in

2011, concern National City Bank’s lending

practices in connection with loans insured by the

Federal Housing Administration (FHA) as well

as certain non-FHA-insured loan origination,

sale and securitization practices, and a third,

served in 2013, seeks information regarding

claims for costs that are incurred by foreclosure

counsel in connection with the foreclosure of

loans insured or guaranteed by FHA, FNMA, or

FHLMC. PNC is cooperating with the

investigations.

• The Department of Justice, Consumer Protection

Bureau, served a subpoena on PNC in 2013 seeking

information concerning the return rate for certain

merchant and payment processor customers with

whom PNC has a depository relationship. We believe

that the subpoena is intended to determine whether,

and to what extent, PNC may have facilitated fraud

committed by third-parties against consumers. We

are cooperating with the subpoena.

• Through the U.S. Attorney’s Office for the District of

Maryland, the office of the Inspector General for the

Small Business Administration (“SBA”) served a

subpoena on PNC in 2012 requesting documents

concerning PNC’s relationship with, including SBA-

guaranteed loans made through, a broker named Jade

Capital Investments, LLC (“Jade”), as well as

information regarding other PNC-originated SBA

guaranteed loans made to businesses located in the

State of Maryland, the Commonwealth of Virginia,

The PNC Financial Services Group, Inc. – Form 10-K 211