PNC Bank 2014 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

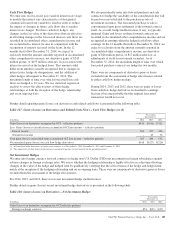

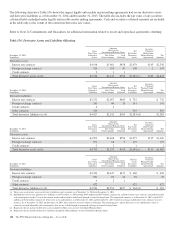

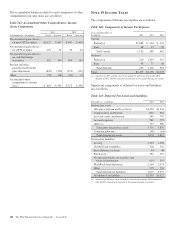

In millions Pretax Tax After-tax

2013 activity

Increase in net unrealized gains

(losses) on cash flow hedge

derivatives (141) 52 (89)

Less: Net gains (losses) realized as a

yield adjustment reclassified to

loan interest income (a) 284 (103) 181

Less: Net gains (losses) realized as a

yield adjustment reclassified to

investment securities interest

income (a) 53 (19) 34

Less: Net gains (losses) realized on

sales of securities reclassified to

noninterest income (a) 49 (18) 31

Net unrealized gains (losses) on cash

flow hedge derivatives (527) 192 (335)

Balance at December 31, 2013 384 (141) 243

2014 activity

Increase in net unrealized gains

(losses) on cash flow hedge

derivatives 431 (158) 273

Less: Net gains (losses) realized as a

yield adjustment reclassified to

loan interest income (a) 251 (92) 159

Less: Net gains (losses) realized as a

yield adjustment reclassified to

investment securities interest

income (a) 12 (5) 7

Net unrealized gains (losses) on cash

flow hedge derivatives 168 (61) 107

Balance at December 31, 2014 $ 552 $(202) $ 350

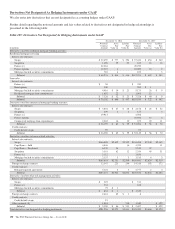

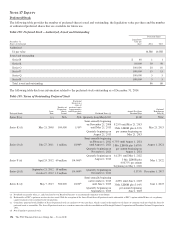

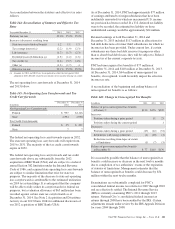

Pension and other postretirement

benefit plan adjustments

Balance at December 31, 2011 $(1,191) $ 436 $ (755)

2012 Activity

Net pension and other postretirement

benefit plan activity (118) 44 (74)

Amortization of actuarial loss (gain)

reclassified to other noninterest

expense 94 (35) 59

Amortization of prior service cost

(credit) reclassified to other

noninterest expense (11) 4 (7)

Total 2012 activity (35) 13 (22)

Balance at December 31, 2012 (1,226) 449 (777)

2013 Activity

Net pension and other postretirement

benefit plan activity 760 (279) 481

Amortization of actuarial loss (gain)

reclassified to other noninterest

expense 103 (37) 66

Amortization of prior service cost

(credit) reclassified to other

noninterest expense (11) 4 (7)

Total 2013 activity 852 (312) 540

Balance at December 31, 2013 (374) 137 (237)

In millions Pretax Tax After-tax

2014 Activity

Net pension and other postretirement

benefit plan activity (440) 161 (279)

Amortization of actuarial loss (gain)

reclassified to other noninterest

expense 4 (1) 3

Amortization of prior service cost

(credit) reclassified to other

noninterest expense (10) 3 (7)

Total 2014 Activity (446) 163 (283)

Balance at December 31, 2014 $ (820) $ 300 $ (520)

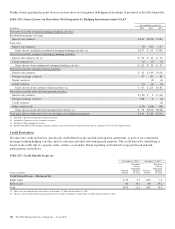

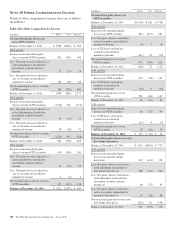

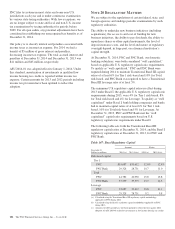

Other

Balance at December 31, 2011 $ (51) $ 26 $ (25)

2012 Activity

PNC’s portion of BlackRock’s OCI 3 (4) (1)

Net investment hedge derivatives (b) (27) 10 (17)

Foreign currency translation

adjustments 34 (12) 22

Total 2012 activity 10 (6) 4

Balance at December 31, 2012 (41) 20 (21)

2013 Activity

PNC’s portion of BlackRock’s OCI 15 (12) 3

Net investment hedge derivatives (b) (21) 8 (13)

Foreign currency translation

adjustments 27 1 28

Total 2013 activity 21 (3) 18

Balance at December 31, 2013 (20) 17 (3)

2014 Activity

PNC’s portion of BlackRock’s OCI (36) 14 (22)

Net investment hedge derivatives (b) 54 (20) 34

Foreign currency translation

adjustments (c) (57) – (57)

Total 2014 activity (39) (6) (45)

Balance at December 31, 2014 $ (59) $ 11 $ (48)

(a) Cash flow hedge derivatives are interest rate contract derivatives designated as

hedging instruments under GAAP.

(b) Net investment hedge derivatives are foreign exchange contracts designated as

hedging instruments under GAAP.

(c) As of September 30, 2013, PNC made an assertion under ASC 740 – Income Taxes

that the earnings of PNC’s Luxembourg-UK lending business were indefinitely

reinvested; thereafter, no U.S. deferred income tax has been recorded on the foreign

currency translation of the investment.

The PNC Financial Services Group, Inc. – Form 10-K 199