PNC Bank 2014 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

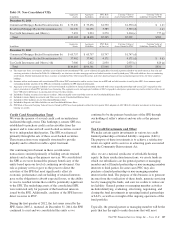

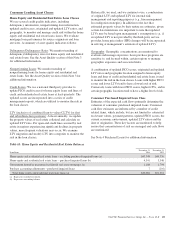

accounted for at amortized cost whose credit quality has deteriorated to the extent that full collection of contractual principal and

interest is not probable. Interest income is not recognized on these loans. Loans accounted for under the fair value option are

reported as performing loans as these loans are accounted for at fair value. However, when nonaccrual criteria is met, interest

income is not recognized on these loans. Additionally, certain government insured or guaranteed loans for which we expect to

collect substantially all principal and interest are not reported as nonperforming loans and continue to accrue interest. Purchased

impaired loans are excluded from nonperforming loans as we are currently accreting interest income over the expected life of the

loans. See Note 4 Purchased Loans for further information.

See Note 1 Accounting Policies for additional delinquency, nonperforming, and charge-off information.

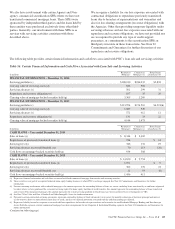

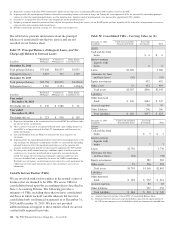

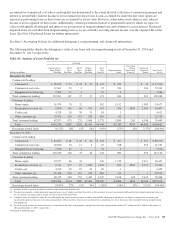

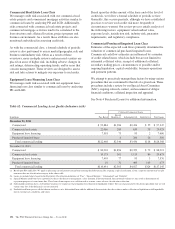

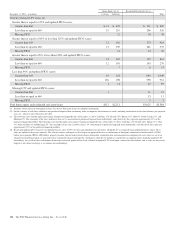

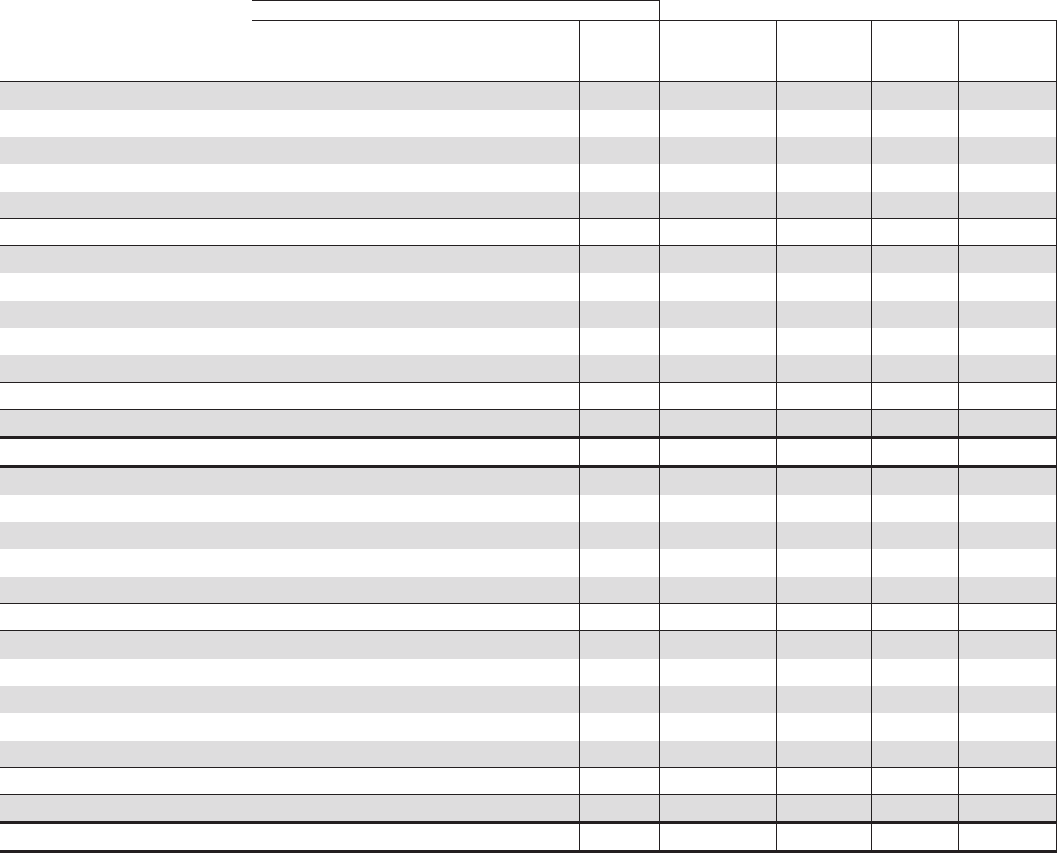

The following tables display the delinquency status of our loans and our nonperforming assets at December 31, 2014 and

December 31, 2013, respectively.

Table 60: Analysis of Loan Portfolio (a)

Accruing

Dollars in millions

Current or Less

Than 30 Days

Past Due

30-59

Days

Past Due

60-89

Days

Past Due

90 Days

Or More

Past Due

Total

Past

Due (b)

Nonperforming

Loans

Fair Value

Option

Nonaccrual

Loans (c)

Purchased

Impaired

Loans

Total Loans

(d) (e)

December 31, 2014

Commercial Lending

Commercial $ 96,922 $ 73 $ 24 $ 37 $ 134 $ 290 $ 74 $ 97,420

Commercial real estate 22,667 23 2 25 334 236 23,262

Equipment lease financing 7,672 11 1 12 2 7,686

Total commercial lending 127,261 107 27 37 171 626 310 128,368

Consumer Lending

Home equity 31,474 70 32 102 1,112 1,989 34,677

Residential real estate (f) 9,900 163 68 742 973 706 $269 2,559 14,407

Credit card 4,528 28 20 33 81 3 4,612

Other consumer (g) 22,071 214 112 293 619 63 22,753

Total consumer lending 67,973 475 232 1,068 1,775 1,884 269 4,548 76,449

Total $195,234 $582 $259 $1,105 $1,946 $2,510 $269 $4,858 $204,817

Percentage of total loans 95.32% .28% .13% .54% 0.95% 1.23% .13% 2.37% 100.00%

December 31, 2013

Commercial Lending

Commercial $ 87,621 $ 81 $ 20 $ 42 $ 143 $ 457 $ 157 $ 88,378

Commercial real estate 20,090 54 11 2 67 518 516 21,191

Equipment lease financing 7,538 31 2 33 5 7,576

Total commercial lending 115,249 166 33 44 243 980 673 117,145

Consumer Lending

Home equity 32,877 86 34 120 1,139 2,311 36,447

Residential real estate (f) 9,311 217 87 1,060 1,364 904 $365 3,121 15,065

Credit card 4,339 29 19 34 82 4 4,425

Other consumer (g) 21,788 216 112 353 681 61 1 22,531

Total consumer lending 68,315 548 252 1,447 2,247 2,108 365 5,433 78,468

Total $183,564 $714 $285 $1,491 $2,490 $3,088 $365 $6,106 $195,613

Percentage of total loans 93.83% .37% .15% .76% 1.28% 1.58% .19% 3.12% 100.00%

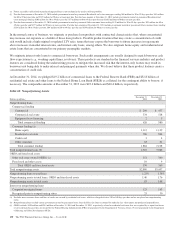

(a) Amounts in table represent recorded investment and exclude loans held for sale.

(b) Past due loan amounts exclude purchased impaired loans, even if contractually past due (or if we do not expect to receive payment in full based on the original contractual terms), as

we are currently accreting interest income over the expected life of the loans.

(c) Consumer loans accounted for under the fair value option for which we do not expect to collect substantially all principal and interest are subject to nonaccrual accounting and

classification upon meeting any of our nonaccrual policies. Given that these loans are not accounted for at amortized cost, these loans have been excluded from the nonperforming

loan population.

(d) Net of unearned income, net deferred loan fees, unamortized discounts and premiums, and purchase discounts and premiums totaling $1.7 billion and $2.1 billion at December 31,

2014 and December 31, 2013, respectively.

(Continued on following page)

The PNC Financial Services Group, Inc. – Form 10-K 129