PNC Bank 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

Our Consolidated Income Statement is presented in Item 8 of

this Report.

Net income for 2014 of $4.2 billion was stable compared with

2013, as a 4% decrease in revenue was mostly offset by a

reduction in provision for credit losses and a 2% decline in

noninterest expense. Lower revenue in the comparison was

driven by a 7% decline in net interest income, as noninterest

income was essentially unchanged.

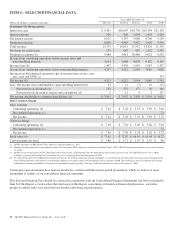

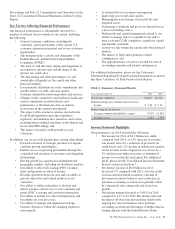

Net Interest Income

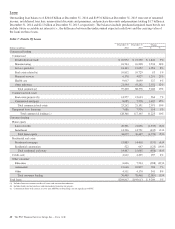

Table 4: Net Interest Income and Net Interest Margin

Year ended

December 31

Dollars in millions 2014 2013

Net interest income $8,525 $9,147

Net interest margin 3.08% 3.57%

Changes in net interest income and margin result from the

interaction of the volume and composition of interest-earning

assets and related yields, interest-bearing liabilities and related

rates paid, and noninterest-bearing sources of funding. See the

Statistical Information (Unaudited) – Average Consolidated

Balance Sheet And Net Interest Analysis and Analysis Of

Year-To-Year Changes In Net Interest Income in Item 8 of

this Report and the discussion of purchase accounting

accretion on purchased impaired loans in the Consolidated

Balance Sheet review in this Item 7 for additional information.

Net interest income decreased by $622 million, or 7%, in 2014

compared with 2013 reflecting the ongoing low rate

environment. Lower yields on loans and investment securities,

a decline in investment securities balances and a reduction in

purchase accounting accretion were partially offset by

commercial and commercial real estate loan growth. Lower

net interest income also included the impact from the second

quarter 2014 correction to reclassify certain commercial

facility fees from net interest income to noninterest income.

Net interest margin decreased in the comparison to the prior

year, driven by a 50 basis point decline in the yield on total

interest-earning assets, which included the impact of lower

purchase accounting accretion, continued spread compression,

and repricing of new and existing loans and securities in the

ongoing low rate environment. The decline also included the

impact of the second quarter 2014 correction to reclassify

certain commercial facility fees and the impact of higher

interest-earning deposits maintained with the Federal Reserve

Bank.

We expect net interest income for the first quarter of 2015 to

remain stable with fourth quarter 2014. However, for full year

2015, we expect purchase accounting accretion to be down

approximately $225 million compared to 2014.

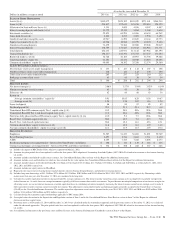

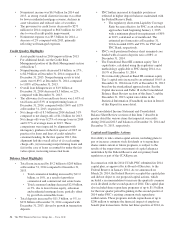

Noninterest Income

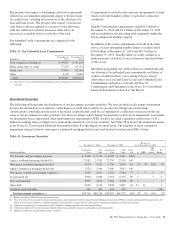

Table 5: Noninterest Income

Year ended December 31 Change

Dollars in millions 2014 2013 $ %

Noninterest income

Asset management $1,513 $1,342 $ 171 13%

Consumer services 1,254 1,253 1 –

Corporate services 1,415 1,210 205 17%

Residential mortgage 618 871 (253) (29)%

Service charges on deposits 662 597 65 11%

Net gains on sales of

securities 4 99 (95) (96)%

Net other-than-temporary

impairments (11) (16) 5 (31)%

Other 1,395 1,509 (114) (8)%

Total noninterest income $6,850 $6,865 $ (15) –

Noninterest income remained relatively stable in 2014

compared to the prior year, as strong overall client fee income

was offset by lower residential mortgage revenue, declines in

asset valuations and reduced sales of securities. Noninterest

income as a percentage of total revenue was 45% for 2014, up

from 43% for 2013.

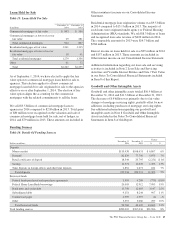

Asset management revenue increased in 2014 compared to

2013, driven by increased earnings from our BlackRock

investment, as well as stronger average equity markets and

positive net flows, after adjustments for cyclical client

activities. Discretionary client assets under management in the

Asset Management Group increased to $135 billion at

December 31, 2014 compared with $127 billion at

December 31, 2013.

Consumer service fees were relatively unchanged in 2014

compared to the prior year, as higher consumer service fees in

Retail Banking were offset by lower revenue from previously

discontinued insurance programs, as well as the termination of

our debit card rewards program in the fourth quarter of 2013,

which resulted in a prior year benefit and consequently diluted

the year-over-year growth comparison.

Corporate service fees increased to $1.4 billion in 2014

compared to $1.2 billion in 2013, driven by higher merger and

acquisition advisory fees from a record year for our mergers

and acquisition advisory firm, Harris Williams, and the impact

of the second quarter 2014 correction to reclassify certain

commercial facility fees from net interest income to

noninterest income. These increases were partially offset by

lower net commercial mortgage servicing rights valuation

gains, which were $38 million in 2014 compared to $68

million in 2013.

The PNC Financial Services Group, Inc. – Form 10-K 37