PNC Bank 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We purchase or originate financial instruments that contain an

embedded derivative. At the inception of the transaction, we

assess if the economic characteristics of the embedded

derivative are clearly and closely related to the economic

characteristics of the host contract, whether the hybrid

financial instrument is measured at fair value with changes in

fair value reported in earnings, and whether a separate

instrument with the same terms as the embedded derivative

would be a derivative. If the embedded derivative does not

meet all of these conditions, the embedded derivative is

recorded separately from the host contract with changes in fair

value recorded in earnings, unless we elect to account for the

hybrid instrument at fair value.

We have elected on an instrument-by-instrument basis, fair

value measurement for certain financial instruments with

embedded derivatives.

We enter into commitments to originate residential and

commercial mortgage loans for sale. We also enter into

commitments to purchase or sell commercial and residential

real estate loans. These commitments are accounted for as

free-standing derivatives which are recorded at fair value in

Other assets or Other liabilities on the Consolidated Balance

Sheet. Any gain or loss from the change in fair value after the

inception of the commitment is recognized in Noninterest

income.

Income Taxes

We account for income taxes under the asset and liability

method. Deferred tax assets and liabilities are determined

based on differences between the financial reporting and tax

bases of assets and liabilities and are measured using the

enacted tax rates and laws that we expect will apply at the

time when we believe the differences will reverse. The

recognition of deferred tax assets requires an assessment to

determine the realization of such assets. Realization refers to

the incremental benefit achieved through the reduction in

future taxes payable or refunds receivable from the deferred

tax assets, assuming that the underlying deductible differences

and carryforwards are the last items to enter into the

determination of future taxable income. We establish a

valuation allowance for tax assets when it is more likely than

not that they will not be realized, based upon all available

positive and negative evidence.

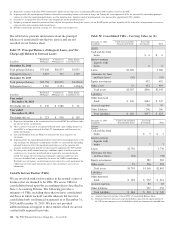

Earnings Per Common Share

Basic earnings per common share is calculated using the two-

class method to determine income attributable to common

shareholders. Unvested share-based payment awards that

contain nonforfeitable rights to dividends or dividend

equivalents are considered participating securities under the

two-class method. Income attributable to common

shareholders is then divided by the weighted-average common

shares outstanding for the period.

Diluted earnings per common share is calculated under the

more dilutive of either the treasury method or the two-class

method. For the diluted calculation, we increase the weighted-

average number of shares of common stock outstanding by the

assumed conversion of outstanding convertible preferred stock

from the beginning of the year or date of issuance, if later, and

the number of shares of common stock that would be issued

assuming the exercise of stock options and warrants and the

issuance of incentive shares using the treasury stock method.

These adjustments to the weighted-average number of shares

of common stock outstanding are made only when such

adjustments will dilute earnings per common share. See Note

16 Earnings Per Share for additional information.

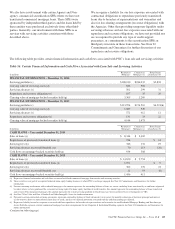

Recently Adopted Accounting Standards

In January 2014, the Financial Accounting Standards Board

(FASB) issued ASU 2014-01, Investments – Equity Method

and Joint Ventures (Topic 323): Accounting for Investments in

Qualified Affordable Housing Projects. This ASU provided

guidance on accounting for investments in flow-through

limited liability entities that manage or invest in affordable

housing projects that qualify for the low income housing tax

credit. If certain criteria are satisfied, investment amortization,

net of tax credits, may be recognized in the income statement

as a component of income taxes attributable to continuing

operations under either the proportional amortization method

or the practical expedient method to the proportional

amortization method. This ASU was effective for annual

periods beginning after December 15, 2014. Retrospective

application was required and early adoption was permitted.

We early adopted this guidance in the first quarter of 2014 for

interim and annual reporting periods because we believe the

presentation more accurately reflects the economics of tax

credit investments. We elected to amortize our qualifying

investments in low income housing tax credits under the

practical expedient method to the proportional amortization

method while continuing to account for our other tax credit

investments under the equity method.

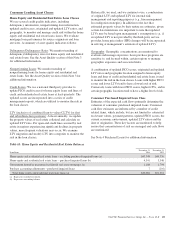

For prior periods, pursuant to ASU 2014-01, (a) amortization

expense related to our qualifying investments in low income

housing tax credits was reclassified from Other noninterest

expense to Income taxes, and (b) additional amortization, net

of the associated tax benefits was recognized in Income taxes

as a result of our adoption of the practical expedient to the

proportional amortization method. The cumulative effect to

retained earnings as of January 1, 2012 of adopting this

guidance was a reduction of $43 million as presented in the

Consolidated Statement of Changes in Equity. The 2012 and

2013 periods within the Consolidated Income Statement have

been updated to reflect the retrospective application.

During 2014, we recognized $181 million of amortization,

$212 million of tax credits, and $66 million of other tax

benefits associated with these investments within Income

taxes. At December 31, 2014, the amount of investments in

The PNC Financial Services Group, Inc. – Form 10-K 123