PNC Bank 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

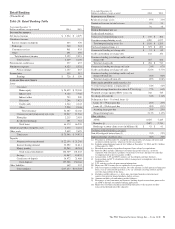

Retail Banking earned $728 million in 2014 compared with

earnings of $550 million in 2013. The increase in earnings

was driven by a lower provision for credit losses, and

increased noninterest income due to strong fee income growth.

These increases in earnings were partially offset by lower net

interest income driven by lower yields on loans, interest rate

spread compression on the value of deposits, and lower

purchase accounting accretion.

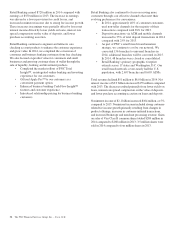

Retail Banking continues to augment and refine its core

checking account products to enhance the customer experience

and grow value. In 2014, we completed the conversion of

consumer and business banking customers from free checking.

We also focused on product value for consumers and small

businesses and growing customer share of wallet through the

sale of liquidity, banking and investment products.

• Completed the market rollout of PNC Total

InsightSM, an integrated online banking and investing

experience for our customers.

• Offered Apple PayTM to our customers as a

convenient payment option.

• Enhanced business banking Cash Flow InsightSM

features and customer experience.

• Introduced relationship pricing for business banking

customers.

Retail Banking also continued to focus on serving more

customers through cost effective channels that meet their

evolving preferences for convenience.

• In 2014, approximately 46% of consumer customers

used non-teller channels for the majority of their

transactions compared with 38% for 2013.

• Deposit transactions via ATM and mobile channels

increased to 35% of total deposit transactions in 2014

compared with 25% for 2013.

• As part of PNC’s retail branch transformation

strategy, we continue to evolve our network. We

converted 156 branches to universal branches in

2014; additional branches will be converted in 2015.

In 2014, 48 branches were closed or consolidated.

• Retail Banking’s primary geographic footprint

extends across 17 states and Washington, D.C. Our

retail branch network covers nearly half the U.S.

population, with 2,697 branches and 8,605 ATMs.

Total revenue declined $51 million to $6.0 billion in 2014. Net

interest income of $3.9 billion decreased $155 million compared

with 2013. The decrease resulted primarily from lower yields on

loans, interest rate spread compression on the value of deposits,

and lower purchase accounting accretion on loans and deposits.

Noninterest income of $2.1 billion increased $104 million, or 5%,

compared to 2013. Noninterest income included strong customer-

related fee income growth primarily resulting from changes in

product offerings, increases in customer-initiated transactions,

and increased brokerage and merchant processing revenue. Gains

on sales of Visa Class B common shares totaled $209 million in

2014 compared to $168 million in 2013; 3.5 million shares were

sold in 2014 compared to four million shares in 2013.

52 The PNC Financial Services Group, Inc. – Form 10-K