PNC Bank 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

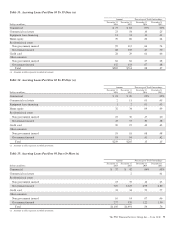

Based upon outstanding balances, and excluding purchased

impaired loans, at December 31, 2014, for home equity lines

of credit for which the borrower can no longer draw (e.g.,

draw period has ended or borrowing privileges have been

terminated), approximately 3% were 30-89 days past due and

approximately 5% were 90 days or more past due. Generally,

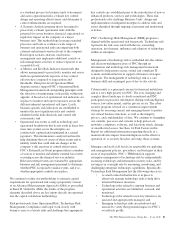

when a borrower becomes 60 days past due, we terminate

borrowing privileges and those privileges are not subsequently

reinstated. At that point, we continue our collection/recovery

processes, which may include loan modification resulting in a

loan that is classified as a TDR.

See Note 3 Asset Quality in the Notes To Consolidated

Financial Statements of this Report for additional information.

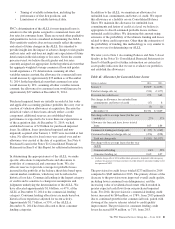

Loan Modifications and Troubled Debt Restructurings

Consumer Loan Modifications

We modify loans under government and PNC-developed

programs based upon our commitment to help eligible

homeowners and borrowers avoid foreclosure, where

appropriate. Initially, a borrower is evaluated for a

modification under a government program. If a borrower does

not qualify under a government program, the borrower is then

evaluated under a PNC program. Our programs utilize both

temporary and permanent modifications and typically reduce

the interest rate, extend the term and/or defer principal. Loans

that are either temporarily or permanently modified under

programs involving a change to loan terms are generally

classified as TDRs. Further, loans that have certain types of

payment plans and trial payment arrangements which do not

include a contractual change to loan terms may be classified

as TDRs. Additional detail on TDRs is discussed below as

well as in Note 3 Asset Quality in the Notes To Consolidated

Financial Statements of this Report.

A temporary modification, with a term between 3 and 24

months, involves a change in original loan terms for a period

of time and reverts to a calculated exit rate for the remaining

term of the loan as of a specific date. A permanent

modification, with a term greater than 24 months, is a

modification in which the terms of the original loan are

changed. Permanent modification programs primarily include

the government-created Home Affordable Modification

Program (HAMP) and PNC-developed HAMP-like

modification programs.

For home equity lines of credit, we will enter into a temporary

modification when the borrower has indicated a temporary

hardship and a willingness to bring current the delinquent loan

balance. Examples of this situation often include delinquency

due to illness or death in the family or loss of employment.

Permanent modifications are entered into when it is confirmed

that the borrower does not possess the income necessary to

continue making loan payments at the current amount, but our

expectation is that the borrower can make payments at a lower

amount.

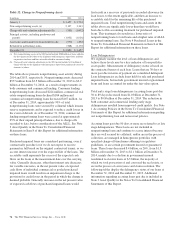

We also monitor the success rates and delinquency status of

our loan modification programs to assess their effectiveness in

serving our customers’ needs while mitigating credit losses.

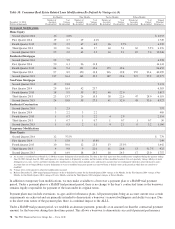

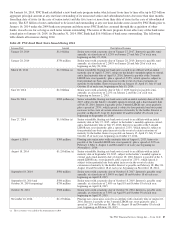

Table 37 provides the number of accounts and unpaid

principal balance of modified consumer real estate related

loans at the end of each year presented and Table 38 provides

the number of accounts and unpaid principal balance of

modified loans that were 60 days or more past due as of six

months, nine months, twelve months and fifteen months after

the modification date.

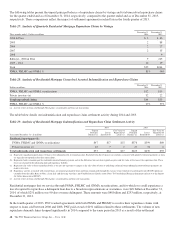

Table 37: Consumer Real Estate Related Loan Modifications

December 31, 2014 December 31, 2013

Dollars in millions

Number of

Accounts

Unpaid

Principal

Balance

Number of

Accounts

Unpaid

Principal

Balance

Home equity

Temporary Modifications 5,346 $ 417 6,683 $ 539

Permanent Modifications 13,128 968 11,717 889

Total home equity 18,474 1,385 18,400 1,428

Residential Mortgages

Permanent Modifications 5,876 1,110 7,397 1,445

Non-Prime Mortgages

Permanent Modifications 4,358 611 4,400 621

Residential Construction

Permanent Modifications 2,292 629 2,260 763

Total Consumer Real Estate Related Loan Modifications 31,000 $3,735 32,457 $4,257

The PNC Financial Services Group, Inc. – Form 10-K 77