PNC Bank 2014 Annual Report Download - page 221

Download and view the complete annual report

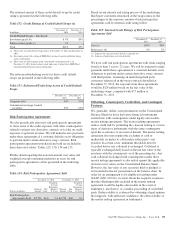

Please find page 221 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The principal source of parent company cash flow is the

dividends it receives from its subsidiary bank, which may be

impacted by the following:

• Capital needs,

• Laws and regulations,

• Corporate policies,

• Contractual restrictions, and

• Other factors.

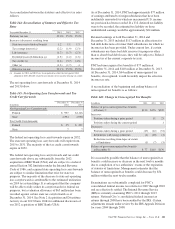

Also, there are statutory and regulatory limitations on the

ability of national banks to pay dividends or make other

capital distributions. The amount available for dividend

payments to the parent company by PNC Bank without prior

regulatory approval was approximately $1.5 billion at

December 31, 2014.

Under federal law, a bank subsidiary generally may not extend

credit to, or engage in other types of covered transactions

(including the purchase of assets) with, the parent company or

its non-bank subsidiaries on terms and under circumstances

that are not substantially the same as comparable transactions

with nonaffiliates. A bank subsidiary may not extend credit to,

or engage in a covered transaction with, the parent company

or a non-bank subsidiary if the aggregate amount of the bank’s

extensions of credit and other covered transactions with the

parent company or non-bank subsidiary exceeds 10% of the

capital stock and surplus of such bank subsidiary or the

aggregate amount of the bank’s extensions of credit and other

covered transactions with the parent company and all non-

bank subsidiaries exceeds 20% of the capital and surplus of

such bank subsidiary. Such extensions of credit, with limited

exceptions, must be at least fully collateralized in accordance

with specified collateralization thresholds, with the thresholds

varying based on the type of assets serving as collateral. In

certain circumstances, federal regulatory authorities may

impose more restrictive limitations.

Federal Reserve Board regulations require depository

institutions to maintain cash reserves with a Federal Reserve

Bank (FRB). At December 31, 2014, the balance outstanding

at the FRB was $31.4 billion.

N

OTE

21 L

EGAL

P

ROCEEDINGS

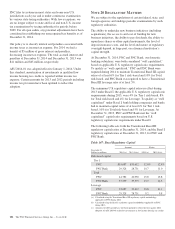

We establish accruals for legal proceedings, including

litigation and regulatory and governmental investigations and

inquiries, when information related to the loss contingencies

represented by those matters indicates both that a loss is

probable and that the amount of loss can be reasonably

estimated. Any such accruals are adjusted thereafter as

appropriate to reflect changed circumstances. When we are

able to do so, we also determine estimates of possible losses

or ranges of possible losses, whether in excess of any related

accrued liability or where there is no accrued liability, for

disclosed legal proceedings (“Disclosed Matters,” which are

those matters disclosed in this Note 21). For Disclosed

Matters where we are able to estimate such possible losses or

ranges of possible losses, as of December 31, 2014, we

estimate that it is reasonably possible that we could incur

losses in an aggregate amount of up to approximately $650

million. The estimates included in this amount are based on

our analysis of currently available information and are subject

to significant judgment and a variety of assumptions and

uncertainties. As new information is obtained we may change

our estimates. Due to the inherent subjectivity of the

assessments and unpredictability of outcomes of legal

proceedings, any amounts accrued or included in this

aggregate amount may not represent the ultimate loss to us

from the legal proceedings in question. Thus, our exposure

and ultimate losses may be higher, and possibly significantly

so, than the amounts accrued or this aggregate amount.

In our experience, legal proceedings are inherently

unpredictable. One or more of the following factors frequently

contribute to this inherent unpredictability: the proceeding is

in its early stages; the damages sought are unspecified,

unsupported or uncertain; it is unclear whether a case brought

as a class action will be allowed to proceed on that basis or, if

permitted to proceed as a class action, how the class will be

defined; the other party is seeking relief other than or in

addition to compensatory damages (including, in the case of

regulatory and governmental investigations and inquiries, the

possibility of fines and penalties); the matter presents

meaningful legal uncertainties, including novel issues of law;

we have not engaged in meaningful settlement discussions;

discovery has not started or is not complete; there are

significant facts in dispute; the possible outcomes may not be

amenable to the use of statistical or quantitative analytical

tools; predicting possible outcomes depends on making

assumptions about future decisions of courts or regulatory

bodies or the behavior of other parties; and there are a large

number of parties named as defendants (including where it is

uncertain how damages or liability, if any, will be shared

among multiple defendants). Generally, the less progress that

has been made in the proceedings or the broader the range of

potential results, the harder it is for us to estimate losses or

ranges of losses that it is reasonably possible we could incur.

The PNC Financial Services Group, Inc. – Form 10-K 203