PNC Bank 2014 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

18 O

THER

C

OMPREHENSIVE

I

NCOME

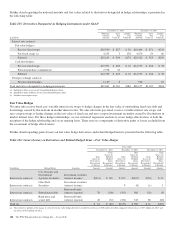

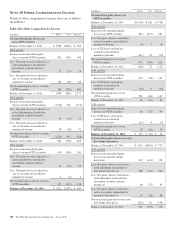

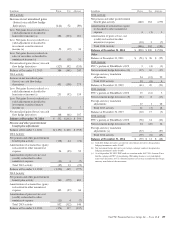

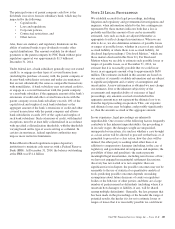

Details of other comprehensive income (loss) are as follows

(in millions):

Table 140: Other Comprehensive Income

In millions Pretax Tax After-tax

Net unrealized gains (losses) on

non-OTTI securities

Balance at December 31, 2011 $ 1,098 $(402) $ 696

2012 activity

Increase in net unrealized gains

(losses) on non-OTTI securities 931 (341) 590

Less: Net gains (losses) realized as a

yield adjustment reclassified to

investment securities interest

income 37 (13) 24

Less: Net gains (losses) realized on

sale of securities reclassified to

noninterest income 134 (49) 85

Net unrealized gains (losses) on non-

OTTI securities 760 (279) 481

Balance at December 31, 2012 1,858 (681) 1,177

2013 activity

Increase in net unrealized gains

(losses) on non-OTTI securities (1,122) 411 (711)

Less: Net gains (losses) realized as a

yield adjustment reclassified to

investment securities interest

income 39 (14) 25

Less: Net gains (losses) realized on

sale of securities reclassified to

noninterest income 50 (18) 32

Net unrealized gains (losses) on non-

OTTI securities (1,211) 443 (768)

Balance at December 31, 2013 647 (238) 409

2014 activity

Increase in net unrealized gains

(losses) on non-OTTI securities 410 (150) 260

Less: Net gains (losses) realized as a

yield adjustment reclassified to

investment securities interest

income 31 (11) 20

Less: Net gains (losses) realized on

sale of securities reclassified to

noninterest income 4 (2) 2

Net unrealized gains (losses) on non-

OTTI securities 375 (137) 238

Balance at December 31, 2014 $ 1,022 $(375) $ 647

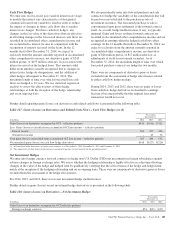

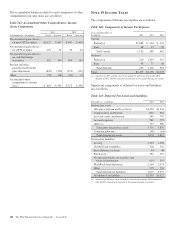

In millions Pretax Tax After-tax

Net unrealized gains (losses) on

OTTI securities

Balance at December 31, 2011 $(1,166) $ 428 $ (738)

2012 activity

Increase in net unrealized gains

(losses) on OTTI securities 854 (313) 541

Less: Net gains (losses) realized on

sales of securities reclassified to

noninterest income (6) 2 (4)

Less: OTTI losses realized on

securities reclassified to

noninterest income (111) 41 (70)

Net unrealized gains (losses) on

OTTI securities 971 (356) 615

Balance at December 31, 2012 (195) 72 (123)

2013 activity

Increase in net unrealized gains

(losses) on OTTI securities 215 (78) 137

Less: OTTI losses realized on

securities reclassified to

noninterest income (16) 6 (10)

Net unrealized gains (losses) on

OTTI securities 231 (84) 147

Balance at December 31, 2013 36 (12) 24

2014 activity

Increase in net unrealized gains

(losses) on OTTI securities 68 (25) 43

Less: OTTI losses realized on

securities reclassified to

noninterest income (11) 4 (7)

Net unrealized gains (losses) on

OTTI securities 79 (29) 50

Balance at December 31, 2014 $ 115 $ (41) $ 74

Net unrealized gains (losses) on cash

flow hedge derivatives

Balance at December 31, 2011 $ 1,131 $(414) $ 717

2012 activity

Increase in net unrealized gains

(losses) on cash flow hedge

derivatives 312 (114) 198

Less: Net gains (losses) realized as a

yield adjustment reclassified to

loan interest income (a) 388 (142) 246

Less: Net gains (losses) realized as a

yield adjustment reclassified to

investment securities interest

income (a) 68 (25) 43

Less: Net gains (losses) realized on

sales of securities reclassified to

noninterest income (a) 76 (28) 48

Net unrealized gains (losses) on cash

flow hedge derivatives (220) 81 (139)

Balance at December 31, 2012 911 (333) 578

198 The PNC Financial Services Group, Inc. – Form 10-K