PNC Bank 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

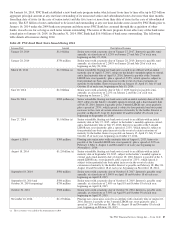

Visa

During 2014, we sold 3.5 million Visa Class B common shares,

in addition to the 13 million shares sold in the previous two

years. We have entered into swap agreements with the purchaser

of the shares as part of these sales. See Note 7 Fair Value in the

Notes To Consolidated Financial Statements in Item 8 of this

Report for additional information. At December 31, 2014, our

investment in Visa Class B common shares totaled

approximately 7 million shares and had a carrying value of $77

million. Based on the December 31, 2014 closing price of

$262.20 for the Visa Class A common shares, the fair value of

our total investment was approximately $742 million at the

current conversion rate, which reflects adjustments in respect of

all litigation funding by Visa to date. The Visa Class B common

shares that we own are transferable only under limited

circumstances (including those applicable to the sales in 2014

and the previous two years) until they can be converted into

shares of the publicly traded class of stock, which cannot happen

until the settlement of all of the specified litigation.

Note 21 Legal Proceedings and Note 22 Commitments and

Guarantees in the Notes To Consolidated Financial Statements

in Item 8 of this Report have additional information regarding

the October 2007 Visa restructuring, our involvement with

judgment and loss sharing agreements with Visa and certain

other banks, and the status of pending interchange litigation.

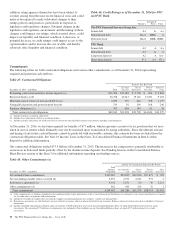

Other Investments

We also make investments in affiliated and non-affiliated

funds with both traditional and alternative investment

strategies. The economic values could be driven by either the

fixed-income market or the equity markets, or both. At

December 31, 2014, other investments totaled $155 million

compared with $234 million at December 31, 2013. We

recognized net gains related to these investments of $19

million during 2014, compared with $39 million during 2013.

Given the nature of these investments, if market conditions

affecting their valuation were to worsen, we could incur future

losses.

Our unfunded commitments related to other investments were

immaterial at both December 31, 2014 and December 31, 2013.

See the Supervision and Regulation section of Item 1 Business

and Item 1A Risk Factors of this Report for additional

information on the potential impact of the Volcker Rule on

PNC’s investments in and relationships with private funds that

are covered by that rule, as well as PNC’s ability to maximize

the value of its investments in such funds.

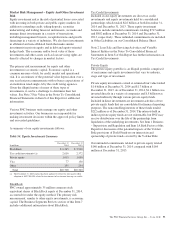

Impact of Inflation

Our assets and liabilities are primarily financial in nature and

typically have varying maturity dates. Accordingly, future

changes in prices do not affect the obligations to pay or

receive fixed and determinable amounts of money. However,

during periods of inflation, there may be a subsequent impact

affecting certain fixed costs or expenses, an erosion of

consumer and customer purchasing power, and fluctuations in

the need or demand for our products and services. Should

significant levels of inflation occur, our business could

potentially be impacted by, among other things, reducing our

tolerance for extending credit or causing us to incur additional

credit losses resulting from possible increased default rates.

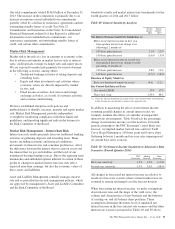

Financial Derivatives

We use a variety of financial derivatives as part of the overall

asset and liability risk management process to help manage

exposure to market and credit risk inherent in our business

activities. Substantially all such instruments are used to

manage risk related to changes in interest rates. Interest rate

and total return swaps, interest rate caps and floors, swaptions,

options, forwards and futures contracts are the primary

instruments we use for interest rate risk management. We also

enter into derivatives with customers to facilitate their risk

management activities.

Financial derivatives involve, to varying degrees, market and

credit risk. For interest rate swaps and total return swaps,

options and futures contracts, only periodic cash payments

and, with respect to options, premiums are exchanged.

Therefore, cash requirements and exposure to credit risk are

significantly less than the notional amount on these

instruments.

Further information on our financial derivatives is presented

in Note 1 Accounting Policies, Note 7 Fair Value and Note 15

Financial Derivatives in the Notes To Consolidated Financial

Statements in Item 8 of this Report, which is incorporated here

by reference.

Not all elements of market and credit risk are addressed

through the use of financial derivatives, and such instruments

may be ineffective for their intended purposes due to

unanticipated market changes, among other reasons.

94 The PNC Financial Services Group, Inc. – Form 10-K