PNC Bank 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

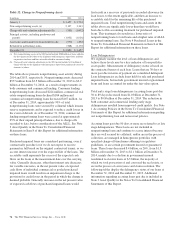

the accounting for repurchase-to-maturity transactions and

linked repurchase financings to secured borrowing accounting,

which is consistent with the accounting for other repurchase

agreements. The ASU also requires separate accounting for a

transfer of a financial asset executed contemporaneously with

a repurchase agreement with the same counterparty (i.e.,a

repurchase financing), which will result in secured borrowing

treatment for the repurchase agreement. We adopted this

guidance as of January 1, 2015. Adoption of this ASU did not

have a material effect on our results of operations or financial

position.

In August 2014, the FASB issued ASU 2014-14, Receivables

– Troubled Debt Restructurings by Creditors (Subtopic 310-

40): Classification of Certain Government-Guaranteed

Mortgage Loans upon Foreclosure (a consensus of the FASB

Emerging Issues Task Force). This ASU requires that a

mortgage loan be derecognized and that a separate other

receivable be recognized upon foreclosure when a) the loan

has a government guarantee that is not separable from the loan

before foreclosure; b) the creditor has the intent to convey the

real estate to the guarantor and make a claim on the guarantee

and the creditor has the ability to recover under that claim at

the time of foreclosure; and c) any amount of the claim that is

determined upon the basis of the real estate is fixed at the time

of foreclosure. The receivable should be measured based on

the loan balance (inclusive of principal and interest) that is

expected to be recovered from the guarantor. This ASU is

effective for annual periods, and interim periods within those

annual periods, beginning after December 15, 2014. The ASU

may be adopted using either a prospective or modified

retrospective transition method consistent with the method

elected to adopt ASU 2014-04, Receivables – Troubled Debt

Restructurings by Creditors (Subtopic 310-40):

Reclassification of Residential Real Estate Collateralized

Consumer Mortgage Loans upon Foreclosure. We adopted

this guidance as of January 1, 2015. Adoption of this ASU did

not have a material effect on our results of operations or

financial position.

In November 2014, the FASB issued ASU 2014-16,

Derivatives and Hedging (Topic 815): Determining Whether

the Host Contract in a Hybrid Financial Instrument Issued in

the Form of a Share is More Akin to Debt or to Equity (a

consensus of the FASB Emerging Issues Task Force). This

ASU clarifies that an entity should consider all relevant terms

and features, inclusive of the embedded derivative feature

being evaluated for bifurcation, when evaluating whether the

nature of the host contract in a hybrid financial instrument

issued in the form of a share, is debt-like or equity-like. When

making this determination, the ASU also clarifies that the

substance of the economic characteristics of the relevant terms

and features, and circumstances under which the instrument

was issued should be considered. The ASU is effective for

annual periods, and interim periods within those annual

periods, beginning after December 15, 2015 and should be

applied on a modified retrospective basis to existing hybrid

financial instruments issued in the form of a share as of the

beginning of the period of adoption. Retrospective application

is permitted to all relevant prior periods. We are currently

evaluating the impact of this ASU on our results of operations

and financial position.

Recently Adopted Accounting Pronouncements

See Note 1 Accounting Policies in the Notes To the

Consolidated Financial Statements in Item 8 of this Report

regarding the impact of new accounting pronouncements

which we have adopted.

S

TATUS OF

Q

UALIFIED

D

EFINED

B

ENEFIT

P

ENSION

P

LAN

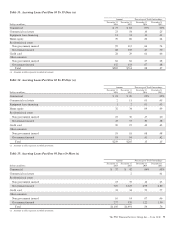

We have a noncontributory, qualified defined benefit pension

plan (plan or pension plan) covering eligible employees.

Benefits are determined using a cash balance formula where

earnings credits are applied as a percentage of eligible

compensation. Pension contributions are based on an

actuarially determined amount necessary to fund total benefits

payable to plan participants. Consistent with our investment

strategy, plan assets are primarily invested in equity

investments and fixed income instruments. Plan fiduciaries

determine and review the plan’s investment policy, which is

described more fully in Note 13 Employee Benefit Plans in

the Notes To Consolidated Financial Statements in Item 8 of

this Report.

We calculate the expense associated with the pension plan and

the assumptions and methods that we use include a policy of

reflecting plan assets at their fair market value. On an annual

basis, we review the actuarial assumptions related to the

pension plan. The primary assumptions used to measure

pension obligations and costs are the discount rate, mortality,

compensation increase and expected long-term return on plan

assets. Among these, the compensation increase assumption

does not significantly affect pension expense.

ASC 715-30 and ASC 715-60 stipulate that each individual

assumption, including mortality, should reflect the plan

sponsor’s best estimate. PNC has historically utilized a

version of the Society of Actuaries’ (SOA) published

mortality tables in developing its best estimate of mortality.

On October 27, 2014, the SOA published a new study on

mortality rates that included updated mortality tables and

mortality improvement scale, which both reflect longer life

expectancy. Based on an evaluation of the mortality

experience of PNC’s qualified pension plan participants in

conjunction with the updated SOA mortality study, PNC

adopted an adjusted version of the SOA’s new mortality table

and improvement scale for purposes of measuring the plan’s

benefit obligations at December 31, 2014. This change to the

mortality assumption increased the qualified pension plan’s

benefit obligations by approximately $115 million at

December 31, 2014.

The PNC Financial Services Group, Inc. – Form 10-K 65