PNC Bank 2014 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

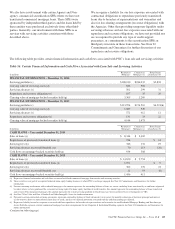

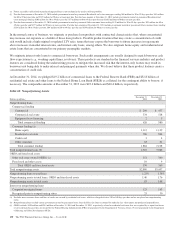

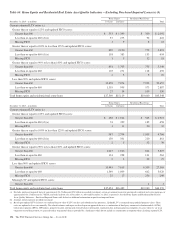

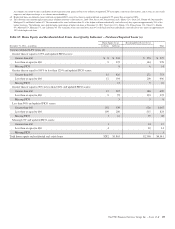

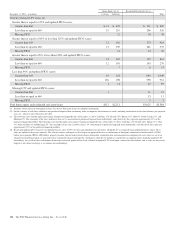

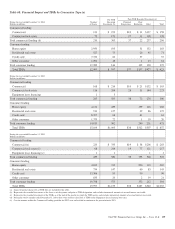

Table 64: Home Equity and Residential Real Estate Asset Quality Indicators – Excluding Purchased Impaired Loans (a) (b)

Home Equity Residential Real Estate

TotalDecember 31, 2014 – in millions 1st Liens 2nd Liens

Current estimated LTV ratios (c)

Greater than or equal to 125% and updated FICO scores:

Greater than 660 $ 333 $ 1,399 $ 360 $ 2,092

Less than or equal to 660 (d) (e) 57 273 92 422

Missing FICO 1 9 8 18

Greater than or equal to 100% to less than 125% and updated FICO scores:

Greater than 660 839 2,190 772 3,801

Less than or equal to 660 (d) (e) 118 383 153 654

Missing FICO 1 5 12 18

Greater than or equal to 90% to less than 100% and updated FICO scores:

Greater than 660 891 1,703 755 3,349

Less than or equal to 660 103 271 118 492

Missing FICO 2 3 5 10

Less than 90% and updated FICO scores:

Greater than 660 13,878 7,874 7,703 29,455

Less than or equal to 660 1,319 995 573 2,887

Missing FICO 27 14 109 150

Total home equity and residential real estate loans $17,569 $15,119 $10,660 $43,348

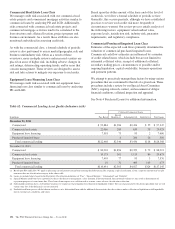

Home Equity Residential Real Estate

TotalDecember 31, 2013 – in millions 1st Liens 2nd Liens

Current estimated LTV ratios (c)

Greater than or equal to 125% and updated FICO scores:

Greater than 660 $ 438 $ 1,914 $ 563 $ 2,915

Less than or equal to 660 (d) (e) 74 399 185 658

Missing FICO 1 11 20 32

Greater than or equal to 100% to less than 125% and updated FICO scores:

Greater than 660 987 2,794 1,005 4,786

Less than or equal to 660 (d) (e) 150 501 210 861

Missing FICO 2 5 32 39

Greater than or equal to 90% to less than 100% and updated FICO scores:

Greater than 660 1,047 1,916 844 3,807

Less than or equal to 660 134 298 131 563

Missing FICO 2 3 22 27

Less than 90% and updated FICO scores:

Greater than 660 13,445 7,615 6,309 27,369

Less than or equal to 660 1,349 1,009 662 3,020

Missing FICO 25 17 256 298

Missing LTV and updated FICO scores:

Greater than 660 11

Total home equity and residential real estate loans $17,654 $16,482 $10,240 $44,376

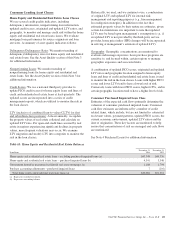

(a) Excludes purchased impaired loans of approximately $4.5 billion and $5.4 billion in recorded investment, certain government insured or guaranteed residential real estate mortgages of

approximately $1.2 billion and $1.7 billion, and loans held for sale at December 31, 2014 and December 31, 2013, respectively. See the Home Equity and Residential Real Estate

Asset Quality Indicators – Purchased Impaired Loans table below for additional information on purchased impaired loans.

(b) Amounts shown represent recorded investment.

(c) Based upon updated LTV (inclusive of combined loan-to-value (CLTV) for first and subordinate lien positions). Updated LTV is estimated using modeled property values. These

ratios are updated at least semi-annually. The related estimates and inputs are based upon an approach that uses a combination of third-party automated valuation models (AVMs),

broker price opinions (BPOs), HPI indices, property location, internal and external balance information, origination data and management assumptions. In cases where we are in an

originated second lien position, we generally utilize origination balances provided by a third-party which do not include an amortization assumption when calculating updated LTV.

134 The PNC Financial Services Group, Inc. – Form 10-K