PNC Bank 2014 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

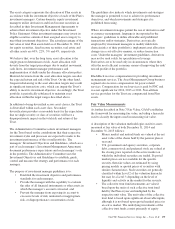

securities, debt obligations, short-term investments,

and other marketable securities. Due to the nature of

these securities, there are no unfunded commitments

or redemption restrictions.

• Limited partnerships are valued by investment

managers based on recent financial information used

to estimate fair value. Other investments held by the

pension plan include derivative financial instruments

and real estate, which are recorded at estimated fair

value as determined by third-party appraisals and

pricing models, and group annuity contracts, which

are measured at fair value by discounting the related

cash flows based on current yields of similar

instruments with comparable durations considering

the credit-worthiness of the issuer.

These methods may result in fair value calculations that may

not be indicative of net realizable values or future fair values.

Furthermore, while the pension plan believes its valuation

methods are appropriate and consistent with other market

participants, the use of different methodologies or

assumptions to determine the fair value of certain financial

instruments could result in a different fair value measurement

at the reporting date.

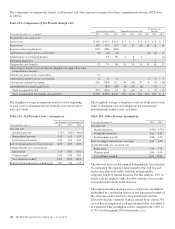

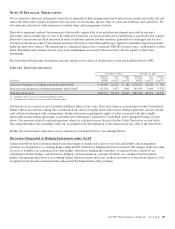

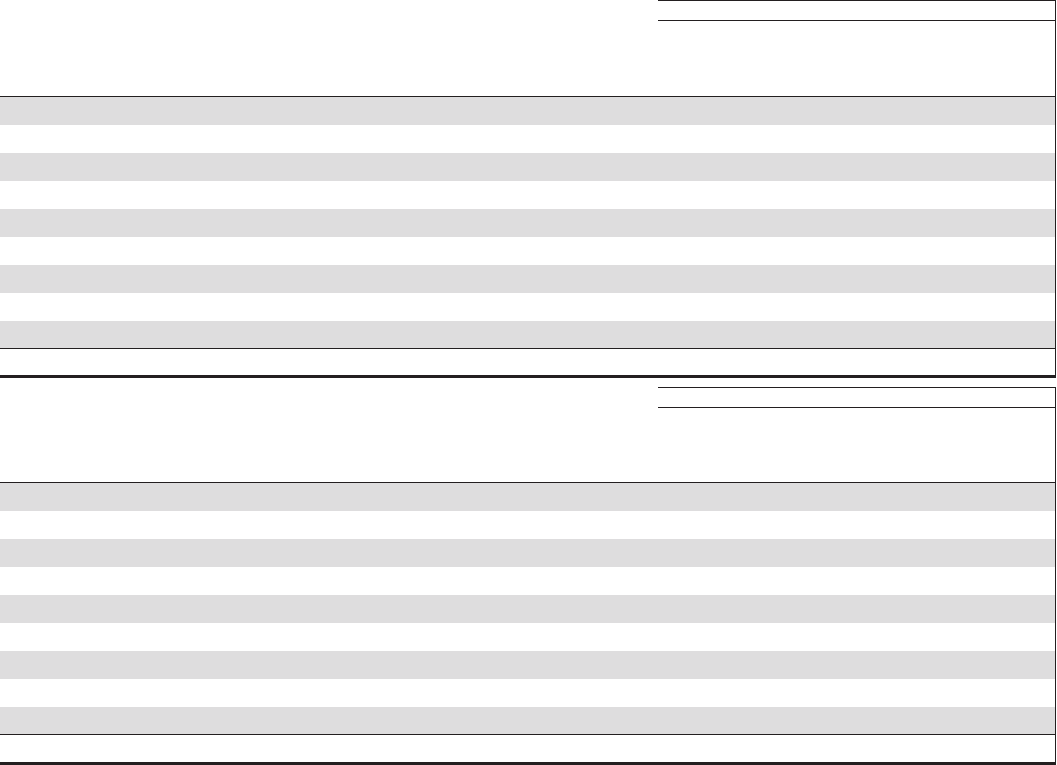

The following table sets forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2014 and

2013.

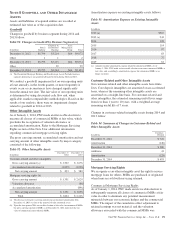

Table 111: Pension Plan Assets – Fair Value Hierarchy

Fair Value Measurements Using:

In millions

December 31

2014

Fair Value

Quoted Prices in

Active Markets

For Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Money market funds $ 121 $ 121

U.S. government and agency securities 294 147 $ 147

Corporate debt (a) 648 638 $ 10

Common stock 1,041 1,040 1

Preferred stock 66

Mutual funds 220 2 218

Interest in Collective Funds (b) 1,698 1,589 109

Limited partnerships 274 2 272

Other 55 (4) 59

Total $4,357 $1,306 $2,660 $391

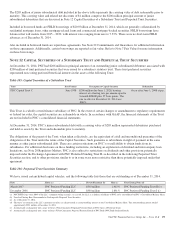

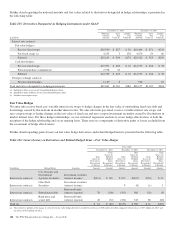

Fair Value Measurements Using:

In millions

December 31

2013

Fair Value

Quoted Prices in

Active Markets

For Identical

Assets (Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Money market funds $ 130 $ 130

U.S. government and agency securities 316 192 $ 124

Corporate debt (a) 751 738 $ 13

Common stock 1,055 1,053 2

Preferred Stock 15 15

Mutual funds 199 4 195

Interest in Collective Funds (c) 1,572 1,474 98

Limited partnerships 184 2 182

Other 30 30

Total $4,252 $1,379 $2,580 $293

(a) Corporate debt includes $63 million and $84 million of non-agency mortgage-backed securities as of December 31, 2014 and 2013, respectively.

(b) The benefit plans own commingled funds that invest in equity securities. The funds seek to mirror the benchmark of the S&P 500 Index, Morgan Stanley Capital International ACWI

X US Index, Morgan Stanley Capital EAFE Index, Morgan Stanley Capital Emerging Markets Index and the NCREIF ODCE NOF Index with the exception of the BlackRock Index

Fund.

(c) The benefit plans own commingled funds that invest in equity and fixed income securities. The funds seek to mirror the performance of the S&P 500 Index, Russell 3000 Index,

Morgan Stanley Capital International ACWI X US Index and the Dow Jones U.S. Select Real Estate Securities Index. The commingled fund that holds fixed income securities invests

in domestic investment grade securities and seeks to mimic the performance of the Barclays Aggregate Bond Index.

180 The PNC Financial Services Group, Inc. – Form 10-K