PNC Bank 2014 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

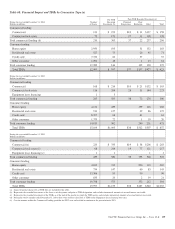

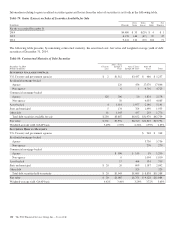

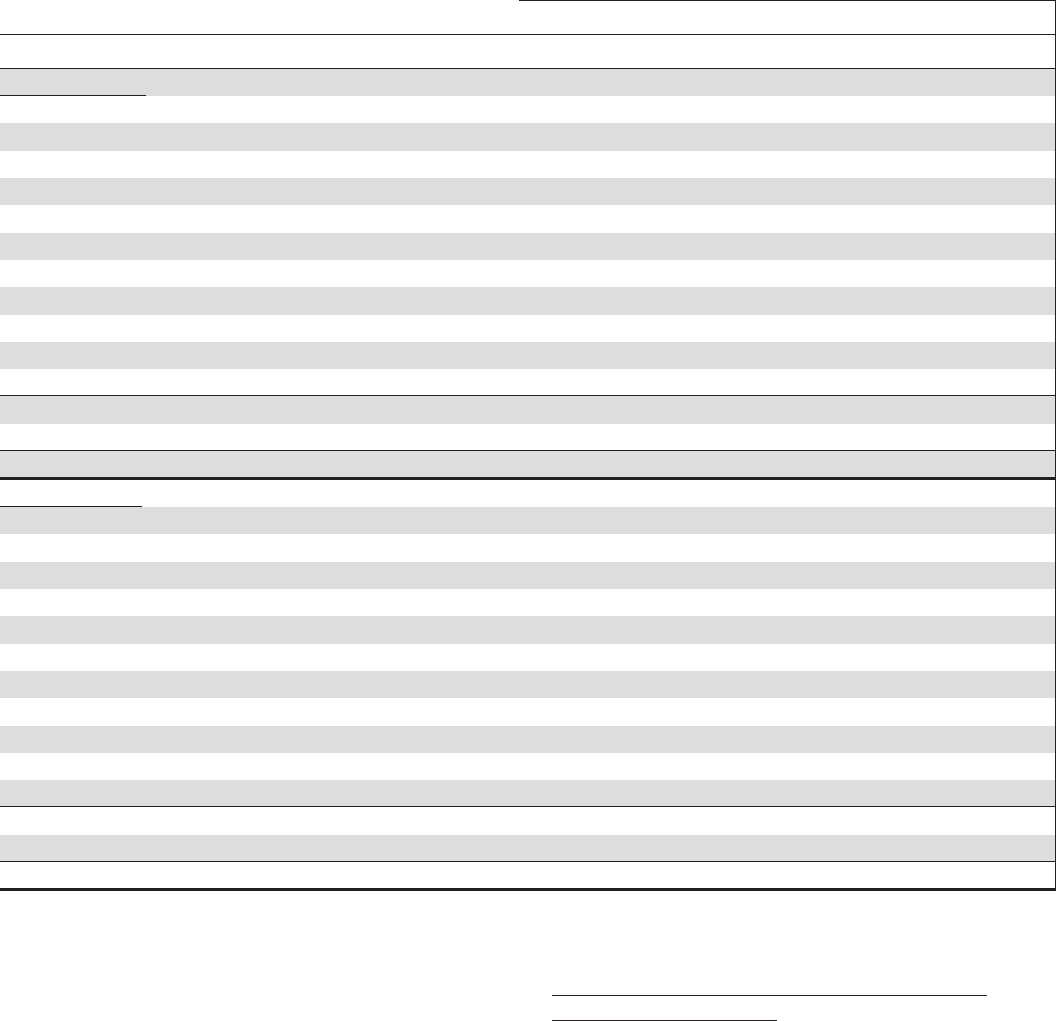

Table 76: Gross Unrealized Loss and Fair Value of Securities Available for Sale

In millions

Unrealized loss position

less than 12 months

Unrealized loss position

12 months or more Total

Unrealized

Loss

Fair

Value

Unrealized

Loss

Fair

Value

Unrealized

Loss

Fair

Value

December 31, 2014

Debt securities

U.S. Treasury and government agencies $ (1) $ 1,426 $ (1) $ 1,426

Residential mortgage-backed

Agency (4) 644 $ (37) $1,963 (41) 2,607

Non-agency (5) 276 (94) 1,487 (99) 1,763

Commercial mortgage-backed

Agency (2) 681 (12) 322 (14) 1,003

Non-agency (4) 928 (7) 335 (11) 1,263

Asset-backed (4) 913 (28) 1,133 (32) 2,046

State and municipal (a) 41 (3) 77 (3) 118

Other debt (2) 314 (4) 186 (6) 500

Total debt securities (22) 5,223 (185) 5,503 (207) 10,726

Corporate stocks and other (1) 15 (1) 15

Total $ (22) $ 5,223 $(186) $5,518 $(208) $10,741

December 31, 2013

Debt securities

U.S. Treasury and government agencies $ (7) $ 1,066 $ (7) $ 1,066

Residential mortgage-backed

Agency (b) (198) 7,519 $ (11) $ 287 (209) 7,806

Non-agency (18) 855 (142) 1,719 (160) 2,574

Commercial mortgage-backed

Agency (b) (13) 454 (1) 6 (14) 460

Non-agency (18) 1,315 (a) 14 (18) 1,329

Asset-backed (11) 1,752 (37) 202 (48) 1,954

State and municipal (23) 897 (21) 286 (44) 1,183

Other debt (17) 844 (1) 12 (18) 856

Total debt securities (305) 14,702 (213) 2,526 (518) 17,228

Corporate stocks and other (1) 15 (1) 15

Total $(306) $14,717 $(213) $2,526 $(519) $17,243

(a) The unrealized loss on these securities was less than $.5 million.

(b) These line items were corrected for the prior period due to a misclassification of Government National Mortgage Association (GNMA) securities collateralized by project loans. $1.1

billion was previously reported as residential mortgage-backed agency securities and was reclassified to commercial mortgage-backed agency securities.

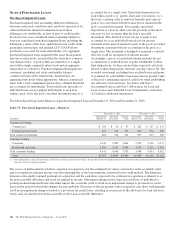

The gross unrealized loss on debt securities held to maturity

was $22 million at December 31, 2014 and $98 million at

December 31, 2013. The majority of the gross unrealized loss

at December 31, 2014 related to agency residential mortgage-

backed securities. The fair value of debt securities held to

maturity that were in a continuous loss position for less than

12 months was $134 million and $3.6 billion at December 31,

2014 and December 31, 2013, respectively, and for positions

that were in a continuous loss position for 12 months or more

was $1.6 billion and $48 million at December 31, 2014 and

December 31, 2013, respectively. For securities transferred to

held to maturity from available for sale, the unrealized loss for

purposes of this analysis is determined by comparing the

security’s original amortized cost to its current estimated fair

value.

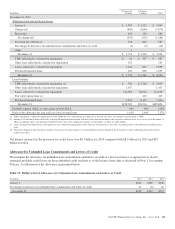

Evaluating Investment Securities for Other-than-

Temporary Impairments

For the securities in the preceding Table 76, as of

December 31, 2014 we do not intend to sell and believe we

will not be required to sell the securities prior to recovery of

the amortized cost basis.

At least quarterly, we conduct a comprehensive security-level

assessment on all securities. For those securities in an

unrealized loss position we determine if OTTI exists. An

unrealized loss exists when the current fair value of an

individual security is less than its amortized cost basis. An

OTTI loss must be recognized for a debt security in an

unrealized loss position if we intend to sell the security or it is

more likely than not we will be required to sell the security

148 The PNC Financial Services Group, Inc. – Form 10-K