PNC Bank 2014 Annual Report Download - page 172

Download and view the complete annual report

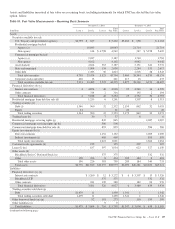

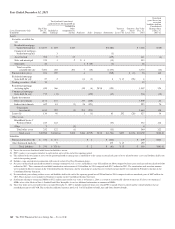

Please find page 172 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The fair values of risk participation agreement assets and

liabilities as of December 31, 2014 and 2013 are included in

the Insignificant Level 3 assets, net of liabilities line item in

Table 85 in this Note 7. The significant unobservable inputs

used in the fair value measurement of risk participation

agreements are probability of default and loss severity.

Significant increases (decreases) in probability of default and

loss severity would result in a significantly higher (lower) fair

value measurement.

In connection with the sales of portions of our Visa Class B

common shares, we entered into swap agreements with the

purchaser of the shares to account for any future risk of

converting Class B common shares to Class A common shares

and to account for the corresponding change in value to the

Class B shares. These adjustments result from resolution of

the specified litigation or the changes in the amount in the

litigation escrow account funded by Visa as well as from

changes in the estimated litigation resolution date (see Note 21

Legal Proceedings and Note 22 Commitments and Guarantees

for additional information). These swaps also require

payments calculated by reference to the market price of the

Class A common shares and a fixed rate of interest. The swaps

are classified as Level 3 instruments and the fair values of the

liability positions totaled $135 million at December 31, 2014

and $90 million at December 31, 2013, respectively. The fair

values of the swap agreements are determined using a

discounted cash flow methodology. The significant

unobservable inputs to the valuations are estimated changes in

the conversion rate of the Class B common shares into

Class A common shares and the estimated growth rate of the

Class A share price. A decrease in the conversion rate will

have a negative impact on the fair value of the swaps and vice

versa. Independent of changes in the conversion rate, an

increase in the estimated growth rate of the Class A share

price will have a negative impact on the fair value of the

swaps and vice versa, through its impact on periodic payments

due to the counterparty until the maturity dates of the swaps.

The fair values of our derivatives include a credit valuation

adjustment (CVA) to reflect our own and our counterparties’

nonperformance risk. Our CVA is computed using new loan

pricing and considers externally available bond spreads, in

conjunction with internal historical recovery observations.

Residential Mortgage Loans Held for Sale

We account for certain residential mortgage loans originated

for sale at fair value on a recurring basis. The election of the

fair value option aligns the accounting for the residential

mortgages with the related hedges. Additionally, we have

elected to account for loans repurchased due to breaches of

representations and warranties at fair value.

Residential mortgage loans are valued based on quoted market

prices, where available, prices for other traded mortgage loans

with similar characteristics, and purchase commitments and

bid information received from market participants. The prices

are adjusted as necessary to include the embedded servicing

value in the loans and to take into consideration the specific

characteristics of certain loans that are priced based on the

pricing of similar loans. These adjustments represent

unobservable inputs to the valuation but are not considered

significant given the relative insensitivity of the value to

changes in these inputs to the fair value of the loans.

Accordingly, the majority of residential mortgage loans held

for sale are classified as Level 2. This category also includes

repurchased and temporarily unsalable residential mortgage

loans. These loans are repurchased due to a breach of

representations and warranties in the loan sales agreement and

typically occur after the loan is in default. The temporarily

unsalable loans have an origination defect that makes them

currently unable to be sold into the performing loan sales

market. Because transaction details regarding sales of this type

of loan are often unavailable, unobservable bid information

from brokers and investors is heavily relied upon.

Accordingly, based on the significance of unobservable

inputs, these loans are classified as Level 3.

Trading Loans

We have elected to account for certain trading loans at fair

value. The fair value for trading loans is based on pricing from

average bid broker quotes received from a loan pricing

service, sale commitments, or a model based on indications

received in marketing the credit or on the loan’s

characteristics in comparison to market data on similar loans.

These instruments are primarily classified as Level 2.

Commercial Mortgage Servicing Rights

As of January 1, 2014, PNC made an irrevocable election to

subsequently measure all classes of commercial mortgage

servicing rights (MSRs) at fair value in order to eliminate any

potential measurement mismatch between our economic

hedges and the commercial MSRs. We recognize recurring

gains/(losses) on changes in the fair value of commercial

MSRs as a result of the election. Assumptions incorporated

into the commercial valuation model reflect management’s

best estimate of factors that a market participant would use in

valuing the commercial MSRs. Although sales of commercial

MSRs do occur, commercial MSRs do not trade in an active,

open market with readily observable prices so the precise

terms and conditions of sales are not available. Due to the

nature of the valuation inputs and the limited availability of

market pricing, commercial MSRs are classified as Level 3.

The fair value of commercial MSRs is estimated by using a

discounted cash flow model incorporating unobservable inputs

for assumptions such as constant prepayment rates, discount

rates and other factors. Significant increases/(decreases) in

constant prepayment rates and discount rates would result in

significantly lower/(higher) commercial MSR value

determined based on current market conditions and

expectations.

154 The PNC Financial Services Group, Inc. – Form 10-K