PNC Bank 2014 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2014 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Stated note rates,

• Estimated prepayment speeds, and

• Estimated servicing costs.

As of January 1, 2014, PNC made an irrevocable election to

subsequently measure all classes of commercial MSRs at fair

value in order to eliminate any potential measurement

mismatch between our economic hedges and the commercial

MSRs. The impact was not material. As a result of that

election, changes in the fair value of commercial MSRs are

recognized as gains/(losses).

Prior to January 1, 2014, we elected to utilize the amortization

method for subsequent measurement of our commercial

mortgage loan servicing rights. This election was made based

on the unique characteristics of the commercial mortgage

loans underlying these servicing rights. Specific risk

characteristics of commercial mortgages include loan type,

currency or exchange rate, interest rates, expected cash flows

and changes in the cost of servicing. We record these

servicing assets as Other intangible assets and amortized them

over their estimated lives based on estimated net servicing

income. On a quarterly basis, we tested the assets for

impairment by categorizing the pools of assets underlying the

servicing rights into various strata. If the estimated fair value

of the assets was less than the carrying value, an impairment

loss was recognized and a valuation reserve was established.

For servicing rights related to residential real estate loans, we

apply the fair value method. This election was made to be

consistent with our risk management strategy to hedge

changes in the fair value of these assets. We manage this risk

by hedging the fair value of this asset with derivatives and

securities which are expected to increase in value when the

value of the servicing right declines. The fair value of these

servicing rights is estimated by using a cash flow valuation

model which calculates the present value of estimated future

net servicing cash flows, taking into consideration actual and

expected mortgage loan prepayment rates, discount rates,

servicing costs, and other economic factors which are

determined based on current market conditions.

Revenue from the various loan servicing contracts for

commercial, residential and other consumer loans is reported

on the Consolidated Income Statement in line items Corporate

services, Residential mortgage and Consumer services.

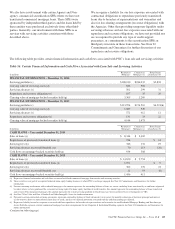

Fair Value Of Financial Instruments

The fair value of financial instruments and the methods and

assumptions used in estimating fair value amounts and

financial assets and liabilities for which fair value was elected

are detailed in Note 9 Fair Value.

Goodwill And Other Intangible Assets

We assess goodwill for impairment at least annually, in the

fourth quarter, or when events or changes in circumstances

indicate the assets might be impaired. Finite-lived intangible

assets are amortized to expense using accelerated or straight-

line methods over their respective estimated useful lives. We

review finite-lived intangible assets for impairment when

events or changes in circumstances indicate that the asset’s

carrying amount may not be recoverable from undiscounted

future cash flows or that it may exceed its fair value.

Depreciation And Amortization

For financial reporting purposes, we depreciate premises and

equipment, net of salvage value, principally using the straight-

line method over their estimated useful lives.

We use estimated useful lives for furniture and equipment

ranging from one to 10 years, and depreciate buildings over an

estimated useful life of up to 40 years. We amortize leasehold

improvements over their estimated useful lives of up to 15

years or the respective lease terms, whichever is shorter.

We purchase, as well as internally develop and customize,

certain software to enhance or perform internal business

functions. Software development costs incurred in the

planning and post-development project stages are charged to

Noninterest expense. Costs associated with designing software

configuration and interfaces, installation, coding programs and

testing systems are capitalized and amortized using the

straight-line method over periods ranging from one to 10

years.

Repurchase And Resale Agreements

Repurchase and resale agreements are treated as collateralized

financing transactions and are carried at the amounts at which

the securities will be subsequently reacquired or resold,

including accrued interest, as specified in the respective

agreements. Our policy is to take possession of securities

purchased under agreements to resell. We monitor the market

value of securities to be repurchased and resold and additional

collateral may be obtained where considered appropriate to

protect against credit exposure. We have elected to account

for structured resale agreements at fair value.

Other Comprehensive Income

Other comprehensive income consists, on an after-tax basis,

primarily of unrealized gains or losses, excluding OTTI

attributable to credit deterioration, on investment securities

classified as available for sale, unrealized gains or losses on

derivatives designated as cash flow hedges, and changes in

pension and other postretirement benefit plan liability

adjustments. Details of each component are included in Note

18 Other Comprehensive Income.

Treasury Stock

We record common stock purchased for treasury at cost. At

the date of subsequent reissue, the treasury stock account is

reduced by the cost of such stock on the first-in, first-out

basis.

The PNC Financial Services Group, Inc. – Form 10-K 121